Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 8, Problem 8.2.3P

Recording payroll and payroll taxes

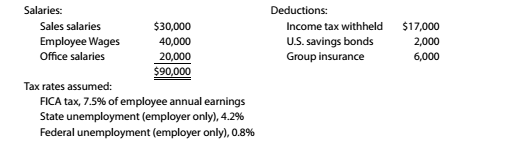

The following information about the payroll for the week ended October 4 was obtained from the records of Simkins Mining Co.:

Instructions

Determine the following amounts for the employer payroll taxes related to the October 4 payroll: (a) FICA tax payable, (b) state

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 8 Solutions

Survey of Accounting (Accounting I)

Ch. 8 - A business issued a $5,000, 60-day, 12% note to...Ch. 8 - Which of the following taxes are employers usually...Ch. 8 - Prob. 3SEQCh. 8 - Prob. 4SEQCh. 8 - A corporation has issued 25,000 shares of $100 par...Ch. 8 - For most companies, what two types of transactions...Ch. 8 - When are short-term notes payable issued?Ch. 8 - Prob. 3CDQCh. 8 - Prob. 4CDQCh. 8 - Identify the two distinct obligations incurred by...

Ch. 8 - A corporation issues $40,000,000 of 6% bonds to...Ch. 8 - The following data relate to an $8,000,000,7% bond...Ch. 8 - When should the liability associated with a...Ch. 8 - Prob. 9CDQCh. 8 - Prob. 10CDQCh. 8 - Prob. 11CDQCh. 8 - Prob. 12CDQCh. 8 - Prob. 13CDQCh. 8 - A corporation reacquires 18,000 shares of its Own...Ch. 8 - Prob. 15CDQCh. 8 - Prob. 16CDQCh. 8 - Prob. 17CDQCh. 8 - Prob. 18CDQCh. 8 - Effect of financing on earnings per share BSF Co.....Ch. 8 - Evaluate alternative financing plans Obj. 1 Based...Ch. 8 - Current liabilities Zahn Inc. -told 16.000annual...Ch. 8 - Notes payable Obj. A business issued a 90-day. 7%...Ch. 8 - Compute payroll An employee earns $28 per hour and...Ch. 8 - Prob. 8.6ECh. 8 - Prob. 8.7ECh. 8 - Prob. 8.8ECh. 8 - Bond price CVS Caremark Corp. (CVS) 5-3% bonds due...Ch. 8 - Issuing bonds Cyber Tech Inc. produces and...Ch. 8 - Accrued product warranty Back in Time Inc....Ch. 8 - Accrued product warranty Ford Motor Company (F)...Ch. 8 - Prob. 8.13ECh. 8 - Prob. 8.14ECh. 8 - Issuing par stock On January 29. Quality Marble...Ch. 8 - Issuing stock for assets other than cash Obj.5 On...Ch. 8 - Treasury stock transactions Obj.5 Blue Moon Water...Ch. 8 - Prob. 8.18ECh. 8 - Treasury stock transactions Banff Water Inc....Ch. 8 - Cash dividends The date of declaration, date of...Ch. 8 - Prob. 8.21ECh. 8 - Effect of stock split Audrey's Restaurant...Ch. 8 - Prob. 8.23ECh. 8 - Prob. 8.24ECh. 8 - Prob. 8.1.1PCh. 8 - Prob. 8.1.2PCh. 8 - Prob. 8.1.3PCh. 8 - Recording payroll and payroll taxes The following...Ch. 8 - Recording payroll and payroll taxes The following...Ch. 8 - Recording payroll and payroll taxes The following...Ch. 8 - Recording payroll and payroll taxes The following...Ch. 8 - Bond premium; bonds payable transactions Beaufort...Ch. 8 - Prob. 8.3.2PCh. 8 - Bond premium; bonds payable transactions Beaufort...Ch. 8 - Prob. 8.3.4PCh. 8 - Stock transactions for corporate expansion Vaga...Ch. 8 - Dividends on preferred and common stock Yukon Bike...Ch. 8 - Dividends on preferred and common stock Yukon Bike...Ch. 8 - Prob. 8.5.3PCh. 8 - Prob. 8.1.1MBACh. 8 - Prob. 8.1.2MBACh. 8 - Prob. 8.2.1MBACh. 8 - Prob. 8.2.2MBACh. 8 - Prob. 8.2.3MBACh. 8 - Prob. 8.3.1MBACh. 8 - Prob. 8.3.2MBACh. 8 - Prob. 8.3.3MBACh. 8 - Prob. 8.4MBACh. 8 - Prob. 8.5.1MBACh. 8 - Prob. 8.5.2MBACh. 8 - Prob. 8.6.1MBACh. 8 - Prob. 8.6.2MBACh. 8 - Prob. 8.6.3MBACh. 8 - Stock split Using the data from E8-22. indicate...Ch. 8 - Prob. 8.8.1MBACh. 8 - Prob. 8.8.2MBACh. 8 - Prob. 8.8.3MBACh. 8 - Prob. 8.8.4MBACh. 8 - Prob. 8.8.5MBACh. 8 - Prob. 8.8.6MBACh. 8 - Prob. 8.8.7MBACh. 8 - Prob. 8.8.8MBACh. 8 - Prob. 8.9.1MBACh. 8 - Prob. 8.9.2MBACh. 8 - Prob. 8.9.3MBACh. 8 - Prob. 8.9.4MBACh. 8 - Prob. 8.9.5MBACh. 8 - Prob. 8.9.6MBACh. 8 - Debt and price-earnings ratios Lowe's Companies...Ch. 8 - Prob. 8.10.1MBACh. 8 - Prob. 8.10.2MBACh. 8 - Prob. 8.10.3MBACh. 8 - Prob. 8.10.4MBACh. 8 - Prob. 8.10.5MBACh. 8 - Debt and price-earnings ratios Alphabet (formerly...Ch. 8 - Prob. 8.10.7MBACh. 8 - Prob. 8.10.8MBACh. 8 - Prob. 8.11MBACh. 8 - Prob. 8.1.1CCh. 8 - Prob. 8.1.2CCh. 8 - Prob. 8.2.1CCh. 8 - Prob. 8.2.2CCh. 8 - Prob. 8.3.1CCh. 8 - Issuing stock Sahara Unlimited Inc. began...Ch. 8 - Prob. 8.4CCh. 8 - Prob. 8.5.1CCh. 8 - Financing business expansion You hold a 30% common...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Wallace Corporation summarizes the following information from its weekly payroll records during April. Prepare the two journal entries to record the payment of the payroll and the accrual of its payroll taxes for April. Assume an 8% FICA rate for both employees and the employer. Also assume a 5.4% state unemployment tax rate, a 0.6% federal unemployment tax rate, and that all wages are subject to all payroll taxes. Round to the nearest dollar.arrow_forwardOn September 30, Hilltop Companys selected payroll accounts are as follows: Prepare general journal entries to record the following: Oct. 15 Payment of federal tax deposit of FICA taxes and the federal income tax. 31 Payment of state unemployment tax. 31 Payment of federal unemployment tax.arrow_forwardThe totals line from Nix Companys payroll register for the week ended March 31, 20--, is as follows: Payroll taxes are imposed as follows: Social Security tax, 6.2%; Medicare tax, 1.45%; FUTA tax, 0.6%; and SUTA tax, 5.4%. REQUIRED 1. a. Prepare the journal entry for payment of this payroll on March 31, 20--. b. Prepare the journal entry for the employers payroll taxes for the period ended March 31, 20--. 2. Nix Company had the following balances in its general ledger before the entries for requirement ( 1 ) were made: a. Prepare the journal entry for payment of the liabilities for federal income taxes and Social Security and Medicare taxes on April 15, 20--. b. Prepare the journal entry for payment of the liability for FUTA tax on April 30, 20--. c. Prepare the journal entry for payment of the liability for SUTA tax on April 30, 20--.arrow_forward

- CALCULATION AND JOURNAL ENTRY FOR EMPLOYER PAYROLL TAXES Portions of the payroll register for Barneys Bagels for the week ended July 15 are shown below. The SUTA tax rate is 5.4%, and the FUTA tax rate is 0.6%, both of which are levied on the first 7,000 of earnings. The Social Security tax rate is 6.2% on the first 118,500 of earnings. The Medicare rate is 1.45% on gross earnings. Calculate the employers payroll taxes expense and prepare the journal entry to record the employers payroll taxes expense for the week ended July 15 of the current year.arrow_forwardPayment and distribution of payroll The general ledger of Berskshire Mountain Manufacturing Inc. showed the following credit balances on January 15: Direct labor earnings amounted to 10,500 from January 16 to 31. Indirect labor was 5,700, and sales and administrative salaries for the same period amounted to 3,800. All wages are subject to FICA, FUTA, state unemployment taxes, and 10% income tax withholding. Required: 1. Prepare the journal entries for the following: a. Recording the payroll. b. Paying the payroll. c. Recording the employers payroll tax liability. d. Distributing the payroll costs for January 1631. 2. Prepare the journal entry to record the payment of the amounts due for the month to the government for FICA and income tax withholdings. 3. Calculate the amount of total earnings for the period from January 1 to 15. 4. Should the same person be responsible for computing the payroll, paying the payroll and making the entry to distribute the payroll? Why or why not?arrow_forwardCALCULATION AND JOURNAL ENTRY FOR EMPLOYER PAYROLL TAXES Earnings for several employees for the week ended March 12, 20--, are as follows: Calculate the employers payroll taxes expense and prepare the journal entry as of March 12, 20--, assuming that FUTA tax is 0.6%, SUTA tax is 5.4%, Social Security tax is 6.2%, and Medicare tax is 1.45%.arrow_forward

- The following information about the payroll for the week ended December 30 was obtained from the records of Qualitech Co.: Tax rates assumed: Social security, 6% Medicare, 1.5% State unemployment (employer only), 5.4% Federal unemployment (employer only), 0.8% Instructions 1. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the following entries: a. December 30, to record the payroll. b. December 30, to record the employers payroll taxes on the payroll to be paid on December 31. Of the total payroll for the last week of the year, 35,000 is subject to unemployment compensation taxes. 2. Assuming that the payroll for the last week of the year is to be paid on January 5 of the following fiscal year, journalize the following entries: a. December 30, to record the payroll. b. January 5, to record the employers payroll taxes on the payroll to be paid on January 5. Because it is a new fiscal year, all 675,000 in salaries is subject to unemployment compensation taxes.arrow_forwardCALCULATING PAYROLL TAXES EXPENSE AND PREPARING JOURNAL ENTRY Selected information from the payroll register of Wrays Drug Store for the week ended July 14,20--, is shown below. The SUTA tax rate is 5.4%, and the FUTA tax rate is 0.6%, both on the first 7,000 of earnings. Social Security tax on the employer is 6.2% on the first 118,500 of earnings, and Medicare tax is 1.45% on gross earnings. REQUIRED 1. Calculate the total employer payroll taxes for these employees. 2. Prepare the journal entry to record the employer payroll taxes as of July 14,20--.arrow_forwardRecording payroll and payroll taxes The following information about the payroll for the week ended October 4 was obtained from the records of Simkins Mining Co.: Instructions Illustrate the effect un (he accounts and financial statements of recording the liability for the October 4 employer payroll taxes.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

How JOURNAL ENTRIES Work (in Accounting); Author: Accounting Stuff;https://www.youtube.com/watch?v=Y-_Q3rANyxU;License: Standard Youtube License