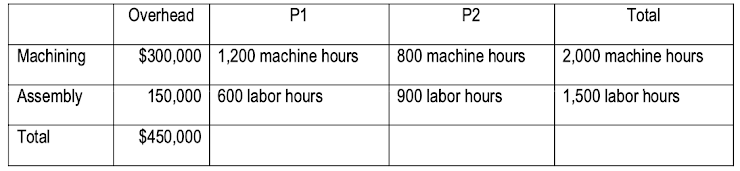

10. Ramona Diaz Ltd. produces two products, P1 and P2, at its two departments: Machining and Assembly, as shown in the table below. The accountant tries to allocate overhead costs to the two products. If the accountant decides to allocate overhead based on labor hours, what is P1’s share of the total overhead costs? $180,000 $200,000 $220,000 $240,000

Q: A business has the following items in it - Land 1 000 000 - Vehicles? - Debtors 60 000 - Cash…

A: Hi studentSince there are multiple questions, we will answer only first question.…

Q: Given the data below for a firm in its first year of operation, determine net income under the…

A: The accrual basis of accounting is related to recognizing the revenues in the period in which they…

Q: Ms. Joan Hanson is an employee of a CCPC. In 2021, she is granted options to purchase 500 shares of…

A: Taxable income refers to the portion of an individual or entity's income that is subject to…

Q: Lakewood Company sold 17,000 jars of its organic honey in the most current year for $12 per jar. The…

A: COST OF GOODS SOLDCost of Goods Sold States the Amount of Cost Included in the number of Units Sold…

Q: On June 8, Williams Compa earest dollar. a. $83,560 b. $75,964 Oc. $7,596 d$78.496

A: In this question, we will find out the maturity value by calculating the interest on notes payable…

Q: bok nt ences Following are the transactions of a new company called Pose-for-Pics. August 1 M.…

A: As per dual concept of accounting, every transaction has dual impact on the books of…

Q: New York Pool Supplies' merchandise inventory data for the year ended December 31, 2025, follow:…

A: Cost of Goods Sold -The cost of goods sold is the cost incurred to generate sales for the company.…

Q: Key Corporation is considering the addition of a new product. The expected cost and revenue data for…

A: Lets understand the basics.Management needs to select between whether to product new product or not.…

Q: Quantitative Problem: Rosnan Industries 2019 and 2018 balance sheets and income statements are shown…

A: Free cash flow is the money that the business entity has left over after paying all of its operating…

Q: Determine the dividends per share for preferred and common stock for each year. all answers to two…

A: A dividend is a share of profits.Which is paid to the shareholders for their investment in a…

Q: 1. State whether the following questions is True (T) or False (F). a. Management accounting is…

A: Branches of Accounting- Accounting has basically many branches included in it, some of which are…

Q: Affordable Electronics Inc. manufactures medium-quality, reasonably priced wireless speakers for…

A: Labor variances:Variable overhead variances:

Q: Birch Company normally produces and sells 48,000 units of RG-6 each month. The selling price is $20…

A: The indifference point is the sales units at which continuing the operation or discontinuing the…

Q: 4. Alma Corporation has developed the following budget formula for annual indirect labor costs:…

A: "Since you have asked multiple questions, we will solve first question for you. If you want any…

Q: a. Determine the number of shares used to compute basic earnings per share for the year ended…

A: The difference between total deductions (including deductions directly related to carrying on any…

Q: IC Co is a shop that sells ice-creams and cakes. The following information relates to the year 20X6:…

A: Activity-Based Costing (ABC) is a costing method used by businesses to allocate indirect costs to…

Q: Mystic Lake Inc. bottles and distributes spring water. On July 9 of the current yea Mystic Lake…

A: In this question, we will first post the Journal entries for recording the reacquisition of stock…

Q: Required: 3 1. Calculate accrual net income for both years. 2. Determine the amount due the…

A: The income statement is prepared to record the revenue and expenses of the current period. The…

Q: c. At the beginning of the year, Quaker Company's liabilities equal $62,000. During the year, assets…

A: ACCOUNTING EQUATIONAccounting Equation is a Financial Accounting Technique which represents the…

Q: 2nd year by adjusting the gross amount of PPE in proportion to the valuation. What would be the…

A: As per IFRS, there are two approaches of revaluation of Asset: (1) Depreciation Elimination Approach…

Q: Sheridan Corporation manufactures safes-large mobile safes, and large walk-in stationary bank safes.…

A: Under traditional costing system a single overhead rate is used for allocating the overhead cost…

Q: Equipment with a cost of $147,819 has an estimated residual value of $8,443 and an estimated life of…

A: The Depreciation expense is charged on fixed assets as reduction in the value of the fixed assets…

Q: Finance Co lent $9.8 million to Corbin Construction on January 1, 2021, to construct a playground.…

A: A promissory note is a legal instrument that serves as a written promise to pay a certain amount of…

Q: [The following information applies to the questions displayed below.] Sandra's Purse Boutique has…

A: Specific identification method :— It is one of the method of inventory valuation in which specific…

Q: ROI, Margin, Turnover Allard, Inc., presented two years of data for its Frozen Foods Division and…

A: FormulaROI = Operating Income/Average Operating Assets x 100Margin= Operating Income/Sales x…

Q: Leach Incorporated experienced the following events for the first two years of its operations.…

A: Financial statements are prepared at the end of an accounting period. First of all, all the…

Q: The Jabba Corporation manufactures the "Snack Buster" which consists of a wooden snack chip bowl…

A: Relevant cost meaning:- Relevant expenditures are expenses that will be important when making future…

Q: Russel Company is a consulting firm. The firm expects to have $34,400 in indirect costs during the…

A: Labor cost is the amount of cost incurred on the wage payment to the laborers. It could be direct or…

Q: Sunland Corporation has an investment in corporate bonds classified as available-for-sale at…

A: Bonds receivable: It is an investment in bonds of an organization that pays a fixed rate of interest…

Q: Earnings per share Financial statement data for the years 20Y5 and 20Y6 for Black Bull Inc. follow:…

A: EPS is a financial term used to quantify the profitability of an organization and its performance on…

Q: Dataspan, Incorporated, automated its plant at the start current year and installed a flexible…

A: Throughput Time Is The Amount Of Time That Required To Complete a Finished Product From Beginning…

Q: Durham Company had two classes of shares outstanding, 10% P100 par preference share capital and P10…

A: To determine the amounts to be reported as additional paid-in capital and Retained Earnings on June…

Q: An SME provided the following on December 31, 2022: Cash Accounts receivable Prepayments Inventories…

A: Current Assets: Current assets are resources or assets that are expected to be converted into cash…

Q: When you undertook the preparation of the financial statements for Telfer Company at December 31,…

A: Ending inventory using conventional retail method is calculated by multiplying the ratio of cost to…

Q: Debt Issued at a Discount (Straight Line) On January 1, 2024, Drew Company issued 5-year bonds with…

A: Lets understand the basics.Bonds can be issued at either par value or at premium or at discount. If…

Q: Following is a table for the present value of $1 at compound interest: Year 6% 10% 12% 1 0.943…

A: Present Value is the Value of one Dollar as of today which will be received in Future. For the…

Q: Required: Prepare the income statement for Armani Company for the current year ended December 31.

A: Income statement shows company's income and expenses over a period of time.Revenues, Expenses, and…

Q: onsider the following transactions. 1. 2. 3. 4. 5. Receive cash from customers, $15,000. Pay cash…

A: T-accounts are a handy tool for visualizing and summarizing account activity over a specified time…

Q: The Prince-Robbins partnership has the following capital account balances on January 1, 2021:…

A: Partnership accounting refers to the process of recording and reporting financial transactions and…

Q: Prior to revaluation to fair value at 30 June 2009 the balance in Thunder's asset revaluation…

A: The assets under IAS 16, are recognized in the books as per revaluation or cost basis. The…

Q: Determining Market-Based and Negotiated Transfer Prices Carreker, Inc., has a number of divisions,…

A: Transfer Pricing is a price at which the organization transfer their services to other division. It…

Q: journal entries to record the (a) purchase c raw materials, (b) use of indirect materials, and (c)…

A: Journal entry is the first stage of accounting process.Journal entry used to record business…

Q: During the year, a merchandising company had the following transactions: Generated 300.000 TL…

A: Retained earnings refer to the portion of a company's net income that is retained or reinvested in…

Q: Required: Prepare a classified balance sheet for the Valley Pump Corporation at December 31, 2021.…

A: Current assets are assets that are anticipated to be used up or turned into cash within a year or…

Q: Baguio Corporation has these selected data: Units to be sold 25,000 Total Cost of the units P500…

A: Selling price of a product is the price at which company sells its products or service.Company sets…

Q: Required information Use the following information for the Exercises below. (Algo) [The following…

A: Net Income = Revenue - Expenses Retained earnings is profits earned by organization over a period…

Q: Dehner Corporation uses a job-order costing system with a single plantwide predetermined overhead…

A: The manufacturing overhead is applied to the production on the basis of pre-determined overhead…

Q: Berbice Sugar Balance Sheet December 31, 2022…

A: Hi studentSince there are multiple subparts, we will answer only first three subparts. Budgets are…

Q: SVK Corporation is a manufacturer of printed circuit boards. For each of the following situations,…

A: Revenue recognition is the process of identifying and recording revenue earned by a company in its…

Q: The Jabba Corporation manufactures the "Snack Buster" which consists of a wooden snack chip bowl…

A: Answer:- Relevant cost meaning:- Relevant expenditures are expenses that will be important when…

10. Ramona Diaz Ltd. produces two products, P1 and P2, at its two departments: Machining and Assembly, as shown in the table below. The accountant tries to allocate

If the accountant decides to allocate overhead based on labor hours, what is P1’s share of the total overhead costs?

Step by step

Solved in 3 steps

- Steeler Towel Company estimates its overhead to be $250,000. It expects to have 100,000 direct labor hours costing $2,500,000 in labor and utilizing 12,500 machine hours. Calculate the predetermined overhead rate using: A. Direct labor hours B. Direct labor dollars C. Machine hoursGreen Bay Cheese Company estimates its overhead to be $375,000. It expects to have 125,000 direct labor hours costing $1,500,000 in labor and utilizing 15,000 machine hours. Calculate the predetermined overhead rate using: A. Direct labor hours B. Direct labor dollars C. Machine hoursWhat is the conversion cost to manufacture insulated travel cups if the costs are: direct materials, $17,000; direct labor, $33,000; and manufacturing overhead, $70,000? A. $16,000 B. $50,000 C. $103,000 D. $120000

- A company estimates its manufacturing overhead will be $750,000 for the next year. What is the predetermined overhead rate given the following independent allocation bases? Budgeted direct labor hours: 60,000 Budgeted direct labor expense: $1,500,000 Estimated machine hours: 100,000Production run size and activity improvement Littlejohn, Inc. manufactures machined parts for the automotive industry. The activity cost associated with Part XX-10 is as follows: Activity Activity-Base Usage Activity Rate = Activity Cost Fabrication 250 dlh 80per dlh 20,000 Setup 10 setups 80 per setup 800 Production control 10 prod, runs 30 per prod, run 300 Moving 10 moves 25 per move 250 Total activity cost per unit 21,350 Estimated units of production 500 Activity cost per unit 42.70 Each unit requires 30 minutes of fabrication direct labor. Moreover, part XX-10 is manufactured in production run sizes of 50 units. Each production run is set up, scheduled (production control), and moved as a batch of 50 units. Management is considering improvements in the setup, production control, and moving activities in order to cut the production run sizes by half. As a result, the number of setups, production runs, and mows will double from 10 to 20. Such improvements are expected to speed the companys ability to respond to customer orders. Setup is reengineered so that it takes 60% of the original cost per setup. Production control software will allow production control effort and cost per production run to decline by 60%. Moving distance was reduced by 40%, thus reducing the cost per mow by the same amount. A. Determine the revised activity cost per unit under the proposed changes. B. Did these improvements reduce the activity cost per unit? C. What cost per unit for setup would be required for the solution in (A) to equal the base solution?Materials Php 65,000.00 (Php 15,000.00 is indirect) Labor Php 70,000.00 (Php 18,000.00 is indirect) Factory overhead Php 95,000.00 (including indirect materials and indirect labor) Unit Produced 1,000 Sold800 General and administrative expense Php 2,600.00 Office Salaries Php 18,600.00 4. Compute total period cost 5. If the selling price is Php 50.00 compute net

- Compute the ABC Rate for Machine Costs. Actual Machine Costs = $450,000 Estimated Machine Hours = 800 Actual Machine Hours = 1000 Estimated Machine Costs = $400,000Machine-hours 60,000 3,000 Direct labor-hours 8,000 80,000 Total fixed manufacturing overhead cost $390,000 $500,000 Variable manufacturing overhead per machine-hour $2.00 Variable manufacturing overhead per direct labor-hour $3.75 Cost summary for Job 407 Department Milling Assembly Machine-hours 90 4 Direct labor-hours 5 20 Direct materials $800 $370 Direct labor cost $70 $280 Enter a formula into each of the cells marked with a ? below Step 1: Calculate the estimated total manufacturing overhead cost for each department Milling Assembly Total fixed manufacturing overhead cost ? ? Variable manufacturing overhead per machine-hour or direct labor-hour ? ? Total machine-hours or direct labor-hours ? ? Total variable manufacturing overhead ? ?…Gell Corporation manufactures computers. Assume that Gell: • allocates manufacturing overhead based on machine hours • estimated 12,000 machine hours and $93,000 of manufacturing overhead costs • actually used 16,000 machine hours and incurred the following actual costs: What is Gell’s actual manufacturing overhead cost? a. $158,000 b. $83,000 c. $145,000 d. $220,000

- The Love Manufacturing Company has the following financial information:· Manufacturing overhead P300,800· Direct materials increased by 130, 000· Work in process increased by 90, 000· Finished goods decreased by 320, 400Manufacturing overhead amounts to 50% of direct labor, and the direct labor and manufacturing overhead combined equal 50% of the total cost of manufacturing.How much is the cost of goods sold?Total Manufacturing Costs ₱325,000 Applied Overhead Costs, 75% of direct labor cost ₱075,000 Selling expenses ₱316,000 Administrative expenses ₱314,000 What is the cost of direct materials? Show solution Group of answer choices ₱175,000 ₱193,750 ₱220,000 ₱150,000Q15. A company manufacturing two products furnishes the following data Annual output: Product Output units Machine Hours Purchase Orders Machine set-ups A 5000 20000 160 20 B 60000 120000 384 44 Total 65000 140000 544 64 The annual overheads are as under. Rs Volume related activity costs 550,000 Set up related costs 820,000 Purchase related costs 618,000 Total 1,988,000 You are required to calculate the overheads cost per unit of each product A and B based on Activity based costing method.