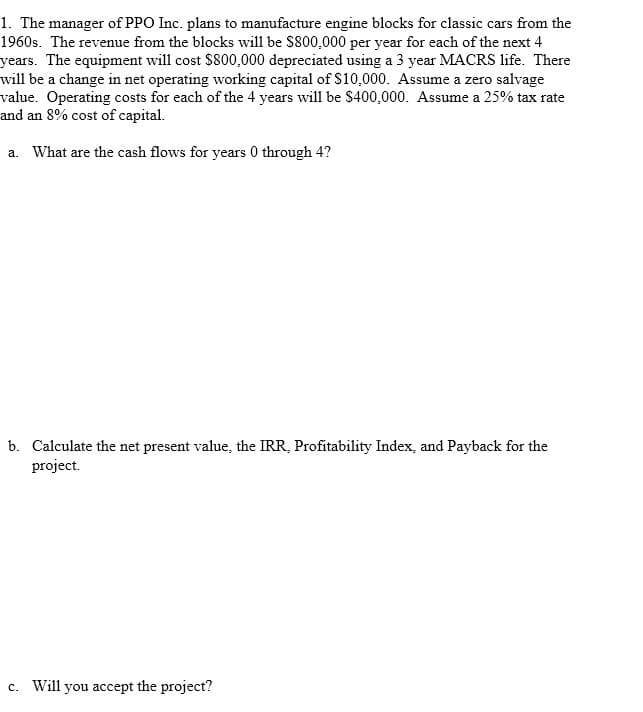

1. The manager of PPO Inc. plans to manufacture engine blocks for classic cars from the 1960s. The revenue from the blocks will be $800,000 per year for each of the next 4 years. The equipment will cost $800,000 depreciated using a 3 year MACRS life. There will be a change in net operating working capital of S10,000. Assume a zero salvage value. Operating costs for each of the 4 years will be $400,000. Assume a 25% tax rate and an 8% cost of capital. a. What are the cash flows for years 0 through 4? b. Calculate the net present value, the IRR, Profitability Index, and Payback for the project. c. Will you accept the project?

1. The manager of PPO Inc. plans to manufacture engine blocks for classic cars from the 1960s. The revenue from the blocks will be $800,000 per year for each of the next 4 years. The equipment will cost $800,000 depreciated using a 3 year MACRS life. There will be a change in net operating working capital of S10,000. Assume a zero salvage value. Operating costs for each of the 4 years will be $400,000. Assume a 25% tax rate and an 8% cost of capital. a. What are the cash flows for years 0 through 4? b. Calculate the net present value, the IRR, Profitability Index, and Payback for the project. c. Will you accept the project?

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 18P

Related questions

Question

Transcribed Image Text:1. The manager of PPO Inc. plans to manufacture engine blocks for classic cars from the

1960s. The revenue from the blocks will be S800,000 per year for each of the next 4

years. The equipment will cost $800,000 depreciated using a 3 year MACRS life. There

will be a change in net operating working capital of $10,000. Assume a zero salvage

value. Operating costs for each of the 4 years will be S$400,000. Assume a 25% tax rate

and an 8% cost of capital.

a. What are the cash flows for years 0 through 4?

b. Calculate the net present value, the IRR, Profitability Index, and Payback for the

project.

c. Will you accept the project?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 6 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College