7. The utility score a typical investor would assign to a particular portfolio, other things equal, • Will decrease as the standard deviation decreases. • Will incrase as the rate of return incraseses. • Will incrase as the covariance between assets in the portfolio incrases. • Will incrase as the risk aversion incrase.

7. The utility score a typical investor would assign to a particular portfolio, other things equal, • Will decrease as the standard deviation decreases. • Will incrase as the rate of return incraseses. • Will incrase as the covariance between assets in the portfolio incrases. • Will incrase as the risk aversion incrase.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter5: Risk Analysis

Section: Chapter Questions

Problem 11QE: Market equity beta measures the covariability of a firms returns with all shares traded on the...

Related questions

Question

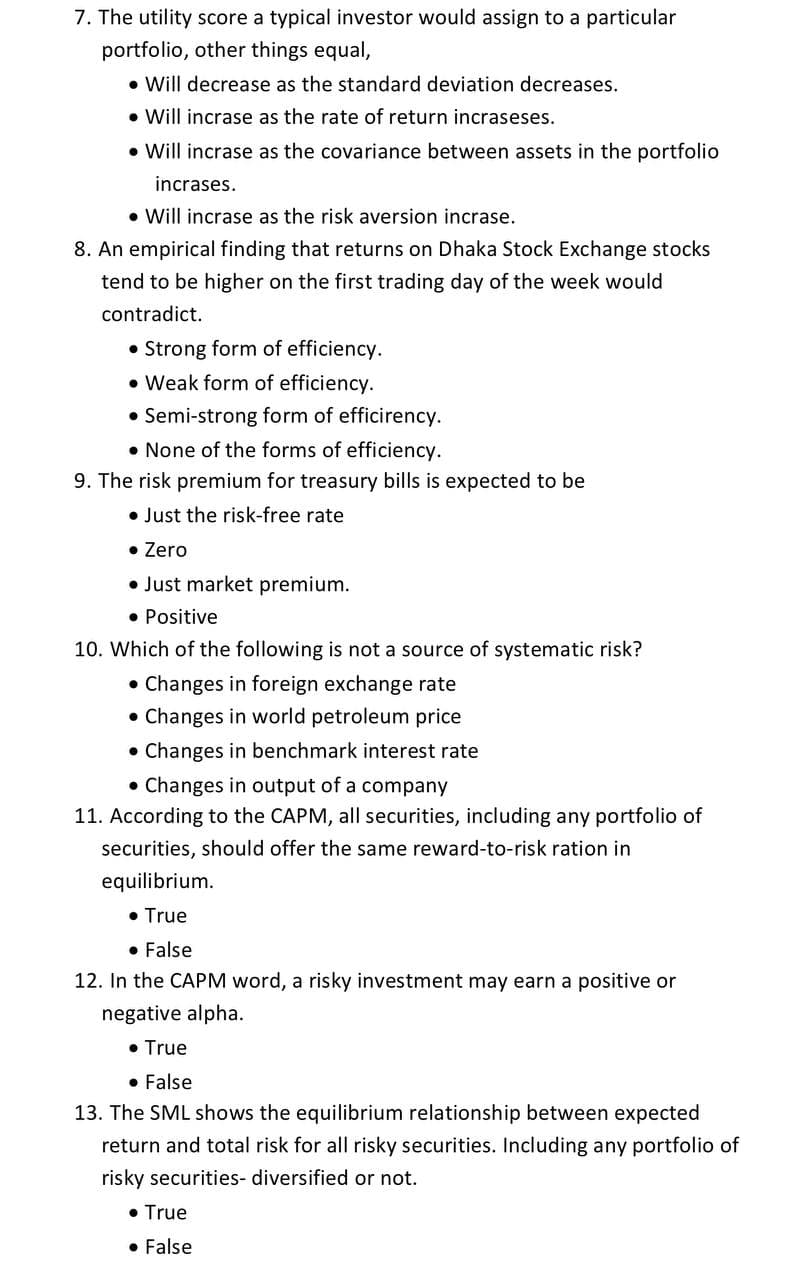

Transcribed Image Text:7. The utility score a typical investor would assign to a particular

portfolio, other things equal,

• Will decrease as the standard deviation decreases.

• Will incrase as the rate of return incraseses.

• Will incrase as the covariance between assets in the portfolio

incrases.

• Will incrase as the risk aversion incrase.

8. An empirical finding that returns on Dhaka Stock Exchange stocks

tend to be higher on the first trading day of the week would

contradict.

• Strong form of efficiency.

• Weak form of efficiency.

Semi-strong form of efficirency.

• None of the forms of efficiency.

9. The risk premium for treasury bills is expected to be

• Just the risk-free rate

• Zero

• Just market premium.

• Positive

10. Which of the following is not a source of systematic risk?

• Changes in foreign exchange rate

Changes in world petroleum price

• Changes in benchmark interest rate

• Changes in output of a company

11. According to the CAPM, all securities, including any portfolio of

securities, should offer the same reward-to-risk ration in

equilibrium.

• True

• False

12. In the CAPM word, a risky investment may earn a positive or

negative alpha.

• True

• False

13. The SML shows the equilibrium relationship between expected

return and total risk for all risky securities. Including any portfolio of

risky securities- diversified or not.

• True

• False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning