1.22. Consider the following investment, in an inflation-free economy. Gamma High-Tech Company is considering the purchase of a $10,000 asset that will be ased for only 2 years (project life). The salvage value of this asset at the end of 2 rears is expected to be $4,000. The asset will generate annual revenue of $20,000 out is expected to have an annual expense of $5,00o0. The investment will be classified as a 3-MACRS property (tax life) with annual depreciation allowances of $3,333, $4,444, $1,481, and $741. The marginal income tax rate for the firm is 25%. The firm's inflation-free interest rate (i') is 10%. a. Determine the after-tax cash flow (ATC) for this investment project. b. The firm expects an average inflation rate (f) of 5% during the project period, but it also expects an 8% annual increase in revenue and a 6% annual increase in expense. No increase in salvage value is expected. Compute the present

1.22. Consider the following investment, in an inflation-free economy. Gamma High-Tech Company is considering the purchase of a $10,000 asset that will be ased for only 2 years (project life). The salvage value of this asset at the end of 2 rears is expected to be $4,000. The asset will generate annual revenue of $20,000 out is expected to have an annual expense of $5,00o0. The investment will be classified as a 3-MACRS property (tax life) with annual depreciation allowances of $3,333, $4,444, $1,481, and $741. The marginal income tax rate for the firm is 25%. The firm's inflation-free interest rate (i') is 10%. a. Determine the after-tax cash flow (ATC) for this investment project. b. The firm expects an average inflation rate (f) of 5% during the project period, but it also expects an 8% annual increase in revenue and a 6% annual increase in expense. No increase in salvage value is expected. Compute the present

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter22: Inflation

Section: Chapter Questions

Problem 33P: The index number representing the price level changes from 110 to 115 in one year and then from 115...

Related questions

Question

Transcribed Image Text:place

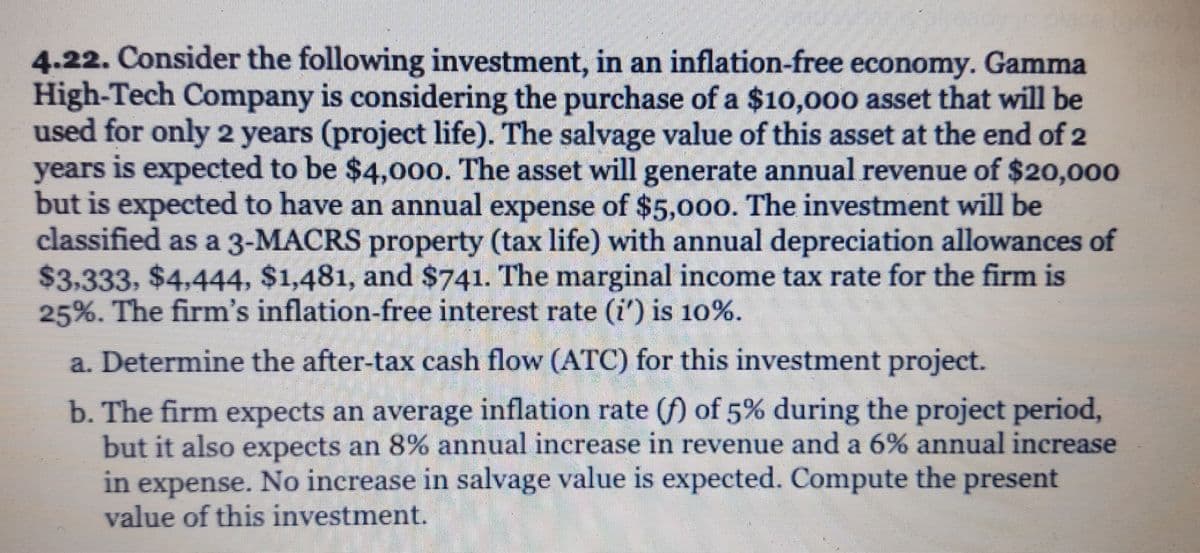

4.22. Consider the following investment, in an inflation-free economy. Gamma

High-Tech Company is considering the purchase of a $10,000 asset that will be

used for only 2 years (project life). The salvage value of this asset at the end of 2

years is expected to be $4,000. The asset will generate annual revenue of $20,000

but is expected to have an annual expense of $5,000. The investment will be

classified as a 3-MACRS property (tax life) with annual depreciation allowances of

$3,333, $4,444, $1,481, and $741. The marginal income tax rate for the firm is

25%. The firm's inflation-free interest rate (i') is 10%.

a. Determine the after-tax cash flow (ATC) for this investment project.

b. The firm expects an average inflation rate (f) of 5% during the project period,

but it also expects an 8% annual increase in revenue and a 6% annual increase

in expense. No increase in salvage value is expected. Compute the present

value of this investment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax