year by making the retirement fund contributions? le 12-1, much will the retirement fund be worth (in $) in 30 years? (Round your answer to the nearest cent.) che income from this investment is taxable each year, using Table 12-1, how much will the "tax savings" fund be worth (in $) in 30 years? (Round your answe

year by making the retirement fund contributions? le 12-1, much will the retirement fund be worth (in $) in 30 years? (Round your answer to the nearest cent.) che income from this investment is taxable each year, using Table 12-1, how much will the "tax savings" fund be worth (in $) in 30 years? (Round your answe

Chapter26: Tax Practice And Ethics

Section: Chapter Questions

Problem 31P

Related questions

Question

Transcribed Image Text:MY NOTES

ASK YOUR TEACHER

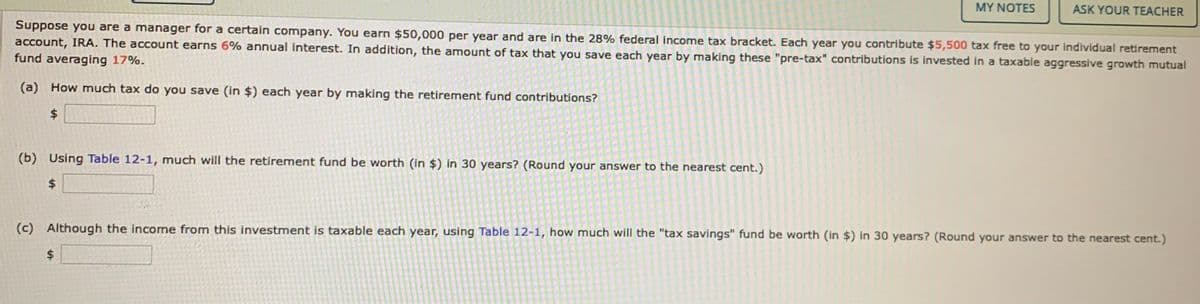

Suppose you are a manager for a certain company. You earn $50,000 per year and are in the 28% federal income tax bracket. Each year you contribute $5,500 tax free to your individual retirement

account, IRA. The account earns 6% annual interest. In addition, the amount of tax that you save each year by making these "pre-tax" contributions is invested in a taxable aggressive growth mutual

fund averaging 17%.

(a) How much tax do you save (in $) each year by making the retirement fund contributions?

(b) Using Table 12-1, much will the retirement fund be worth (in $) in 30 years? (Round your answer to the nearest cent.)

(c) Although the income from this investment is taxable each year, using Table 12-1, how much will the "tax savings" fund be worth (in $) in 30 years? (Round your answer to the nearest cent.)

$4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College