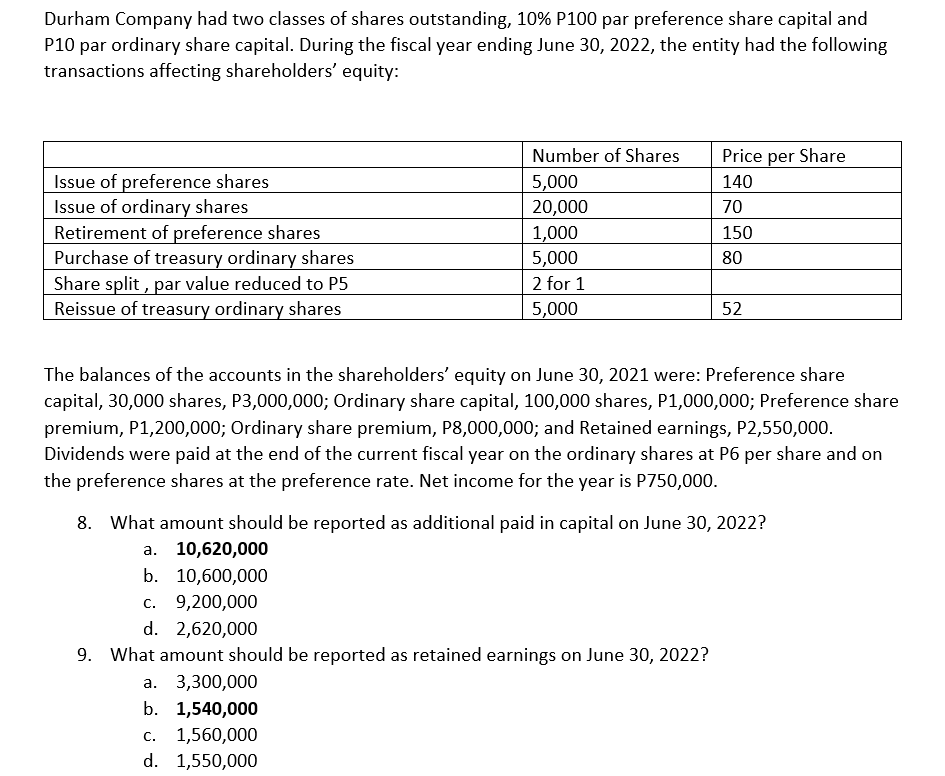

Durham Company had two classes of shares outstanding, 10% P100 par preference share capital and P10 par ordinary share capital. During the fiscal year ending June 30, 2022, the entity had the following transactions affecting shareholders' equity: Issue of preference shares Issue of ordinary shares Retirement of preference shares Purchase of treasury ordinary shares Share split, par value reduced to P5 Reissue of treasury ordinary shares Number of Shares 5,000 20,000 1,000 5,000 2 for 1 5,000 Price per Share 140 70 150 80 52 The balances of the accounts in the shareholders' equity on June 30, 2021 were: Preference share capital, 30,000 shares, P3,000,000; Ordinary share capital, 100,000 shares, P1,000,000; Preference share premium, P1,200,000; Ordinary share premium, P8,000,000; and Retained earnings, P2,550,000. Dividends were paid at the end of the current fiscal year on the ordinary shares at P6 per share and on the preference shares at the preference rate. Net income for the year is P750,000. 8. What amount should be reported as additional paid in capital on June 30, 2022? a. 10,620,000 b. 10,600,000 c. 9,200,000 d. 2,620,000 9. What amount should be reported as retained earnings on June 30, 2022? a. 3,300,000 b. 1,540,000 c. 1,560,000 d. 1,550,000

Durham Company had two classes of shares outstanding, 10% P100 par

|

|

Number of Shares |

Price per Share |

|

Issue of preference shares |

5,000 |

140 |

|

Issue of ordinary shares |

20,000 |

70 |

|

Retirement of preference shares |

1,000 |

150 |

|

Purchase of treasury ordinary shares |

5,000 |

80 |

|

Share split , par value reduced to P5 |

2 for 1 |

|

|

Reissue of treasury ordinary shares |

5,000 |

52 |

The balances of the accounts in the shareholders’ equity on June 30, 2021 were: Preference share capital, 30,000 shares, P3,000,000; Ordinary share capital, 100,000 shares, P1,000,000; Preference share premium, P1,200,000; Ordinary share premium, P8,000,000; and

- What amount should be reported as additional paid in capital on June 30, 2022?

10,620,000

10,600,000

9,200,000

2,620,000

What amount should be reported as retained earnings on June 30, 2022?

3,300,000

1,540,000

1,560,000

1,550,000

Please kindly show solution for two question.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps