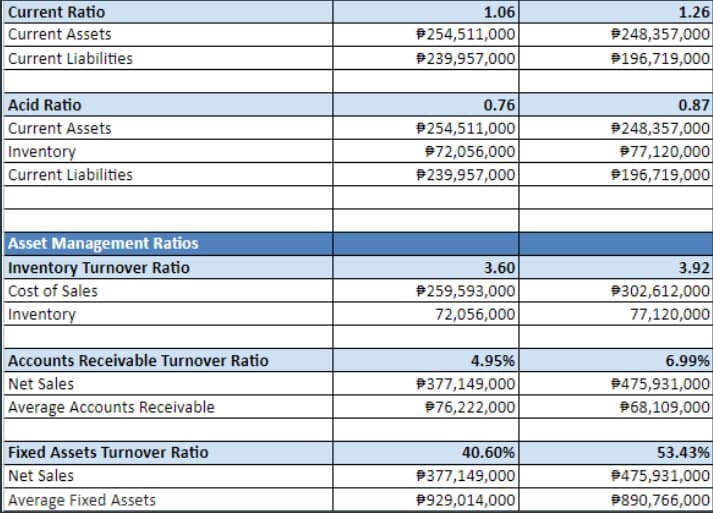

1.06 $254,511,000 P239,957,000 Current Ratio 1.26 Current Assets 9248,357,000 Current Liabilities $196,719,000 Acid Ratio 0.76 0.87 Current Assets $254,511,000 9248,357,000 Inventory 972,056,000 P239,957,000 977,120,000 P196,719,000 Current Liabilities Asset Management Ratios Inventory Turnover Ratio Cost of Sales 3.60 $259,593,000 72,056,000 3.92 9302,612,000 77,120,000 Inventory 4.95% P377,149,000 976,222,000| Accounts Receivable Turnover Ratio 6.99% 9475,931,000 968,109,000 Net Sales Average Accounts Receivable 40.60% P377,149,000 9929,014,000 Fixed Assets Turnover Ratio 53.43% 9475,931,000 9890,766,000 Net Sales Average Fixed Assets

1.06 $254,511,000 P239,957,000 Current Ratio 1.26 Current Assets 9248,357,000 Current Liabilities $196,719,000 Acid Ratio 0.76 0.87 Current Assets $254,511,000 9248,357,000 Inventory 972,056,000 P239,957,000 977,120,000 P196,719,000 Current Liabilities Asset Management Ratios Inventory Turnover Ratio Cost of Sales 3.60 $259,593,000 72,056,000 3.92 9302,612,000 77,120,000 Inventory 4.95% P377,149,000 976,222,000| Accounts Receivable Turnover Ratio 6.99% 9475,931,000 968,109,000 Net Sales Average Accounts Receivable 40.60% P377,149,000 9929,014,000 Fixed Assets Turnover Ratio 53.43% 9475,931,000 9890,766,000 Net Sales Average Fixed Assets

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.10P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

Analyze and explain the data presented.

Transcribed Image Text:1.26

$248,357,000

P196,719,000

Current Ratio

1.06

254,511,000

P239,957,000

Current Assets

Current Liabilities

0.87

9248,357,000

977,120,000

$196,719,000

Acid Ratio

0.76

Current Assets

P254,511,000

972,056,000

P239,957,000

Inventory

Current Liabilities

Asset Management Ratios

Inventory Turnover Ratio

3.60

3.92

P259,593,000

$302,612,000

77,120,000

Cost of Sales

Inventory

72,056,000

Accounts Receivable Turnover Ratio

4.95%

P377,149,000

976,222,000

6.99%

9475,931,000

968,109,000

Net Sales

Average Accounts Receivable

40.60%

P377,149,000

53.43%

9475,931,000

P890,766,000

Fixed Assets Turnover Ratio

Net Sales

Average Fixed Assets

9929,014,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning