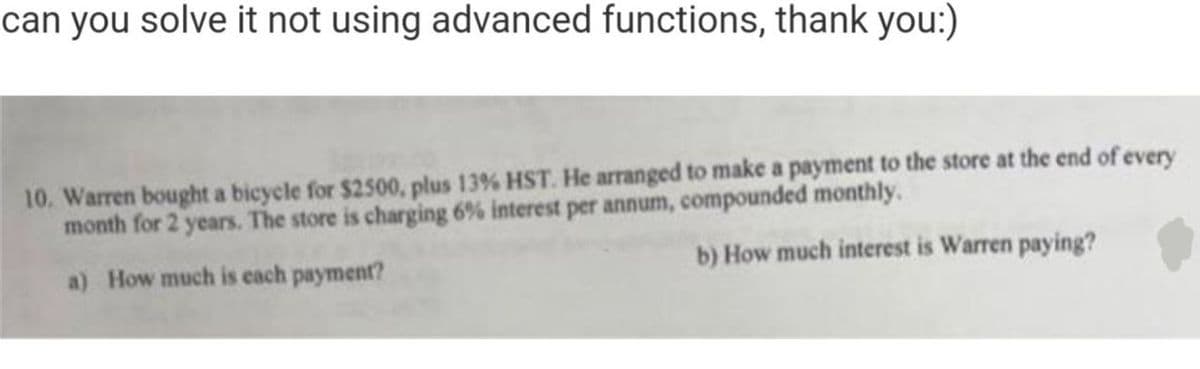

can you solve it not using advanced functions, thank you:) 10. Warren bought a bicycle for $2500, plus 13% HST. He arranged to make a payment to the store at the end of every month for 2 years. The store is charging 6% interest per annum, compounded monthly. a) How much is each payment? b) How much interest is Warren paying?

Q: March Issued 3,000 share of Common Stock, $2 par for $15 per share.

A: Introduction: Journals: All the business transactions are to be recorded in Journals. Journals are…

Q: A machine bought at P420,000 has an economic life of 6 years with a salvage value of P50,000. Cost…

A: Depreciation is the decrease in the value of assets due to its use or obsolescence.

Q: 37)At Dec 31, Michael Corp has the following bank information: Cash balance per bank $4,500…

A: The bank reconciliation statement is prepared to equate the balances of cash book and passbook with…

Q: Which of the following statements aligns with legitimacy theory? Companies will voluntarily disclose…

A: Legitimacy theory helps to understand the organization’s behavior in implementing, developing and…

Q: High-Low Method; Scattergraph Analysis The following data below relates to units shipped and total…

A: Scattergraph Method is a method by which the mixed costs are separated into fixed costs and variable…

Q: Prepare journal entry for delivery of equipment. A leading vegetable organic farm named Fresh…

A: Transactions of an entity will be initially recorded through various journal entries in the books of…

Q: Using the theory of constraints, which of the following is the constraint at LuxSo? Wood supply

A: Theory of constraints is the theory which gives solution regarding how to improve the system which…

Q: Computing Impairment of Patent In January 2017, Idea Company purchased a patent for a new consumer…

A: Introduction: Amortization is an accounting technique that is used to reduce the market price of a…

Q: Bicol Company uses approximately 20 material in its manufacturing operatio On December 1, 2021, the…

A: A call option gives the buyer the right to buy the option at a particular price on or before…

Q: Beginning inventory and purchases Units Unit Cost Total Cost Jan 1 60 $7 $420 April 1 45 $10 $450…

A: Weighted-average method: Weighted-average method is a method of inventory valuation. In this method,…

Q: He Brat fetime pilt on 4 May 2015 was to a trust and this resulted in a gross changeable transfer of…

A: Gift Tax: The gift tax prevent the individual who are transferring their property or cash as a gift…

Q: Cash balance per bank $4,500 Outstanding checks $200 Deposits in transit $1,000 Credit memo for…

A: Introduction: Bank reconciliation statement: To reconcile the differences between cash and pass book…

Q: Debt issuance costs are: Accounted for as a deduction from the equity balance on the balance sheet…

A: Debt Issuance costs Accounted for as a deduction from the equity balance on the balance sheet

Q: WHAT ARE SOME EXAMPLES OF POLICY CREDITS AND ADMINISTRATIVE GUIDANCE

A: Policy credits: The credit limit portion specifies the maximum amount of credit that consumers will…

Q: The capital balances and the income and loss sharing ratio of the partners May, Jun, and Julie are…

A: An agreement is a written agreement signed by partners to operate a business and share profits and…

Q: lassique Designs sells a variety of merchandise, including school shoes for girls. The business…

A: 1. FIFO Method - Under FIFO Method, Inventory purchased first is sold first. Perpetual Inventory…

Q: IFRS is a Single set of high quality, globally accepted and enforced set of standards that require…

A: IFRS refers to International Financial Reporting standards which are the globally accepted…

Q: need help with question 6

A: The purchase term 2/15, n/30 means 2% discount is available if the payment made in 15 days, the…

Q: How much does Bill Bloggs receive from the above transaction?

A: It is given in the question that the Bill Bloggs has taken the sell position on the shares of the…

Q: a. On July 1, a business collected $3,300 rent in advance, debiting Cash and crediting Unearned…

A: The accounting entries are passed according to the world entry system which states that and…

Q: ang Daiyu expects to retire in 30 years. She has decided that she would like to retire with enough…

A:

Q: On June 1, 2021, Johnson & Sons sold equipment to James Landscaping Service in exchange for a…

A: Revenue needs to be properly recorded and accounted by the entity as it falls under the fundamental…

Q: The income statement for the year ended 31 December 2021 and the balance sheet as of 31 December…

A: A cash flow statement indicates cash inflow and cash outflow information of a particular time…

Q: 1. Form 1096 is completed by the employer and submitted to the IRS for what purpose? Answer: A.…

A: Various taxes and forms are introduced by the Internal Revenue Services (IRS) in relation to the…

Q: Cash Prepaid Insurance Accounts Receivable Inventory Land Held for Investment Land Buildings Less…

A: Current liabilities means liabilities payable within normal course of business which is usually be…

Q: How to show the change in the account and note whether this change was a source or use of cash ?…

A: Operating Activities - Under this activity all the company operation-related activities like sales,…

Q: The IM Broke Co., has the following collection pattern for its accounts receivable: 40% in the month…

A: Entities often prepare for its expected collections from total sales made, where it can able to get…

Q: Jerry and sallie we divorced in July 1, 2020 the terms of the agreement provide that jerry will…

A: The gain can be defined as the increase in the value of assets or realizing the gain by selling the…

Q: Due to erratic sales of its sole product-a high-capacity battery for laptop computers-PEM,…

A: (Since you have posted a multi-part question, we will solve the first three sub-parts for you. For…

Q: May and Jun are partners with profit and loss ratio of 55:45 and capital balances of ₱530,000 and…

A:

Q: 1. The annual contribution limit to a 401(k) plan is _____. Answer: A. $6,000 B.…

A: An IRA payroll deduction represents the contribution made from the salary of the employee towards…

Q: Last year Minden Company Introduced a new product and sold 25,/00 units of it at a price of $100 per…

A: Formulas Break-even in units = Fixed Costs/Contribution MarginBreak-even in sales = Fixed…

Q: How much is the depreciation expense at Dec 31, 20X3?

