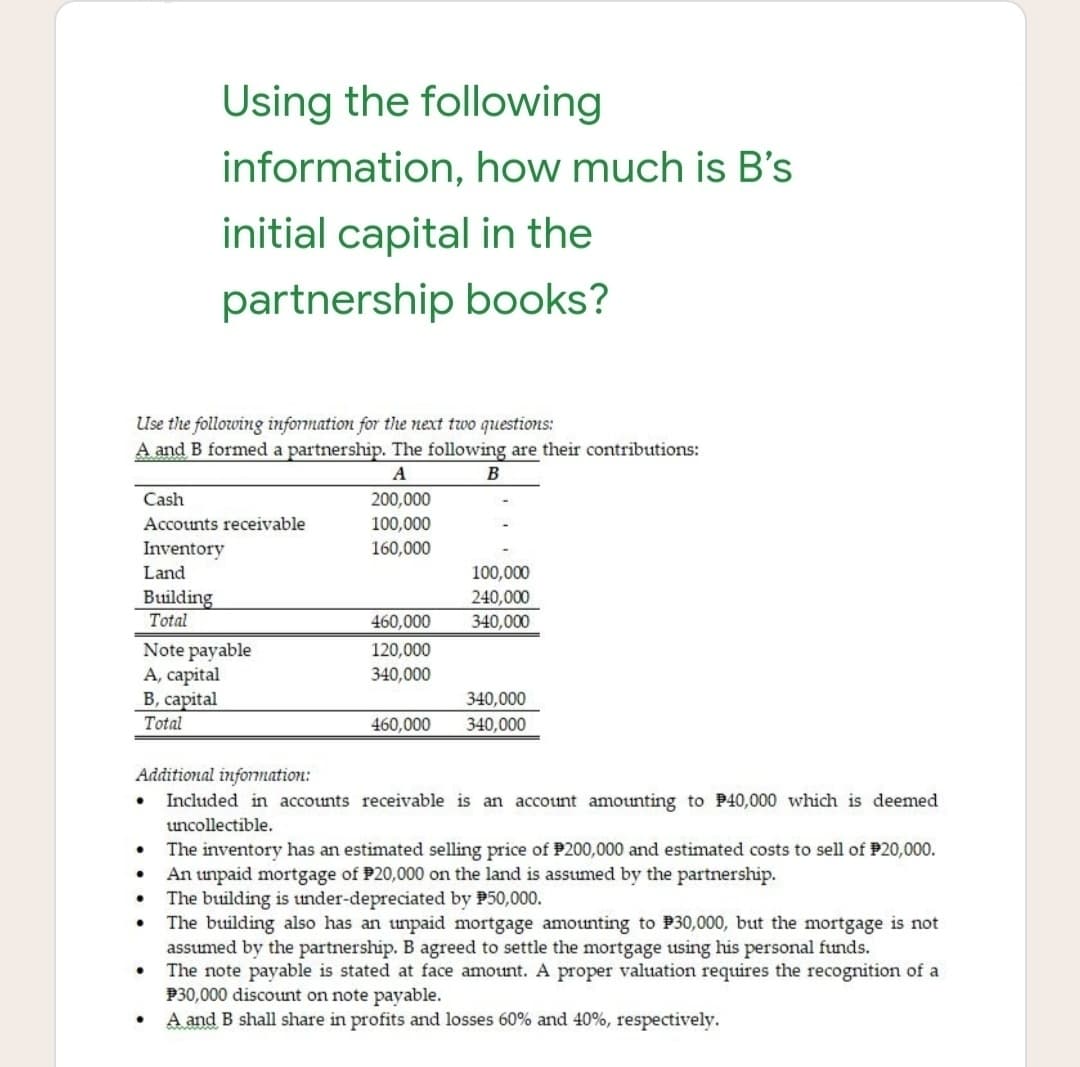

Using the following information, how much is B's initial capital in the partnership books? Use the following information for the next two questions: A and B formed a partnership. The following are their contributions: A B Cash 200,000 Accounts receivable 100,000 Inventory 160,000 Land 100,000 240,000 Building Total 460,000 340,000 Note payable А, саpital В. саptal 120,000 340,000 340,000 340,000 Total 460,000 Additional infonation: Included in accounts receivable is an account amounting to P40,000 which is deeme uncollectible. The inventory has an estimated selling price of P200,000 and estimated costs to sell of P20,000 An unpaid mortgage of P20,000 on the land is assumed by the partnership. The building is under-depreciated by P50,000. The building also has an unpaid mortgage amounting assumed by the partnership. B agreed to settle the mortgage using his personal funds. The note payable is stated at face amount. A proper valuation requires the recognition of P30,000 discount on note payable. A and B shall share in profits and losses 60% and 40%, respectively. P30,000, but the mortgage is no

Using the following information, how much is B's initial capital in the partnership books? Use the following information for the next two questions: A and B formed a partnership. The following are their contributions: A B Cash 200,000 Accounts receivable 100,000 Inventory 160,000 Land 100,000 240,000 Building Total 460,000 340,000 Note payable А, саpital В. саptal 120,000 340,000 340,000 340,000 Total 460,000 Additional infonation: Included in accounts receivable is an account amounting to P40,000 which is deeme uncollectible. The inventory has an estimated selling price of P200,000 and estimated costs to sell of P20,000 An unpaid mortgage of P20,000 on the land is assumed by the partnership. The building is under-depreciated by P50,000. The building also has an unpaid mortgage amounting assumed by the partnership. B agreed to settle the mortgage using his personal funds. The note payable is stated at face amount. A proper valuation requires the recognition of P30,000 discount on note payable. A and B shall share in profits and losses 60% and 40%, respectively. P30,000, but the mortgage is no

Chapter21: Partnerships

Section: Chapter Questions

Problem 57P

Related questions

Question

Transcribed Image Text:Using the following

information, how much is B's

initial capital in the

partnership books?

Use the following information for the next two questions:

A and B formed a partnership. The following are their contributions:

A

В

Cash

200,000

Accounts receivable

100,000

Inventory

160,000

Land

100,000

Building

Total

240,000

460,000

340,000

Note payable

A, capital

В, сарital

Total

120,000

340,000

340,000

460,000

340,000

Additional infonation:

Included in accounts receivable is an account amounting to P40,000 which is deemed

uncollectible.

The inventory has an estimated selling price of P200,000 and estimated costs to sell of P20,000.

An unpaid mortgage of P20,000 on the land is assumed by the partnership.

The building is under-depreciated by P50,000.

The building also has an unpaid mortgage amounting to P30,000, but the mortgage is not

assumed by the partnership. B agreed to settle the mortgage using his personal funds.

The note payable is stated at face amount. A proper valuation requires the recognition of a

P30,000 discont on note payable.

A and B shall share in profits and losses 60% and 40%, respectively.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College