1. The capital balances of C, P and A respectively are: (Use this format C,P and A are sole proprietors looking to form a new partnership. C is to contribute cash of P150,000 and his delivery vehicle originally bought at P160,000 but has a second-hand value of P100,000. P is to contribute cash amounting to P200,000 and furniture worth P40,000 but was only acquired by P for P36,000. Partner A, whose family business is to sell computers contributed cash of P80,000 and computers and printers with a regular price of P160,000 but with a cost of P140,000. CPA Partnership stipulates their P and L ratio to be 3:2:3.

1. The capital balances of C, P and A respectively are: (Use this format C,P and A are sole proprietors looking to form a new partnership. C is to contribute cash of P150,000 and his delivery vehicle originally bought at P160,000 but has a second-hand value of P100,000. P is to contribute cash amounting to P200,000 and furniture worth P40,000 but was only acquired by P for P36,000. Partner A, whose family business is to sell computers contributed cash of P80,000 and computers and printers with a regular price of P160,000 but with a cost of P140,000. CPA Partnership stipulates their P and L ratio to be 3:2:3.

Chapter11: Partnerships: Distributions, Transfer Of Interests, And Terminations

Section: Chapter Questions

Problem 39P

Related questions

Question

Kindly answer the 1-5 problems. Thank you. I badly need it.

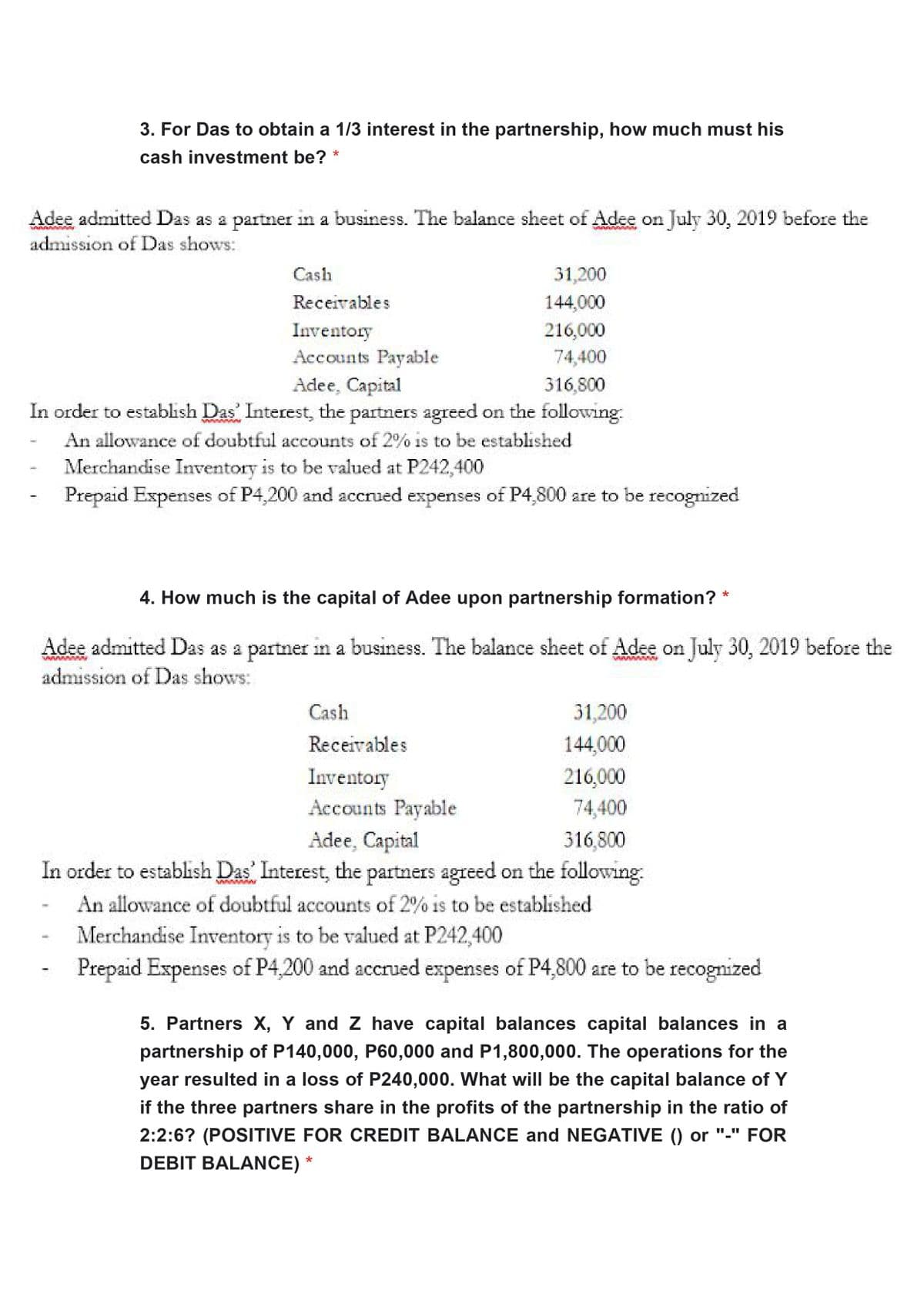

Transcribed Image Text:3. For Das to obtain a 1/3 interest in the partnership, how much must his

cash investment be?

Adee admitted Das as a partner in a business. The balance sheet of Adee on July 30, 2019 before the

admission of Das shows:

Cash

31,200

Receivables

144,000

Inventory

216,000

Accounts Payable

74,400

Adee, Capital

In order to establish Das Interest, the partners agreed on the following

316,800

An allowance of doubtful accounts of 2% is to be established

Merchandise Inventory is to be valued at P242,400

Prepaid Expenses of P4,200 and accrued expenses of P4,800 are to be recognized

4. How much is the capital of Adee upon partnership formation?

Adee admitted Das as a partner in a business. The balance sheet of Adee on July 30, 2019 before the

admission of Das shows:

Cash

31,200

Receivables

144,000

Inventory

216,000

Accounts Payable

74,400

Adee, Capital

In order to establish Das Interest, the partners agreed on the following

316,800

An allowance of doubtful accounts of 2% is to be established

Merchandise Inventory is to be valued at P242,400

Prepaid Expenses of P4,200 and accrued expenses of P4,800 are to be recognized

5. Partners X, Y and Z have capital balances capital balances in a

partnership of P140,000, P60,000 and P1,800,000. The operations for the

year resulted in a loss of P240,000. What will be the capital balance of Y

if the three partners share in the profits of the partnership in the ratio of

2:2:6? (POSITIVE FOR CREDIT BALANCE and NEGATIVE () or "-" FOR

DEBIT BALANCE) *

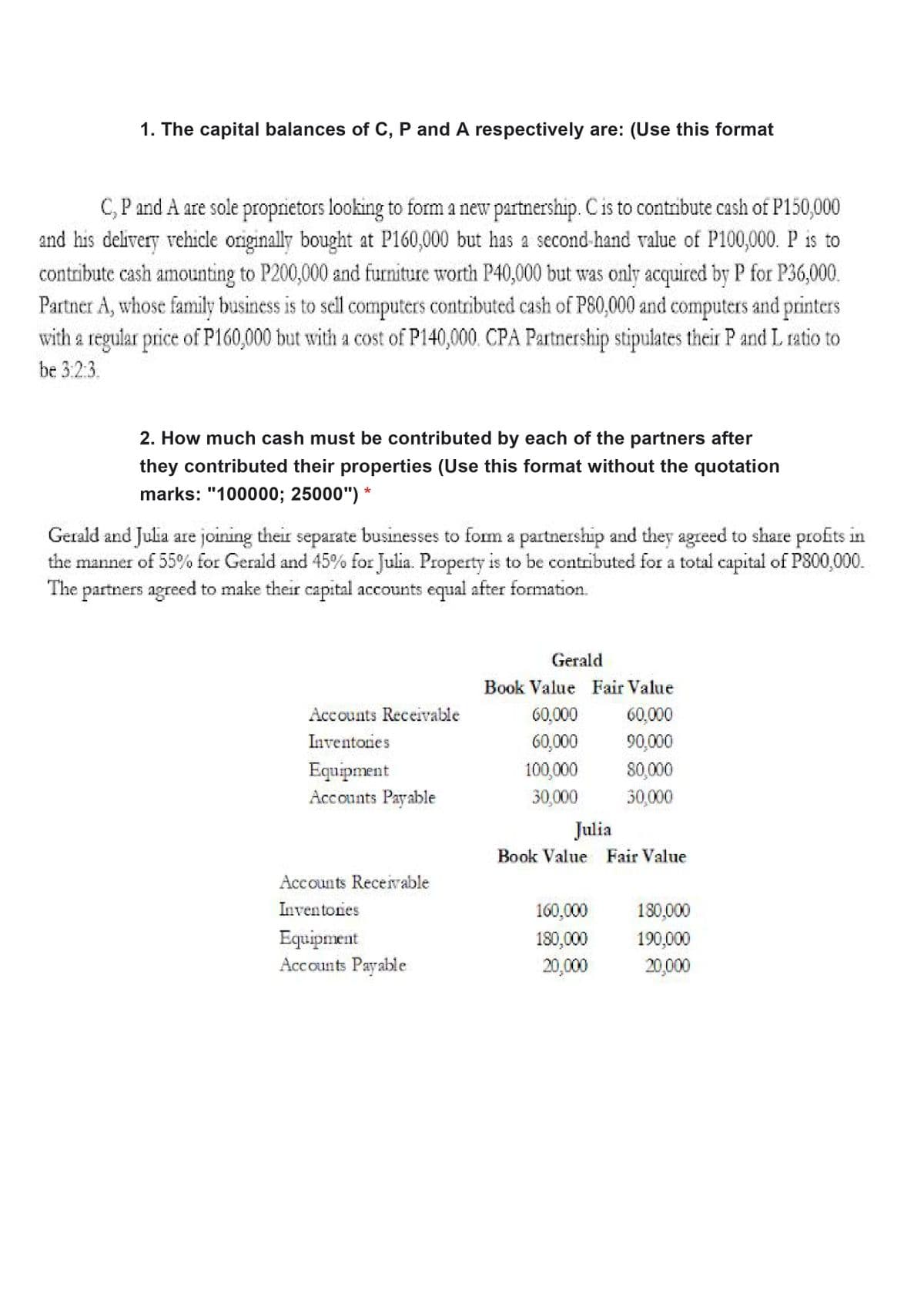

Transcribed Image Text:1. The capital balances of C, P and A respectively are: (Use this format

C, P and A are sole proprietors looking to form a new partnership. Cis to contribute cash of P150,000

and his delivery vehicle originally bought at P160,000 but has a second-hand value of P100,000. P is to

contribute cash amounting to P200,000 and furniture worth P40,000 but was only acquired by P for P36,000.

Partner A, whose family business is to sell computers contributed cash of P80,000 and computers and printers

with a regular price of P160,000 but with a cost of P140,000. CPA Partnership stipulates their P and L ratio to

be 3:2:3.

2. How much cash must be contributed by each of the partners after

they contributed their properties (Use this format without the quotation

marks: "100000; 25000") *

Gerald and Julia are joining their separate businesses to form a partnership and they agreed to share profits in

the manner of 55% for Gerald and 45% for Julia. Property is to be contributed for a total capital of P800,000.

The

partners agreed to make their capital accounts equal after formation.

Gerald

Book Value Fair Value

Accounts Receivable

60,000

60,000

Inventories

60,000

90,000

Equipment

Accounts Payable

100,000

80,000

30,000

30,000

Julia

Book Value Fair Value

Accounts Receivable

Inventories

160,000

180,000

Equipment

Accounts Payable

180,000

20,000

190,000

20,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT