Conor Company provided the following data for the current year: Sales P 10,000,000 Cost of goods sold 5,300,000 Operating expenses 3,800,000 December 31 January 1 Prepaid operating expenses P 1,000,000 P 700,000 Accounts payable 1,350,000 1,200,000 Inventory 2,500,000 2,100,000 Accounts receivable 1,400,000 1,375,000 What amount should be reported as purchases under the cash basis of accounting?

Conor Company provided the following data for the current year:

Sales P 10,000,000

Cost of goods sold 5,300,000

Operating expenses 3,800,000

December 31 January 1

Prepaid operating expenses P 1,000,000 P 700,000

Accounts payable 1,350,000 1,200,000

Inventory 2,500,000 2,100,000

Accounts receivable 1,400,000 1,375,000

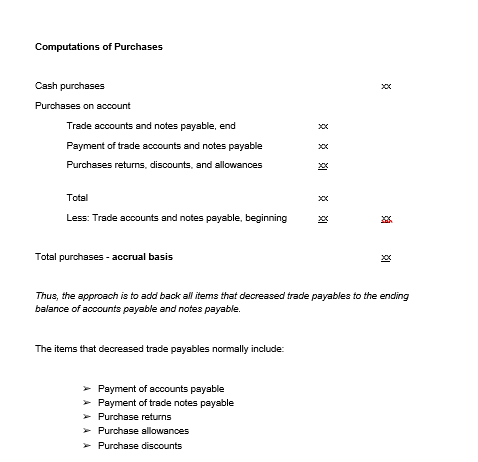

What amount should be reported as purchases under the cash basis of accounting?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps