Assume that a company has developed a new industrial component called Part A that offers superior performance relative to its competitors. The competing part sells for $1,500 and needs to be replaced after 1,500 hours of use. It also requires $400 of preventive maintenance during its useful life. Part A is similar to its competing product with two important exceptions-it needs to be replaced after 3,000 hours of use and it requires only $200 of preventive maintenance during its useful life. From a value-based pricing standpoint, what is the differentiation value offered by Part A relative to the competitor's offering for each 3.000 hours of usage? Multiple Choice $3.200 $3,600 $2.100 S700 O o o O

Assume that a company has developed a new industrial component called Part A that offers superior performance relative to its competitors. The competing part sells for $1,500 and needs to be replaced after 1,500 hours of use. It also requires $400 of preventive maintenance during its useful life. Part A is similar to its competing product with two important exceptions-it needs to be replaced after 3,000 hours of use and it requires only $200 of preventive maintenance during its useful life. From a value-based pricing standpoint, what is the differentiation value offered by Part A relative to the competitor's offering for each 3.000 hours of usage? Multiple Choice $3.200 $3,600 $2.100 S700 O o o O

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 9PB: ZZOOM, Inc., has decided to discontinue manufacturing its Z Best model. Currently, the company has...

Related questions

Question

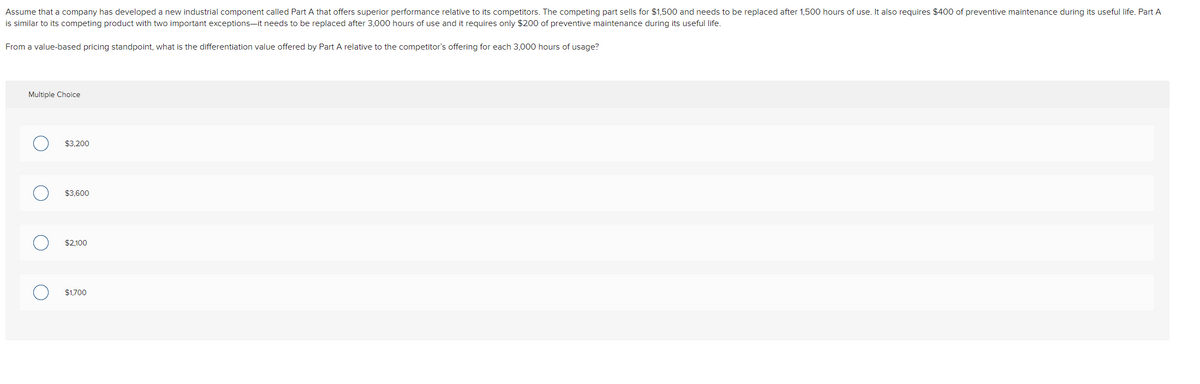

Transcribed Image Text:Assume that a company has developed a new industrial component called Part A that offers superior performance relative to its competitors. The competing part sells for $1,500 and needs to be replaced after 1,500 hours of use. It also requires $400 of preventive maintenance during its useful life. Part A

is similar to its competing product with two important exceptions-it needs to be replaced after 3,000 hours of use and it requires only $200 of preventive maintenance during its useful life.

From a value-based pricing standpoint, what is the differentiation value offered by Part A relative to the competitor's offering for each 3,000 hours of usage?

Multiple Choice

$3.200

$3,600

$2,100

$1,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning