1. What is the balance in the accounts receivable account at year end? 2. What is the balance in the allowance for doubtful accounts at year end? 3. What is the balance in the bad debt expense account at year end?

1. What is the balance in the accounts receivable account at year end? 2. What is the balance in the allowance for doubtful accounts at year end? 3. What is the balance in the bad debt expense account at year end?

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter16: Accounting For Accounts Receivable

Section: Chapter Questions

Problem 3CP: At the end of 20-3, Martel Co. had 410,000 in Accounts Receivable and a credit balance of 300 in...

Related questions

Question

Please do not give solution in image format thanku

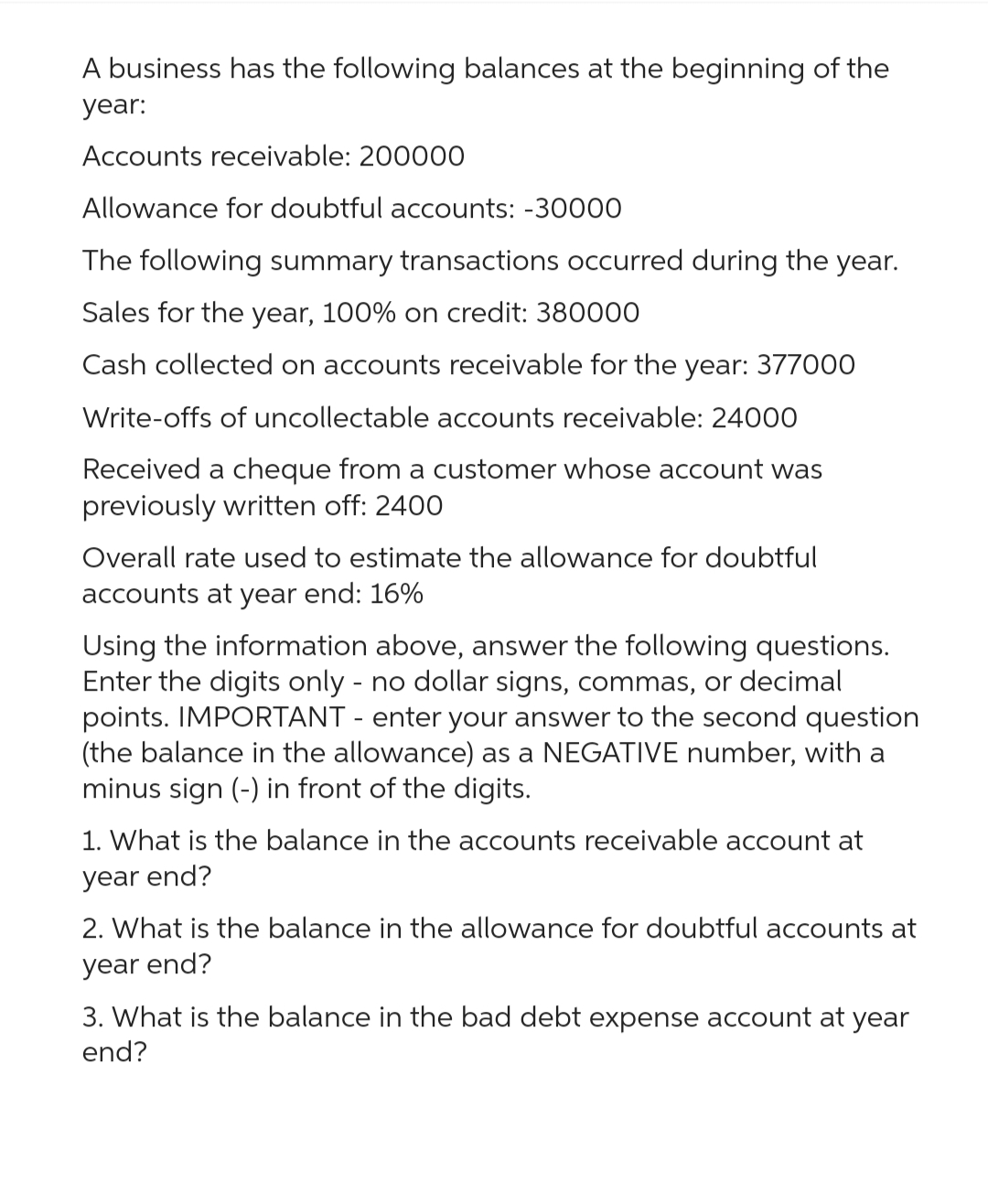

Transcribed Image Text:A business has the following balances at the beginning of the

year:

Accounts receivable: 200000

Allowance for doubtful accounts: -30000

The following summary transactions occurred during the year.

Sales for the year, 100% on credit: 380000

Cash collected on accounts receivable for the year: 377000

Write-offs of uncollectable accounts receivable: 24000

Received a cheque from a customer whose account was

previously written off: 2400

Overall rate used to estimate the allowance for doubtful

accounts at year end: 16%

Using the information above, answer the following questions.

Enter the digits only - no dollar signs, commas, or decimal

points. IMPORTANT - enter your answer to the second question

(the balance in the allowance) as a NEGATIVE number, with a

minus sign (-) in front of the digits.

1. What is the balance in the accounts receivable account at

year end?

2. What is the balance in the allowance for doubtful accounts at

year end?

3. What is the balance in the bad debt expense account at year

end?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning