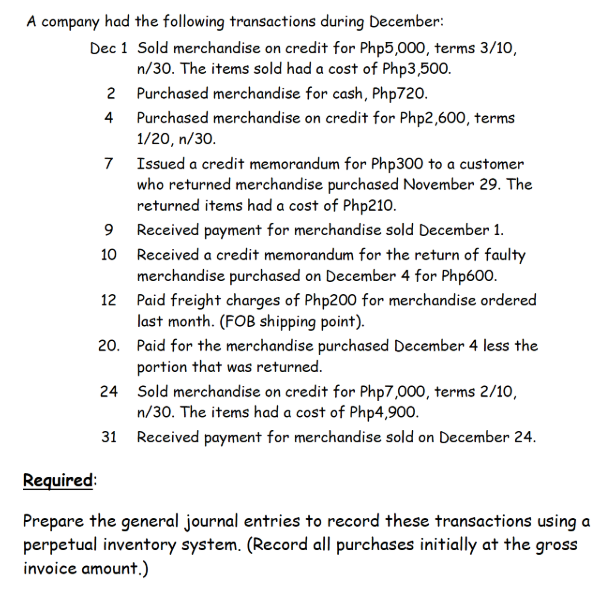

A company had the following transactions during December: Dec 1 Sold merchandise on credit for Php5,000, terms 3/10, n/30. The items sold had a cost of Php3,500. 2 Purchased merchandise for cash, Php720. Purchased merchandise on credit for Php2,600, terms 1/20, n/30. 7 Issued a credit memorandum for Php300 to a customer who returned merchandise purchased November 29. The returned items had a cost of Php21o. 9 Received payment for merchandise sold December 1. 10 Received a credit memorandum for the return of faulty merchandise purchased on December 4 for Php600. 12 Paid freight charges of Php200 for merchandise ordered last month. (FOB shipping point). 20. Paid for the merchandise purchased December 4 less the portion that was returned. 24 Sold merchandise on credit for Php7,000, terms 2/10, n/30. The items had a cost of Php4,900. 31 Received payment for merchandise sold on December 24.

A company had the following transactions during December: Dec 1 Sold merchandise on credit for Php5,000, terms 3/10, n/30. The items sold had a cost of Php3,500. 2 Purchased merchandise for cash, Php720. Purchased merchandise on credit for Php2,600, terms 1/20, n/30. 7 Issued a credit memorandum for Php300 to a customer who returned merchandise purchased November 29. The returned items had a cost of Php21o. 9 Received payment for merchandise sold December 1. 10 Received a credit memorandum for the return of faulty merchandise purchased on December 4 for Php600. 12 Paid freight charges of Php200 for merchandise ordered last month. (FOB shipping point). 20. Paid for the merchandise purchased December 4 less the portion that was returned. 24 Sold merchandise on credit for Php7,000, terms 2/10, n/30. The items had a cost of Php4,900. 31 Received payment for merchandise sold on December 24.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter9: Sales And Purchases

Section: Chapter Questions

Problem 4PB: The following transactions relate to Khan, Inc., a sporting goods wholesaler, during November of...

Related questions

Question

2. With complete answer

Transcribed Image Text:A company had the following transactions during December:

Dec 1 Sold merchandise on credit for Php5,000, terms 3/10,

n/30. The items sold had a cost of Php3,500.

2 Purchased merchandise for cash, Php720.

Purchased merchandise on credit for Php2,600, terms

1/20, n/30.

4

Issued a credit memorandum for Php300 to a customer

who returned merchandise purchased November 29. The

returned items had a cost of Php210.

7

Received payment for merchandise sold December 1.

10 Received a credit memorandum for the return of faulty

merchandise purchased on December 4 for Php600.

12 Paid freight charges of Php200 for merchandise ordered

last month. (FOB shipping point).

20. Paid for the merchandise purchased December 4 less the

portion that was returned.

24 Sold merchandise on credit for Php7,000, terms 2/10,

n/30. The items had a cost of Php4,900.

31 Received payment for merchandise sold on December 24.

Required:

Prepare the general journal entries to record these transactions using a

perpetual inventory system. (Record all purchases initially at the gross

invoice amount.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College