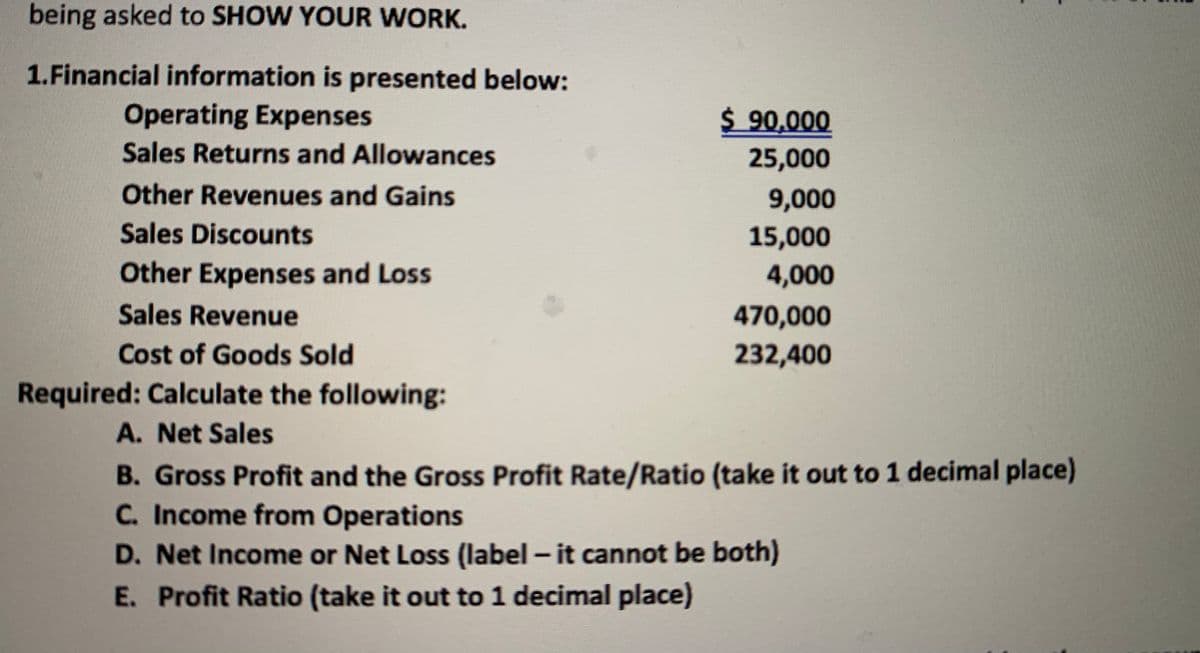

1.Financial information is presented below: Operating Expenses $ 90,000 Sales Returns and Allowances 25,000 Other Revenues and Gains 9,000 Sales Discounts 15,000 Other Expenses and Loss 4,000 Sales Revenue 470,000 Cost of Goods Sold 232,400 Required: Calculate the following: A. Net Sales B. Gross Profit and the Gross Profit Rate/Ratio (take it out to 1 decimal place) C. Income from Operations D. Net Income or Net Loss (label – it cannot be both) E. Profit Ratio (take it out to 1 decimal place)

1.Financial information is presented below: Operating Expenses $ 90,000 Sales Returns and Allowances 25,000 Other Revenues and Gains 9,000 Sales Discounts 15,000 Other Expenses and Loss 4,000 Sales Revenue 470,000 Cost of Goods Sold 232,400 Required: Calculate the following: A. Net Sales B. Gross Profit and the Gross Profit Rate/Ratio (take it out to 1 decimal place) C. Income from Operations D. Net Income or Net Loss (label – it cannot be both) E. Profit Ratio (take it out to 1 decimal place)

Chapter6: Merchandising Transactions

Section: Chapter Questions

Problem 19Q: The following is select account information for Sunrise Motors. Sales: $256,400; Sales Returns and...

Related questions

Question

Transcribed Image Text:being asked to SHOW YOUR WORK.

1.Financial information is presented below:

Operating Expenses

$ 90,000

Sales Returns and Allowances

25,000

Other Revenues and Gains

9,000

Sales Discounts

15,000

Other Expenses and Loss

4,000

Sales Revenue

470,000

Cost of Goods Sold

232,400

Required: Calculate the following:

A. Net Sales

B. Gross Profit and the Gross Profit Rate/Ratio (take it out to 1 decimal place)

C. Income from Operations

D. Net Income or Net Loss (label - it cannot be both)

E. Profit Ratio (take it out to 1 decimal place)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning