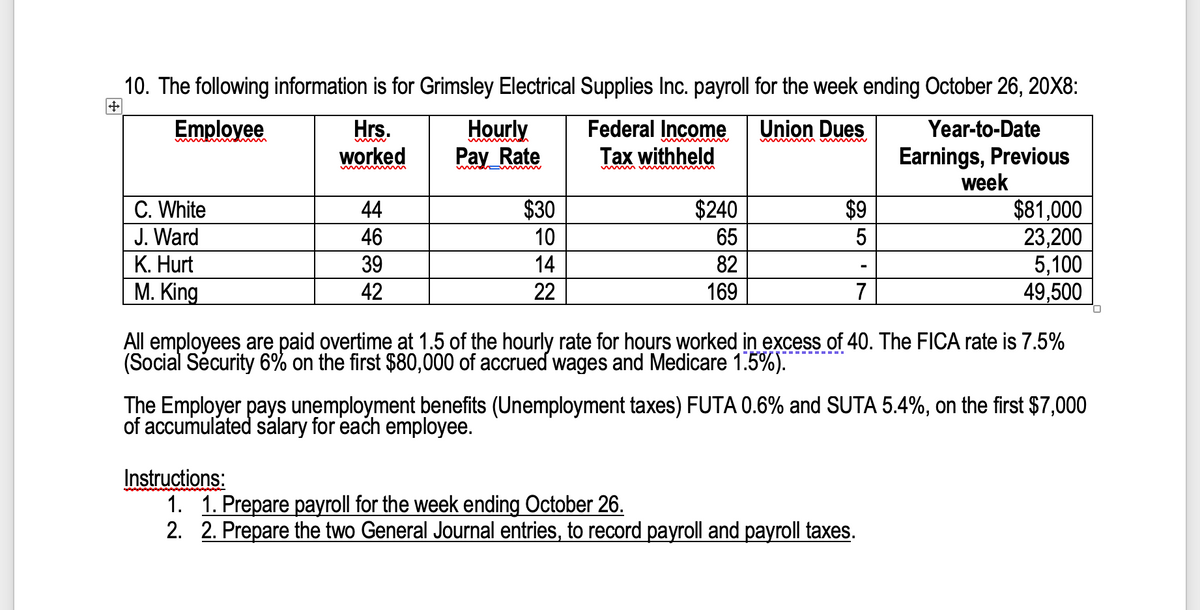

10. The following information is for Grimsley Electrical Supplies Inc. payroll for the week ending October 26, 20X8: Hrs. worked Hourly Pay Rate Union Dues Federal Income Tax withheld Employee Year-to-Date Earnings, Previous week C. White J. Ward K. Hurt M. King $30 10 14 $240 $9 $81,000 23,200 5,100 49,500 44 46 39 65 82 42 22 169 7 All employees are paid overtime at 1.5 of the hourly rate for hours worked in excess of 40. The FICA rate is 7.5% (Social Sécurity 6% on the first $80,000 of accrued wages and Medicare 1.5%). The Employer pays unemployment benefits (Unemployment taxes) FUTA 0.6% and SUTA 5.4%, on the first $7,000 of accumulated salary for each employee.

10. The following information is for Grimsley Electrical Supplies Inc. payroll for the week ending October 26, 20X8: Hrs. worked Hourly Pay Rate Union Dues Federal Income Tax withheld Employee Year-to-Date Earnings, Previous week C. White J. Ward K. Hurt M. King $30 10 14 $240 $9 $81,000 23,200 5,100 49,500 44 46 39 65 82 42 22 169 7 All employees are paid overtime at 1.5 of the hourly rate for hours worked in excess of 40. The FICA rate is 7.5% (Social Sécurity 6% on the first $80,000 of accrued wages and Medicare 1.5%). The Employer pays unemployment benefits (Unemployment taxes) FUTA 0.6% and SUTA 5.4%, on the first $7,000 of accumulated salary for each employee.

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter8: Employer Taxes, Payments, And Reports

Section: Chapter Questions

Problem 1E

Related questions

Question

Transcribed Image Text:10. The following information is for Grimsley Electrical Supplies Inc. payroll for the week ending October 26, 20X8:

Federal Income

Tax withheld

Union Dues

Hrs.

worked

Hourly

Pay_Rate

Employee

Year-to-Date

Earnings, Previous

week

$30

$9

C. White

J. Ward

К. Hurt

М. King.

$81,000

23,200

5,100

49,500

44

$240

46

10

65

39

14

82

42

22

169

7

All employees are paid overtime at 1.5 of the hourly rate for hours worked in excess of 40. The FICA rate is 7.5%

(Social Sécurity 6% on the first $80,000 of accrued wages and Medicare 1.5%)."

The Employer pays unemployment benefits (Unemployment taxes) FUTA 0.6% and SUTA 5.4%, on the first $7,000

of accumulated salary for each employee.

Instructions:

1. 1. Prepare payroll for the week ending October 26.

2. 2. Prepare the two General Journal entries, to record payroll and payroll taxes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage