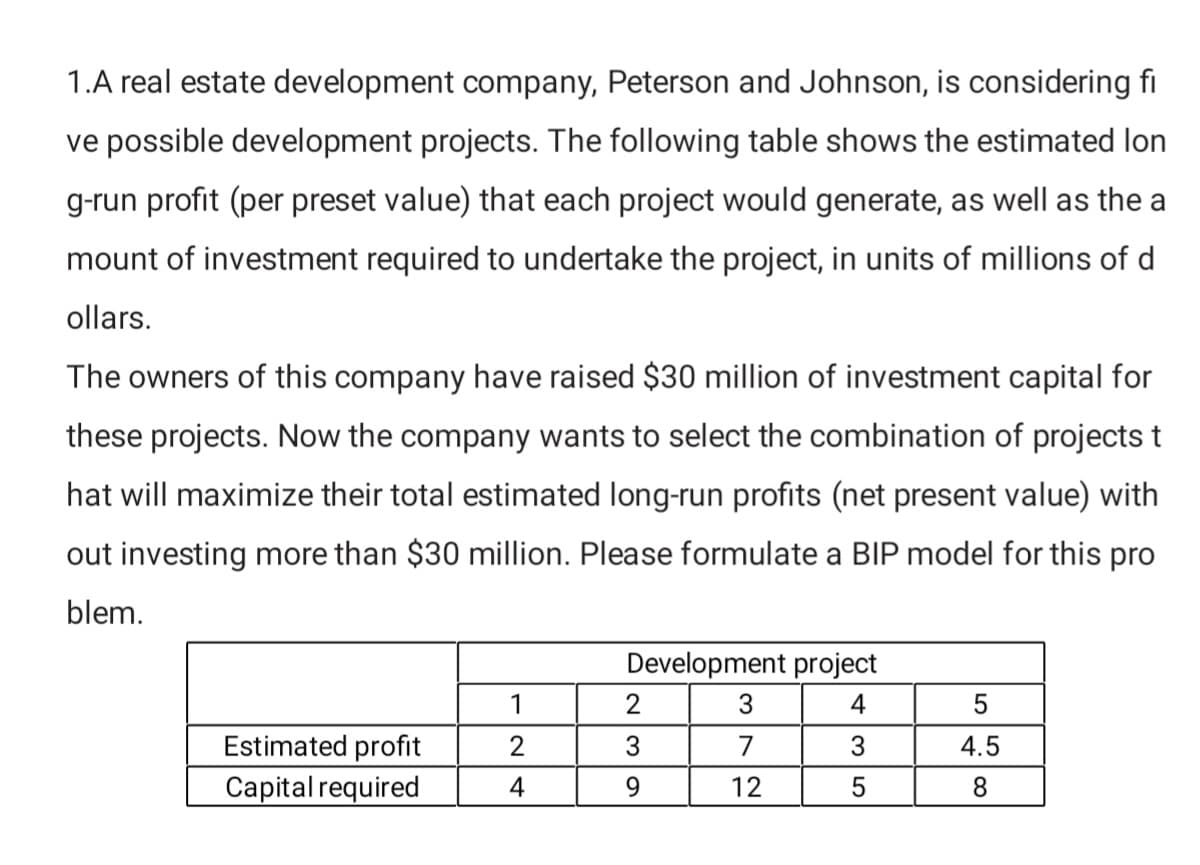

1.A real estate development company, Peterson and Johnson, is considering fi ve possible development projects. The following table shows the estimated lon g-run profit (per preset value) that each project would generate, as well as the a mount of investment required to undertake the project, in units of millions of d ollars. The owners of this company have raised $30 million of investment capital for these projects. Now the company wants to select the combination of projects t hat will maximize their total estimated long-run profits (net present value) with out investing more than $30 million. Please formulate a BIP model for this pro blem. Development project 1 2 4 5 Estimated profit 2 7 3 4.5 Capital required 4 12 8.

1.A real estate development company, Peterson and Johnson, is considering fi ve possible development projects. The following table shows the estimated lon g-run profit (per preset value) that each project would generate, as well as the a mount of investment required to undertake the project, in units of millions of d ollars. The owners of this company have raised $30 million of investment capital for these projects. Now the company wants to select the combination of projects t hat will maximize their total estimated long-run profits (net present value) with out investing more than $30 million. Please formulate a BIP model for this pro blem. Development project 1 2 4 5 Estimated profit 2 7 3 4.5 Capital required 4 12 8.

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter5: Network Models

Section: Chapter Questions

Problem 80P

Related questions

Question

Transcribed Image Text:1.A real estate development company, Peterson and Johnson, is considering fi

ve possible development projects. The following table shows the estimated lon

g-run profit (per preset value) that each project would generate, as well as the a

mount of investment required to undertake the project, in units of millions of d

ollars.

The owners of this company have raised $30 million of investment capital for

these projects. Now the company wants to select the combination of projects t

hat will maximize their total estimated long-run profits (net present value) with

out investing more than $30 million. Please formulate a BIP model for this pro

blem.

Development project

1

2

4

5

Estimated profit

2

7

3

4.5

Capital required

4

12

8.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,