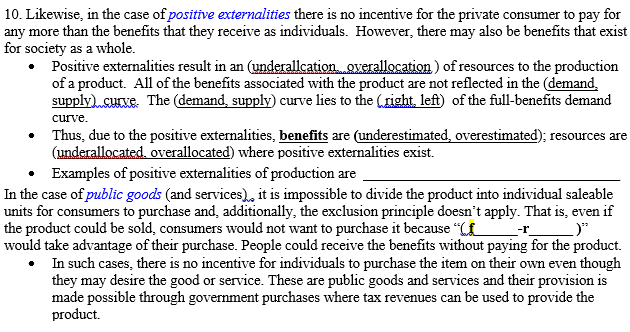

10. Likewise, in the case of positive externalities there is no incentive for the private consumer to pay for any more than the benefits that they receive as individuals. However, there may also be benefits that exist for society as a whole. • Positive externalities result in an (underallcation. overallocation) of resources to the production of a product. All of the benefits associated with the product are not reflected in the (demand, supply) curve. The (demand, supply) curve lies to the (right, left) of the full-benefits demand curve. • Thus, due to the positive externalities, benefits are (underestimated, overestimated); resources are (underallocated, overallocated) where positive externalities exist. • Examples of positive externalities of production are In the case of public goods (and services), it is impossible to divide the product into individual saleable units for consumers to purchase and, additionally, the exclusion principle doesn't apply. That is, even if the product could be sold, consumers would not want to purchase it because "CE would take advantage of their purchase. People could receive the benefits without paying for the product. • In such cases, there is no incentive for individuals to purchase the item on their own even though they may desire the good or service. These are public goods and services and their provision is made possible through government purchases where tax revenues can be used to provide the product. --r_ _)"

10. Likewise, in the case of positive externalities there is no incentive for the private consumer to pay for any more than the benefits that they receive as individuals. However, there may also be benefits that exist for society as a whole. • Positive externalities result in an (underallcation. overallocation) of resources to the production of a product. All of the benefits associated with the product are not reflected in the (demand, supply) curve. The (demand, supply) curve lies to the (right, left) of the full-benefits demand curve. • Thus, due to the positive externalities, benefits are (underestimated, overestimated); resources are (underallocated, overallocated) where positive externalities exist. • Examples of positive externalities of production are In the case of public goods (and services), it is impossible to divide the product into individual saleable units for consumers to purchase and, additionally, the exclusion principle doesn't apply. That is, even if the product could be sold, consumers would not want to purchase it because "CE would take advantage of their purchase. People could receive the benefits without paying for the product. • In such cases, there is no incentive for individuals to purchase the item on their own even though they may desire the good or service. These are public goods and services and their provision is made possible through government purchases where tax revenues can be used to provide the product. --r_ _)"

Principles of Microeconomics

7th Edition

ISBN:9781305156050

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter11: Public Goods And Common Resources

Section: Chapter Questions

Problem 2PA

Related questions

Question

Transcribed Image Text:10. Likewise, in the case of positive externalities there is no incentive for the private consumer to pay for

any more than the benefits that they receive as individuals. However, there may also be benefits that exist

for society as a whole.

• Positive externalities result in an (underallcation. overallocation) of resources to the production

of a product. All of the benefits associated with the product are not reflected in the (demand,

supply) curve. The (demand, supply) curve lies to the (right, left) of the full-benefits demand

curve.

• Thus, due to the positive externalities, benefits are (underestimated, overestimated); resources are

(underallocated, overallocated) where positive externalities exist.

• Examples of positive externalities of production are

In the case of public goods (and services), it is impossible to divide the product into individual saleable

units for consumers to purchase and, additionally, the exclusion principle doesn't apply. That is, even if

the product could be sold, consumers would not want to purchase it because "CE

would take advantage of their purchase. People could receive the benefits without paying for the product.

• In such cases, there is no incentive for individuals to purchase the item on their own even though

they may desire the good or service. These are public goods and services and their provision is

made possible through government purchases where tax revenues can be used to provide the

product.

--r_

_)"

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax