10) Order is delivered to customer .Customer closed the balance by issuing half check, half on account.Cost of Goods Sold is 116.000 TL. 11. 15.000 USD is paid by the customer for USD Merchandise Sale. Rate is 7.10 TL/USD 12) Customer returned 26.000 TL + 10% VAT merchandise. Cost of Goods Sold is 8.400 TL. Check is issued for returned merchandise and TL cash is paid for VAT.

10) Order is delivered to customer .Customer closed the balance by issuing half check, half on account.Cost of Goods Sold is 116.000 TL. 11. 15.000 USD is paid by the customer for USD Merchandise Sale. Rate is 7.10 TL/USD 12) Customer returned 26.000 TL + 10% VAT merchandise. Cost of Goods Sold is 8.400 TL. Check is issued for returned merchandise and TL cash is paid for VAT.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 37E: Analyzing the Accounts Casey Company uses a perpetual inventory system and engaged in the following...

Related questions

Question

MAKE THE NECCESSARY JOURNAL ENTRIES FOR THE FOLLOWING

TRANSACTIONS:

Questions 10/11/12

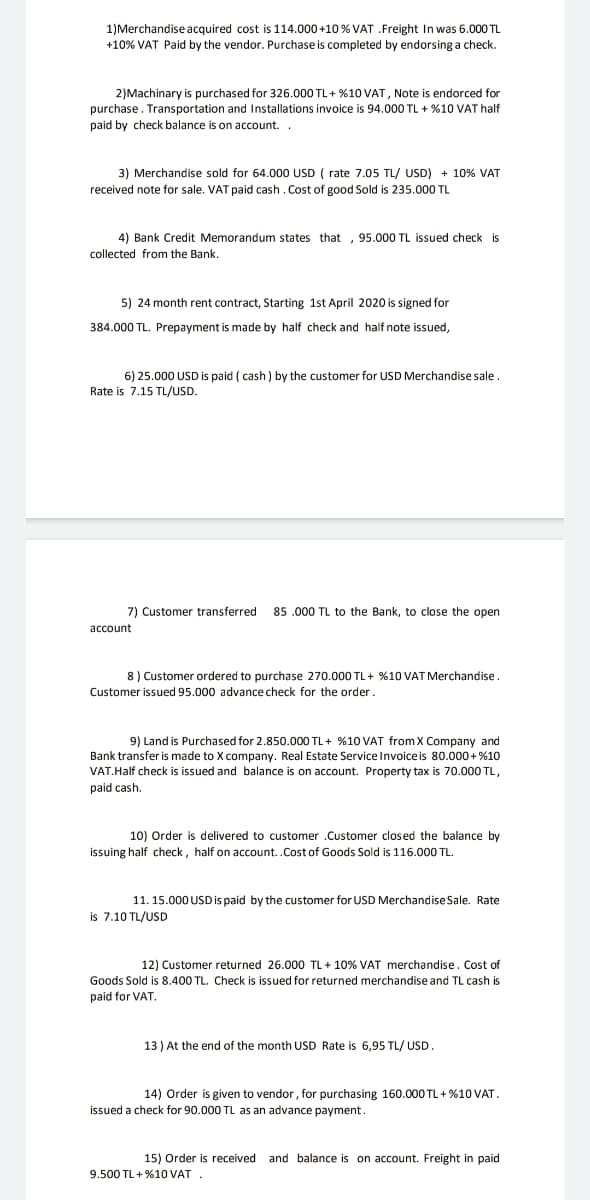

Transcribed Image Text:1)Merchandise acquired cost is 114.000+10 % VAT .Freight In was 6.000 TL

+10% VAT Paid by the vendor. Purchase is completed by endorsing a check.

2)Machinary is purchased for 326.000 TL + %10 VAT, Note is endorced for

purchase. Transportation and Installations invoice is 94.000 TL + %10 VAT half

paid by check balance is on account.

3) Merchandise sold for 64.000 USD ( rate 7.05 TL/ USD) + 10% VAT

received note for sale. VAT paid cash. Cost of good Sold is 235.000 TL

4) Bank Credit Memorandum states that

95.000 TL isued check is

collected from the Bank.

5) 24 month rent contract, Starting 1st April 2020 is signed for

384.000 TL. Prepayment is made by half check and half note issued,

6) 25.000 USD is paid ( cash) by the customer for USD Merchandise sale.

Rate is 7.15 TL/USD.

7) Customer transferred

85 .000 TL to the Bank, to close the open

account

8) Customer ordered to purchase 270.000 TL+ %10 VAT Merchandise.

Customer issued 95.000 advance check for the order.

9) Land is Purchased for 2.850.000 TL+ %10 VAT from X Company and

Bank transfer is made to X company. Real Estate Service Invoice is 80.000+%10

VAT.Half check is issued and balance is on account. Property tax is 70.000 TL,

paid cash.

10) Order is delivered to customer .Customer closed the balance by

issuing half check, half on account..Cost of Goods Sold is 116.000 TL.

11. 15.000 USD is paid by the customer for USD Merchandise Sale. Rate

is 7.10 TL/USD

12) Customer returned 26.000 TL + 10% VAT merchandise. Cost of

Goods Sold is 8.400 TL. Check is issued for returned merchandise and TL cash is

paid for VAT.

13) At the end of the month USD Rate

6,95 TL/ USD.

14) Order is given to vendor, for purchasing 160.000 TL + %10 VAT.

issued a check for 90.000 TL as an advance payment.

15) Order is received and balance is on account. Freight in paid

9.500 TL + %10 VAT

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning