10- For the data in Problem 10-16: 38 A 16 10-A robot has just been installed at a cost of $81,000. It will have no salvage value at the end of its useful life. Savings per Year Probability Useful Life (years) Probability $18,000 12 1/6 20,000 S 2/3 22,000 4 1/6 (a) What is the joint probability distribution for savings per year and useful life? (b) Define optimistic, most likely, and pessimistic scenarios by using both optimistic, both most likely, and both pessimistic estimates. What is the rate of return for each scenario? (a) What are the expected savings per year, life, and corresponding rate of return for the expected values? (b) Compute the rate of return for each combination of savings per year and life. What is the expected rate of return? (c) Do the answers for (a) and (b) match? Why or why not? A 0.2 0.7 0.1

10- For the data in Problem 10-16: 38 A 16 10-A robot has just been installed at a cost of $81,000. It will have no salvage value at the end of its useful life. Savings per Year Probability Useful Life (years) Probability $18,000 12 1/6 20,000 S 2/3 22,000 4 1/6 (a) What is the joint probability distribution for savings per year and useful life? (b) Define optimistic, most likely, and pessimistic scenarios by using both optimistic, both most likely, and both pessimistic estimates. What is the rate of return for each scenario? (a) What are the expected savings per year, life, and corresponding rate of return for the expected values? (b) Compute the rate of return for each combination of savings per year and life. What is the expected rate of return? (c) Do the answers for (a) and (b) match? Why or why not? A 0.2 0.7 0.1

Chapter7: Valuation Of Stocks And Corporations

Section: Chapter Questions

Problem 23SP

Related questions

Question

Solve 10.38 using excel and use IRR to find the rate of return . Please show the steps clearly

Transcribed Image Text:10- For the data in Problem 10-16:

38

F2

A

10-

16

A

nited States) Text Predictions: On

#

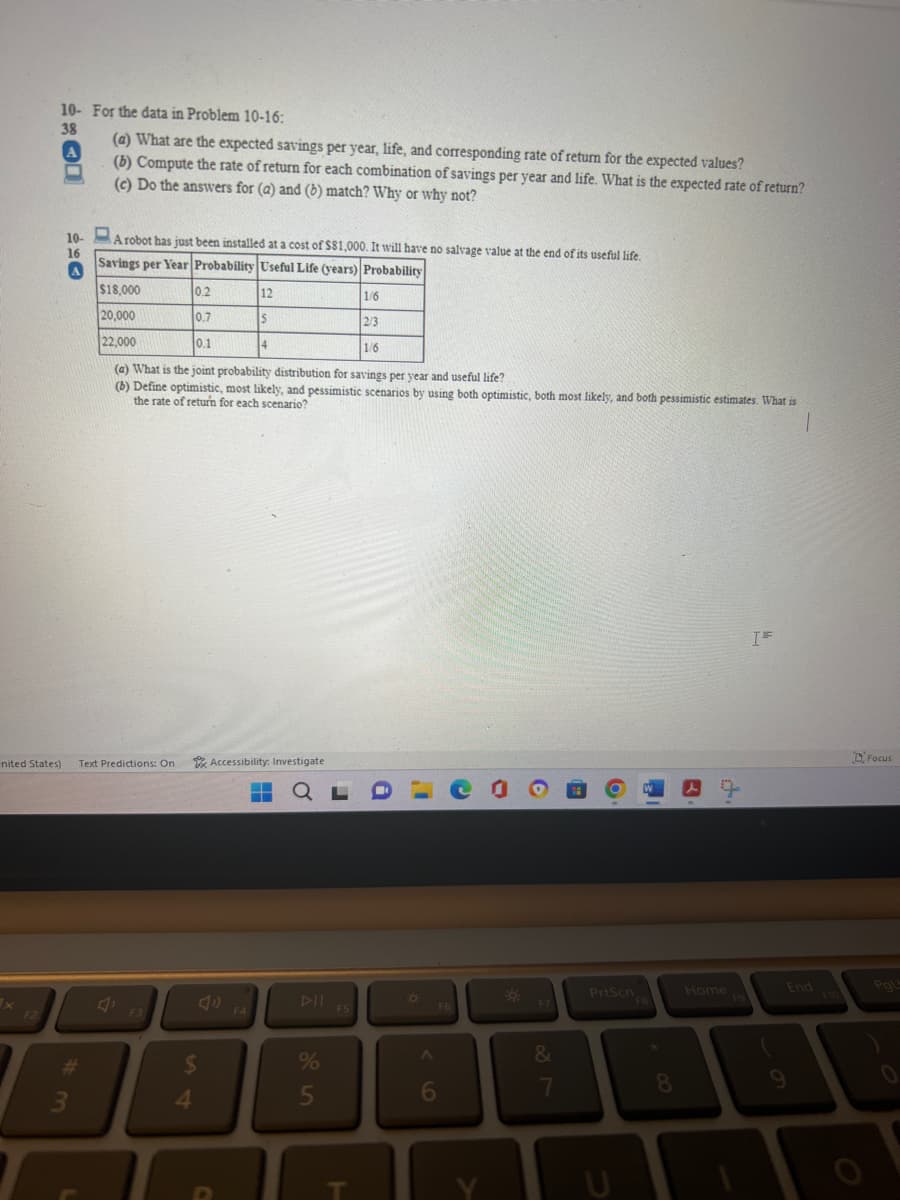

(a) What are the expected savings per year, life, and corresponding rate of return for the expected values?

(b) Compute the rate of return for each combination of savings per year and life. What is the expected rate of return?

(c) Do the answers for (a) and (b) match? Why or why not?

3

A robot has just been installed at a cost of $81,000. It will have no salvage value at the end of its useful life.

Savings per Year Probability Useful Life (years) Probability

$18,000

0.2

1/6

20,000

0.7

2/3

22,000

0.1

1/6

(a) What is the joint probability distribution for savings per year and useful life?

(b) Define optimistic, most likely, and pessimistic scenarios by using both optimistic, both most likely, and both pessimistic estimates. What is

the rate of return for each scenario?

F3

$

4

C

12

Accessibility: Investigate

F4

Is

14

▬▬▬ QL

1

DII

%

5

F5

T

1

¤

6

F6

Co

Y

*

F7

&

7

6

PrtScn

W

FB

8

A

d.

Home

IF

End

9

Focus

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College