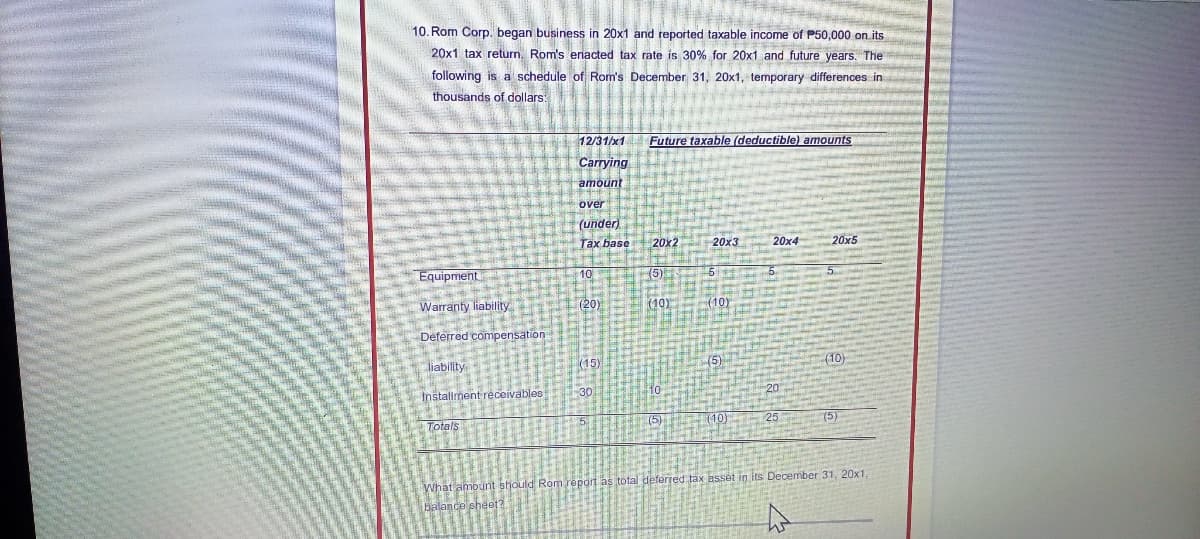

10. Rom Corp. began business in 20x1 and reported taxable income of P50,000 on its 20x1 tax return, Rom's enacted tax rate is 30% for 20x1 and future years. The following is a schedule of Rom's December 31, 20x1, temporary differences in thousands of dollars: 12/31/x1 Future taxable (deductible) amounts Carrying amount over (under) Tax base 20x2 20x3 20x4 20x5 Equipment 10 (5) Warranty liability (20) (10) (10) Deferred compensation liabilty (15) (10) Instaliment réceivables 30 10 20 Totals (10) 25 (5) 20x1

10. Rom Corp. began business in 20x1 and reported taxable income of P50,000 on its 20x1 tax return, Rom's enacted tax rate is 30% for 20x1 and future years. The following is a schedule of Rom's December 31, 20x1, temporary differences in thousands of dollars: 12/31/x1 Future taxable (deductible) amounts Carrying amount over (under) Tax base 20x2 20x3 20x4 20x5 Equipment 10 (5) Warranty liability (20) (10) (10) Deferred compensation liabilty (15) (10) Instaliment réceivables 30 10 20 Totals (10) 25 (5) 20x1

Chapter26: Tax Practice And Ethics

Section: Chapter Questions

Problem 32P

Related questions

Question

Transcribed Image Text:10. Rom Corp. began business in 20x1 and reported taxable income of P50,000 on its

20x1 tax return. Rom's enacted tax rate is 30% for 20x1 and future years. The

following is a schedule of Rom's December 31, 20x1, temporary differences in

thousands of dollars:

12/31/x1

Future taxable (deductible) amounts

Carrying

amount

over

(under)

Tax base

20x2

20x3

20x4

20x5

Equipment

10

(5)

Warranty liability

(20)

(10)

Deferred compensation

liability

(10)

Instaliment receivables

30

10

Totals

5

(5)

(10)

25

(5)

What amount should Rom repon as total deferred tax asset in its December 31, 20x1,

balance sheet

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning