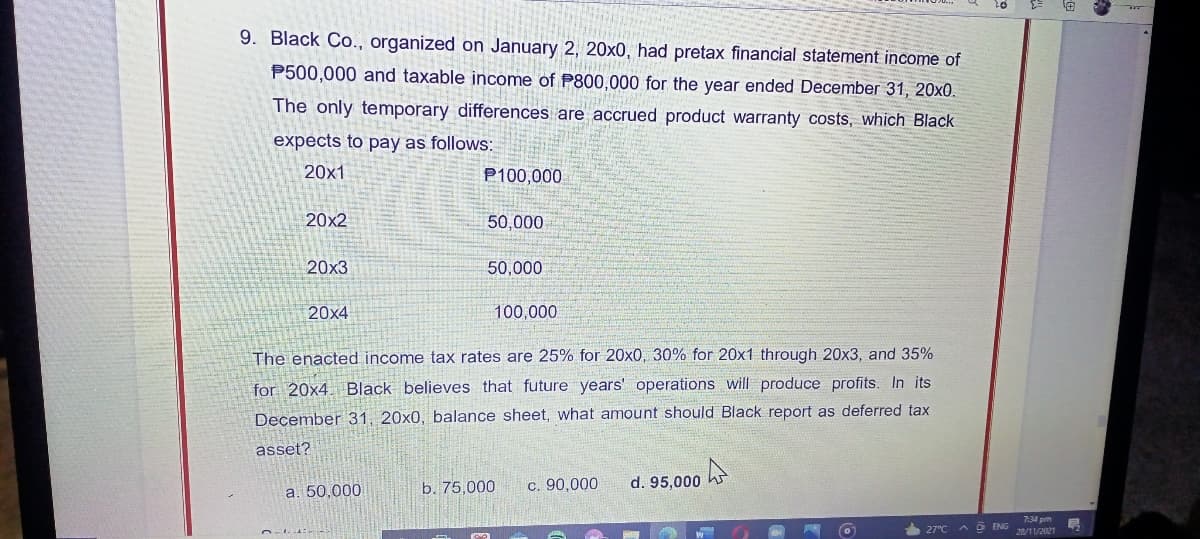

9. Black Co., organized on January 2, 20x0, had pretax financial statement income c P500,000 and taxable income of P800,000 for the year ended December 31, 20×C The only temporary differences are accrued product warranty costs, which Blach expects to pay as follows: 20x1 P100,000 20x2 50,000 20x3 50,000 20x4 100,000 The enacted income tax rates are 25% for 20x0, 30% for 20x1 through 20x3, and 35% for 20x4. Black believes that future years' operations will produce profits. In its December 31, 20x0, balance sheet, what amount should Black report as deferred tax

9. Black Co., organized on January 2, 20x0, had pretax financial statement income c P500,000 and taxable income of P800,000 for the year ended December 31, 20×C The only temporary differences are accrued product warranty costs, which Blach expects to pay as follows: 20x1 P100,000 20x2 50,000 20x3 50,000 20x4 100,000 The enacted income tax rates are 25% for 20x0, 30% for 20x1 through 20x3, and 35% for 20x4. Black believes that future years' operations will produce profits. In its December 31, 20x0, balance sheet, what amount should Black report as deferred tax

Chapter14: Taxes On The Financial Statements

Section: Chapter Questions

Problem 3BCRQ

Related questions

Question

Transcribed Image Text:9. Black Co., organized on January 2, 20x0, had pretax financial statement income of

P500,000 and taxable income of P800,000 for the year ended December 31, 20x0.

The only temporary differences are accrued product warranty costs, which Black

expects to pay as follows:

20x1

P100,000

20x2

50,000

20x3

50,000

20x4

100,000

The enacted income tax rates are 25% for 20x0, 300% for 20x1 through 20x3, and 35%

for 20x4 Black believes that future years' operations will produce profits. In its

December 31, 20x0, balance sheet, what amount should Black report as deferred tax

asset?

c. 90,000

d. 95,000 h

a. 50,000

b. 75,000

7:34 pm

AD ENG /1/2021

27°C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning