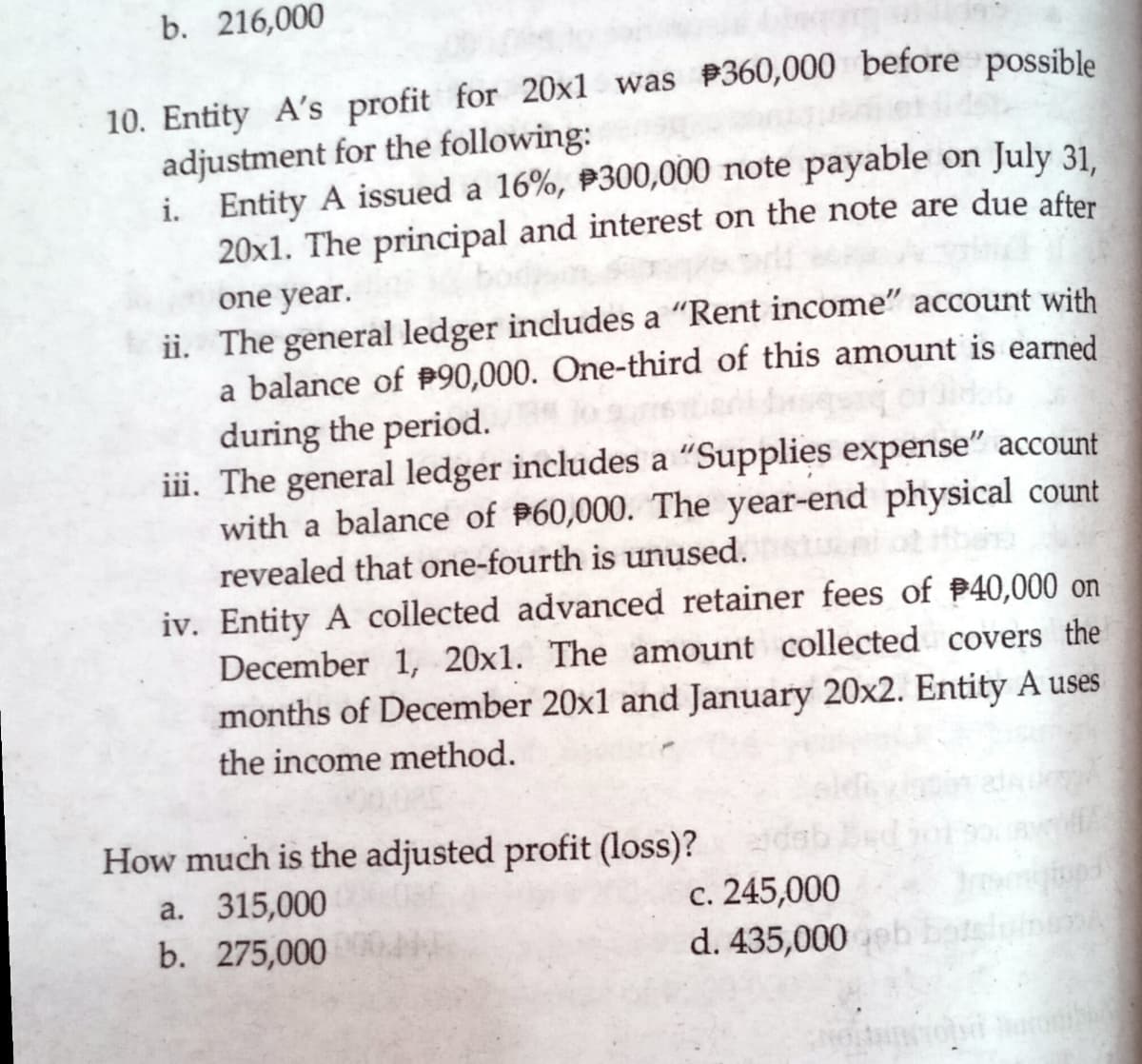

10. Entity A's profit for 20x1 was P360,000 before possible adjustment for the following: i. Entity A issued a 16%, P300,000 note payable on July 31. 20x1. The principal and interest on the note are due after one year. ii. The general ledger includes a "Rent income" account with a balance of 90,000. One-third of this amount is earned during the period. iii. The general ledger includes a "Supplies expense" account with a balance of P60,000. The year-end physical count revealed that one-fourth is unused. iv. Entity A collected advanced retainer fees of 40,000 on December 1, 20x1. The amount collected covers the months of December 20x1 and January 20x2. Entity A uses the income method. How much is the adjusted profit (loss)? a. 315,000 b. 275,000 ed c. 245,000 d. 435,000 eb ba

10. Entity A's profit for 20x1 was P360,000 before possible adjustment for the following: i. Entity A issued a 16%, P300,000 note payable on July 31. 20x1. The principal and interest on the note are due after one year. ii. The general ledger includes a "Rent income" account with a balance of 90,000. One-third of this amount is earned during the period. iii. The general ledger includes a "Supplies expense" account with a balance of P60,000. The year-end physical count revealed that one-fourth is unused. iv. Entity A collected advanced retainer fees of 40,000 on December 1, 20x1. The amount collected covers the months of December 20x1 and January 20x2. Entity A uses the income method. How much is the adjusted profit (loss)? a. 315,000 b. 275,000 ed c. 245,000 d. 435,000 eb ba

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 52E: Juroe Company provided the following income statement for last year: Juroes balance sheet as of...

Related questions

Question

100%

Transcribed Image Text:b. 216,000

10. Entity A's profit for 20x1 was P360,000 before possible

adjustment for the following:

i. Entity A issued a 16%, P300,000 note payable on July 31.

20x1. The principal and interest on the note are due after

one year.

ii. The general ledger includes a "Rent income" account with

a balance of P90,000. One-third of this amount is earned

during the period.

iii. The general ledger includes a "Supplies expense" account

with a balance of P60,000. The year-end physical count

revealed that one-fourth is unused.

iv. Entity A collected advanced retainer fees of 40,000 on

December 1, 20x1. The amount collected covers the

months of December 20x1 and January 20x2. Entity A uses

the income method.

How much is the adjusted profit (loss)?

a. 315,000

b. 275,000

c. 245,000

d. 435,000

botelyinum

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College