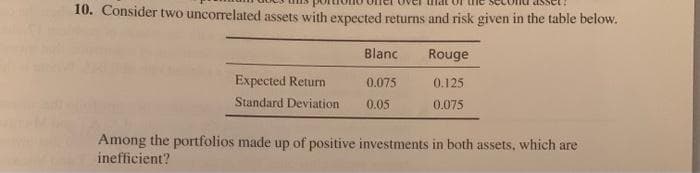

10. Consider two uncorrelated assets with expected returns and risk given in the table below. Blanc Rouge Expected Return 0.075 0.125 Standard Deviation 0.05 0.075 Among the portfolios made up of positive investments in both assets, which are inefficient?

Q: Two investments, X and Y, have the characteristics shown below. E(X) = $70, E(Y)%3D$120, o =7,000, o…

A: Expected Return on Portfolio = (Weight of security X * Return on security X ) + (Weight of security…

Q: Assume the market has the following assets: Asset Expected Return (%) Standard Deviation (%)…

A: Investors are three risk averse,risk NUETRAL and risk seeking.

Q: A two-asset portfolio has the following characteristics. The correlation coefficient between the…

A: The expected return of the portfolio is the weighted average of individual securities' returns. The…

Q: Two assets, A and B, have the same expected return (10%) and the same level of risk (average). Which…

A: Investments are the funds that are invested or parked in some financial instruments or assets by…

Q: When P12 =+1, the standard deviation of a two-security portfolio P is equal to the weighted average…

A: Part B. The portfolios along the (EF) efficient frontier are those that deliver the highest returns…

Q: Which of the following statements regarding non-systematic risk, systematic risk and total risk…

A: Systematic risk is the risk derived from the market and which is measured by the beta of the stock…

Q: b. Suppose that you have the following information of three risky assets. Security Return (%)…

A: Risk free asset = 6% A= 6

Q: 1. The possible returns from investing in BestMax share are as follows: Probability of state Return…

A: The standard deviation of a stock is a measure of dispersion that a security faces due to variation…

Q: (Net income ∕ Total assets)

A: Operating Profit Margin: It shows the performance of the firm in generating operating profit from…

Q: You invest $1,000 in a risky asset with an expected rate of return of 0.17 and a standard deviation…

A: Given: Expected return of risky asset(A) = 17% Return of T-bill (B) = 4% So, Expected return of…

Q: 7. The utility score a typical investor would assign to a particular portfolio, other things equal,…

A: The utility score of an investor depends on return and total risk. The Capital Market Line shows the…

Q: You manage a risky portfolio with an expected rate of return of 17% and a standard deviation of 36%.…

A: Given, Expected return = 17% Standard deviation = 36% T-bill rate = 6%

Q: Consider two assets (1 & 2) with the following information: E (R1) = 10 %, σ1 = 10 %, E (R2) = 12 %,…

A: 1. Portfolio's expected return: Portfolio's expected return can be calculated with the following…

Q: Suppose an investment is equally likely to have a 37.9% return or a -20% return. The total…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Two assets A and B have the following risk and return characteristics RA =22% ; RB = 20% ; =…

A: The required variables are as below: RA=Risk or Standard Deviation for Asset A=22%=0.22RB=Risk or…

Q: 4. Suppose portfolio P's expected return in 12%, its volatility (standard deviation) is 20%, and the…

A: Solution:- Sharpe Ratio measures the excess return over risk free return, per unit of risk taken ie.…

Q: In the Table below , which portfolio (s) is (are) inefficient (s)? Portfolio A B C E F Expected…

A: In order to check which portfolio is inefficient, we need to study the table thoroughly.

Q: Consider the following information: Standard Deviation. Beta Security T…

A: Financial security is the financial asset that is traded in the financial markets and refers to…

Q: O If the correlation coefficient is less than one, then no portfolio obtained by combining assets 1…

A: Correlation coefficient indicates that relationships between two whether moving in same direction or…

Q: a. What would be the expected return and beta of portfolios constructed from these two assets with…

A: Information Provided: Beta = 1.0 Expected return = 11% T-bill risk-free return = 6% Expected…

Q: 3. Suppose that you have two investments, each of which has a 0.9% chance of a loss of S10 million…

A:

Q: Suppose that there are two assets: A and B. Asset A has expected return of 20%. B has expected…

A: Hello since your question has multiple sub-parts, we will solve first three sub-parts for you. If…

Q: Asset 1 has a standard deviation of returns of 0.15 while Asset 2 has a standard deviation of…

A: The covariance of return is product of coefficient of correlation and standard deviations of two…

Q: Example 9: What is the portfolio standard deviation for a two-asset portfolio comprised of the…

A: Weight in asset A (Wa) = 40000 / (40000 + 60000) = 0.4 Weight in asset B (Wb) = 1 - 0.4 = 0.6…

Q: 14. Risk free asset, the market, and stock X have the expected returns of 2%, 8%, and 12%…

A: The expected rate of return of the stock based on the risk involved in the stock is given by the…

Q: 6. Consider an optimal risky portfolio with expected return of 8% and standard deviation of 26% and…

A: The slope of the best feasible Capital Allocation Line (CAL) of the optimal portfolio as follows:…

Q: Which one of the following statements is NOT correct?

A: Portfolio is the combination of stock, bonds, etc.

Q: Which of the following statement(s) is/ are correct? Select one or more: Portfolio standard…

A: Portfolio is the combination of different securities. Portfolio Standard Deviation is a measure of…

Q: wo assets have the following expected returns and standard deviations when the risk-free rate is 5%:…

A: Given: Asset A E(rA) = 10% σA = 20% Asset B E(rB) = 15% σB = 27% Risk free rate = 5% = 0.05

Q: sider two assets with the following characteristics: Expected return of asset 1 = 0.15,…

A: Expected return of portfolio depends on the weight of assets in the portfolio

Q: Expected returns and standard deviations of three risky assets are as follows: Expected Return…

A: Portfolio is the investment basket where several assets like bonds, securities and real assets like…

Q: 5. How is optimal asset allocation (y*) affected by the expected risk premium, the variance of risky…

A: Since you have asked multiple questions, we will answer the first question for you. Please ask…

Q: b. Suppose that you have the following information of three risky assets. Security Return (%)…

A: Here, Risk Free Asset is 6% Other Details are as follows: A= 6

Q: 9. This problem will give you some practice calculating measures of prospective portfolio…

A: A statistical measure that provides information concerning the value that is dispersed from the mean…

Q: Suppose that there are two assets: A and B. Asset A has expected return of 20% and standard…

A: A well-maintained portfolio is required for an investor's success. The asset allocation should be…

Q: Assume a Portfolio of two assets A and B whose standard deviations of their returns are 8.6% and…

A: The question is related to the portfolio Management. In this question we will first calculate…

Q: Return on a portfolio of two risky assets which are perfectly negatively correlated is equivalent to…

A: Two assets which are having negatively correlated which means risk can be can be reduced to zero.…

Q: Assume that both portfolios A and B are well diversified, that E(rA) = 16%, and E(rB) = 14%. If the…

A: according to capm model: r = rf+β×rm-rfwhere,rf= risk free raterm= market return

Q: f. Assume a Portfolio of two assets A and B whose standard deviations of their returns are 8.6% and…

A: Optimum Portfolio Optimum portfolios represent the possible combination of portfolios that maximize…

Q: Q5. You are considering two assets with the following characteristics. Return Standard deviation…

A: Standard deviation is a variation in the mean value of given data. Standard deviation is a…

Q: 9. Consider the case of two financial assets and three market conditions (states). The table below…

A: The question is related Portfolio Management. The expected return is calculated with the help of…

Q: Assume that both portfolios A and B are well diversified, that E(rA) = 12%, and E(rB) = 9%. If the…

A: E(ra) Expected Return of security A = 12% E(rb) Expected Return of security B = 9% Beta of security…

Q: 1.You have the chance to invest in a two risky assets, A and B. the expected return and standard…

A: Portfolio risk is given by standard deviation of portfolio.

Q: market

A: Systematic risk refers to the type of risk which has an impact on the entire market. Also known as…

Q: a. Use the following information: E[rXOM] = 15.6%, standard deviationXOM = 15.9% E[rMS]=29.7%,…

A: “Since you have posted a many questions, we will solve first question for you. To get the remaining…

Please show all the steps

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- You are evaluating various investment opportunities currently available and you have calculated expected returns and standard deviations for five different well-diversified portfolios of risky assets. PORTFOLIO EXPECTED RETURN STANDARD DEVIATION Q 7.8% 10.5% R 10.0% 14.0% S 4.6% 5.0% T 11.7% 18.5% U 6.2% 7.5% a) For each portfolio, calculate the risk premium per unit of risk that you expect to receive [(E(R) –RFR)/ơ]. Assume that the risk free rate is 3.0%. b) Using…The expected return of a portfolio that is totally invested in the risk free asset is caclculated as: E(R) = WA * E(RA) Wf * E(RB) = 0 * 0.16 1.0 * 0.08 = 0 0.08 = 0.08 or 8% Therefore the expected return of a portfolio with risk free asset is 8% There is no standard deviation for the risk free asset. Please full ExplainConsider the following two assets: Asset Expected return Standard deviation of returns 1 18% 30% 2 8% 10% The returns on the two assets are perfectly negatively correlated (i.e. coefficient of -1). Calculate the proportions of assets 1 and 2 that generate a portfolio with a standard deviation of zero. What is the expected return of that portfolio?

- You are evaluating various investment opportunities currently available and you have calculated expected returns and standard deviations for five different well-diversified portfolios of risky assets:Portfolio Expected Return Standard DeviationQ 7.8% 10.5%R 10.0 14.0S 4.6 5.0T 11.7 18.5U 6.2 7.5a. For each portfolio, calculate the risk premium per unit of risk that you expect to receive ([E(R) − RFR]/σ). Assume that the risk-free rate is 3.0 percent.b. Using your computations in Part a, explain which of these five portfolios is most likely tobe the market portfolio. Use your calculations to draw the capital market line (CML).c. If you are only willing to make an investment with σ = 7.0%, is it possible for you toearn a return of 7.0 percent?d. What is the minimum level of risk that would be necessary for an investment to earn7.0 percent? What is the composition of the portfolio along the CML that will generatethat expected return?e. Suppose you are now willing to make an investment…Expected returns and standard deviations of three risky assets are as follows: Expected Return Standard Deviations Correlations A B C A 11% 30% 1.0 0.3 0.15 B 14.5% 45% 0.3 1.0 0.45 C 9% 30% 0.15 0.45 1.0 3. Assume a portfolio of asset B and C. Determine the weight in asset B, such that the total portfolio risk is minimized.Asset 1 has a standard deviation of returns of 0.15 while Asset 2 has a standard deviation of returns of 0.20. The correlation coefficient between the returns of the two assets is 0.34. Which of the following is closest to the covariance of the returns of the two assets if they are combined into an equally weighted portfolio? Group of answer choices 0.0129 0.0207 0.0102 0.1440

- The following expected return and the standard deviation of current returns are known: Security (i) Expected Return Standard Deviation βi A 0.20 0.12 1.1 B 0.12 0.10 0.8 T-Bills 0.05 0 0 Market Portfolio 0.20 0.15 1 Required: Determine which of A or B is over-valued or undervalued.Which of the following will be a part of Efficient Frontier? A B C D E F Return (%) 8 8 12 4 9 8 Risk (Standard deviation) 4 5 12 4 5 6 Plot them in Risk return graph. Assuming correlation between A and C as 0.3, find the risk and return of the portfolio with 75 % proportion in A and 25 % in C, also interpret the result of such diversification.Which of the following statements regarding non-systematic risk, systematic risk and total risk is/are true? Select one or more:a. As the number of assets within a portfolio increases, the total risk of a portfolio will go to zero.b. A riskfree asset must have zero non-systematic risk.c. A well diversified portfolio must have zero systematic riskd. Under the Capital Asset Pricing Model (CAPM).an asset with zero systematic risk must have expected return equal to the riskfree rate.

- assume that risk free rate, RF, is currently 8%, the market return, 1m, is 12%, and asset a beta ba, is 1.10. (a) Draw the SML on a set of "non-diversifiable risk Please sent me complete this question for further reliance.a) Consider two assets with the following characteristics: Expected return of asset 1 = 0.15, Standard deviation of asset 1 = 0.10, portion in asset 1 = 0.5 Expected return of asset 2 = 0.20, Standard deviation of asset 2 = 0.20, Compute the expected return and standard deviation of portfolio if correlation coefficient (r1,2) = 0.40 and (r1,2)= -0.60 b) Why do most investors hold diversified portfolio?Consider the following two assets: Asset Expected return Standard deviation of returns 1 18% 30% 2 8% 10% The returns on the two assets are perfectly negatively correlated (i.e. coefficient of -1). Calculate the proportions of assets 1 and 2 that generate a portfolio with a standard deviation of zero. What is the expected return of that portfolio Calculate the expected returns and standard deviations of three other portfolios with weightingsof your choice. Present a graph of your results.