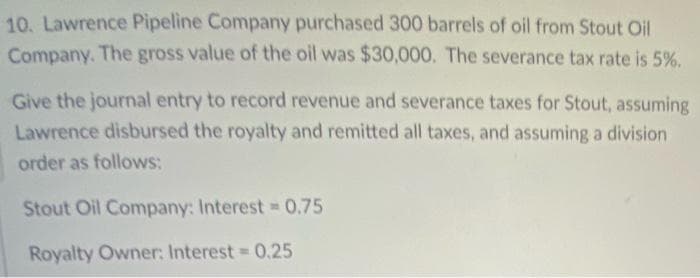

10. Lawrence Pipeline Company purchased 300 barrels of oil from Stout Oil Company. The gross value of the oil was $30,000. The severance tax rate is 5%. Give the journal entry to record revenue and severance taxes for Stout, assuming Lawrence disbursed the royalty and remitted all taxes, and assuming a division order as follows: Stout Oil Company: Interest 0.75 Royalty Owner: Interest 0.25

10. Lawrence Pipeline Company purchased 300 barrels of oil from Stout Oil Company. The gross value of the oil was $30,000. The severance tax rate is 5%. Give the journal entry to record revenue and severance taxes for Stout, assuming Lawrence disbursed the royalty and remitted all taxes, and assuming a division order as follows: Stout Oil Company: Interest 0.75 Royalty Owner: Interest 0.25

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 5EB: Steele Corp. purchases equipment for $30,000. Regarding the purchase, Steele paid shipping of...

Related questions

Question

1

Transcribed Image Text:10. Lawrence Pipeline Company purchased 300 barrels of oil from Stout Oil

Company. The gross value of the oil was $30,000. The severance tax rate is 5%.

Give the journal entry to record revenue and severance taxes for Stout, assuming

Lawrence disbursed the royalty and remitted all taxes, and assuming a division

order as follows:

Stout Oil Company: Interest 0.75

Royalty Owner: Interest 0.25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College