Bon Nebo Co. sold 15,500 annual subscriptions of Magazine 20XX for $59 during December 20Y8. These new subscribers will receive monthly issues, beginning in January 20Y9. In addition, the business had taxable income of $576,000 during the first calendar quarter of 20Y9. The federal tax rate is 40%. A quarterly tax payment will be made on April 12, 20Y9. Prepare the Current Liabilities section of the balance sheet for Bon Nebo Co. on March 31, 20Y9. Bon Nebo Co. Current Liabilities Section of Balance Sheet March 31, 20Y9 Federal income taxes payable 576,000 X Advances on magazine subscriptions Total current liabilities Feedhack

Bon Nebo Co. sold 15,500 annual subscriptions of Magazine 20XX for $59 during December 20Y8. These new subscribers will receive monthly issues, beginning in January 20Y9. In addition, the business had taxable income of $576,000 during the first calendar quarter of 20Y9. The federal tax rate is 40%. A quarterly tax payment will be made on April 12, 20Y9. Prepare the Current Liabilities section of the balance sheet for Bon Nebo Co. on March 31, 20Y9. Bon Nebo Co. Current Liabilities Section of Balance Sheet March 31, 20Y9 Federal income taxes payable 576,000 X Advances on magazine subscriptions Total current liabilities Feedhack

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter9: Current Liabilities And Contingent Obligations

Section: Chapter Questions

Problem 8RE: Borat Company gives annual bonuses after the end of the year. Borat computes the bonuses based on...

Related questions

Question

Current liabilities

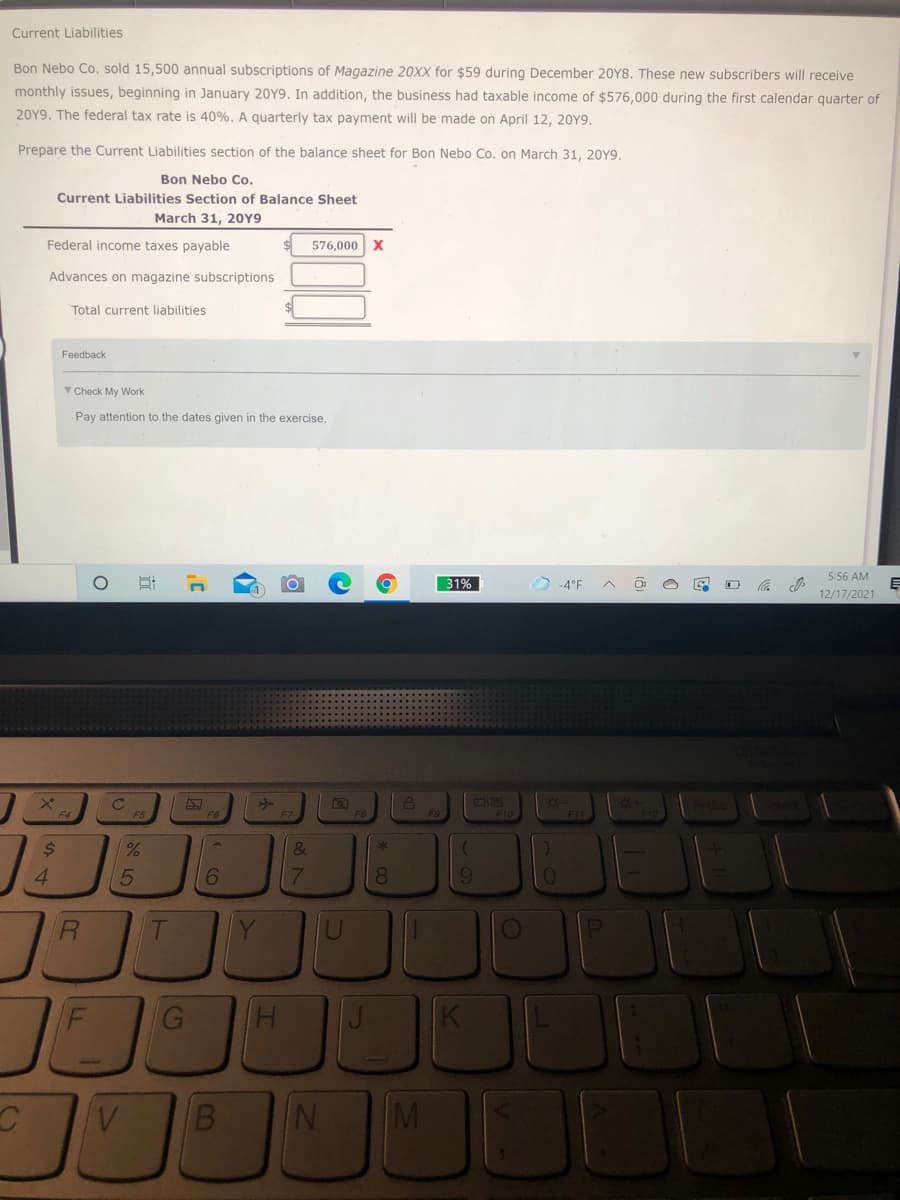

Transcribed Image Text:Current Liabilities

Bon Nebo Co. sold 15,500 annual subscriptions of Magazine 20XX for $59 during December 20Y8. These new subscribers will receive

monthly issues, beginning in January 20Y9. In addition, the business had taxable income of $576,000 during the first calendar quarter of

20Y9. The federal tax rate is 40%. A quarterly tax payment will be made on April 12, 20Y9.

Prepare the Current Liabilities section of the balance sheet for Bon Nebo Co. on March 31, 20Y9.

Bon Nebo Co.

Current Liabilities Section of Balance Sheet

March 31, 20Y9

Federal income taxes payable

576,000 x

Advances on magazine subscriptions

Total current liabilities

Feedback

V Check My Work

Pay attention to the dates given in the exercise.

5:56 AM

31%

D -4°F

12/17/2021

F10

2$

&

4.

6.

7.

8.

R.

Y

B.

IN

M

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College