A: Under straight line method, the amount of depreciation charged for each year would remain same. The…

Q: Accounting Cherry Corporation had 600,000 shares of common stock outstanding during 2020. In…

A: Answer a:- EPS = $1.67. Explanation:- Computation of EPS:- EPS = Net Income / Outstanding shares…

Q: Caves Beach Tiles is reviewing a capital investment proposal. The initial cost of the project and…

A: Introduction: The average cost of buying your existing inventory is the initial cost of adding your…

Q: In January 2013, Edi Thomas and George Lopez agreed to produce and sell chocolate cand under the…

A: Partnership is a firm joined by two or more people for running an organization and to earn profit…

Q: Balance of Work in Process and Finished Goods, Cost of Goods Sold Derry Company uses job-order…

A: Cost of goods sold for the month Given that the costs Job nos 302 , 307 Are sold

Q: 8. Ninety-five thousand units were started into production during the month. The production report…

A: Process costing is one of the method of cost accounting, which is used for industries where product…

Q: Question. What are Operating and non-operating expence?

A: Operating expenses are the expenses which incurred in normal course of business. Non operating…

Q: deliver £750 m in savings for Lidl, but it is valueless to any other company. SAP needs to make an…

A: Hold up money that is what was agreed but lesser amount is paid due to any prevailing situation of…

Q: ABC Partnership decided to admit Dan who invested P100,000 for a 20% interest. The effect of this…

A: Every transaction has a dual effect in the books of account (Accounting equation) Assets =…

Q: 1. Create and Income Statement with schedules for BLAZING ENTERPRISES for the Year Ended December…

A: Income statement particulars shows all incomes and expenses of the business along with net income or…

Q: 1. Create and Income Statement with schedules for BLAZING ENTERPRISES for the Year Ended December…

A: Income statement is one of the type of financial statement, which is generated for reviewing…

Q: 6. Given the following cost information for DeltaCorps Inc., calculate the flowing: Internal failure…

A: Costs of quality is an important part of management accounting in business. It shows prevention…

Q: 1. Mohammed is admitted to the partnership of Rashed & Ameer. Prior to his admission, the…

A: Introduction: Partnership: Its an agreement between two or more partners for forming a business and…

Q: Dewey, Cheatum & Howe, LLP, is a legal firm. The lawyers are paid $150 per hour and overhead is…

A: Job costing is one of the form of costing which is used by industries and they treat individual job…

Q: Asset 2 (Plant); Plant was purchased by the business at a cost price of OMR 6,000 and accumulated…

A: The depreciation expense is charged on fixed assets as reduced value of the fixed asset with usage…

Q: IFRS11-1 On May 10, Romano Corporation issues 1,000 shares of $10 par value ordinary shares for cash…

A: Introduction: A journal entry can be used to record a transaction in a company's accounting records.…

Q: 3. A company requires $1,360,000 in sales to meet its net income target. Its contribution margin is…

A: The contribution margin is calculated as difference between sales and variable costs. The break…

Q: mprovements has an estimated useful life of 20 years. The lease contract will be terminated on…

A: Leasehold improvements are properties which are modified or adjusted so as to meet the requirements…

Step by step

Solved in 3 steps

- Now assume that it is several years later. The brothers are concerned about the firm’s current credit terms of net 30, which means that contractors buying building products from the firm are not offered a discount and are supposed to pay the full amount in 30 days. Gross sales are now running $1,000,000 a year, and 80% (by dollar volume) of the firm’s paying customers generally pay the full amount on Day 30; the other 20% pay, on average, on Day 40. Of the firm’s gross sales, 2% ends up as bad-debt losses. The brothers are now considering a change in the firm’s credit policy. The change would entail: (1) changing the credit terms to 2/10, net 20, (2) employing stricter credit standards before granting credit, and (3) enforcing collections with greater vigor than in the past. Thus, cash customers and those paying within 10 days would receive a 2% discount, but all others would have to pay the full amount after only 20 days. The brothers believe the discount would both attract additional customers and encourage some existing customers to purchase more from the firm—after all, the discount amounts to a price reduction. Of course, these customers would take the discount and hence would pay in only 10 days. The net expected result is for sales to increase to $1,100,000; for 60% of the paying customers to take the discount and pay on the 10th day; for 30% to pay the full amount on Day 20; for 10% to pay late on Day 30; and for bad-debt losses to fall from 2% to 1% of gross sales. The firm’s operating cost ratio will remain unchanged at 75%, and its cost of carrying receivables will remain unchanged at 12%. To begin the analysis, describe the four variables that make up a firm’s credit policy and explain how each of them affects sales and collections.Biden has purchased a new piano for $5,000. He made a downpament of $500. He paid the balance by a loan from 5/3 bank. The loan is to be paid on a monthly basis for two years charging 12 percent interest. How much are the monthly payments? Include the following variables to help you solve the problem: m Nper (or N) =n*m Rate (or I/Y)=i/m PV PMT FVKiko bought a smart TV with Php 135,000. Assuming that there is no downpayment, Kiko needs to pay this amount regularly for 2 years. The interest rate is 6% compounded semi-annually. 1.How much is the interest payment for the first semi-annual period? 2.How much is the principal repayment for the first semi-annual period? (The answer is not 33750) 3.How much is the outstanding balance after the first payment?(The answer is not 101250)

- Ten years ago, you deposited P5400 per month. You made the deposit for 6 years and then stopped. 4 years later, you established a belts and nuts factory, and start withdrawing P2300 every month for advertisement. Money is worth 6% compounded monthly. How many months can you withdraw before the money is exhausted? What is the present worth of the withdrawal?(kindly give tye given, complete and detailed solution. Thank you)Acme Steamer purchased a new pump for $75,000. They borrowed the money for the pump from the bank at an interest rate of 0.5% per month and will make a total of 24 equal, monthly payments. How much will Acme’s monthly payments be?Ten years ago, you deposited P5400 per month. You made the deposit for 6 years and then stopped. 4 years later, you established a belts and nuts factory, and start withdrawing P2,300 every month for advertisement. Money is worth 6% compounded monthly. How many months can you withdraw before the money is exhausted? What is the present worth of the withdrawal

- I. Hamilton wants to accumulate ₺ 20,000 at the end of 4 years. It starts quarterly payments in a bank account which pays J4= %4 (annual interest rate with quarterly compounding). a) Find the size of quarterly payments. b) If, after 2 years, bank switches the rate to J4= 8%, what would be the size of quarterly payments for last 2 years required to meet the 24,000 ₺ goal? II. Ayhan invested 18,000 ₺ in an account that paid simple interest. How long he would need to invest in at 7% interest to accumulate 25,000₺ ? III. a) What would be the accumulated value of 500₺ in a saving account at 8% per year for 3 years when the interest is compounded? b) What would be the accumulated value of the same amount after 3 years with the same rate but not compounded (simple interest) annually?1. How much money you must invest today in order to withdraw ? 1,000 per year for 10 years, if the interest rate is 12%? 2. A service car whose cash price was ? 540,000 was bought with a down payment of ? 162,000 and monthly of ?10,874.29 for five years. What was the rate of interest compounded monthly? 3. A man bought an equipment costing P60,000 payable in 12 quarterly payments each installment payable at the beginning of each period. The rate of interest is 24% compounded quarterly. What is the amount of each paymentA man bought a refrigerator for P500 down and P300 per month for 24 months. The same brand of refrigerator could have been purchased for P6,750 cash. What nominal annual interest rate is the man paying?

- Ten years ago, you deposited P5400 per month. You made the deposit for 6 years and then stopped 4 years later, you established a belts and nuts factory, and start withdrawing P2.300 every month for advertisement. Money is worth 6% compounded monthly. How many months can you withdraw before the money is exhausted? What is the present worth of the withdrawal?(please give the real real not the copied one)1. Suppose that Nora invested $800at 8.5% compounded annually for 7years and Patti invested $800 at 8% compounded quarterly for 7 years. At the end of 7years, who will have the most money and by how much (to the nearest dollar)? 2. Use the formula I=Prt to reach a solution for the following problem. One month a credit card company charged $9.27in interest on a balance of $3,708. What annual interest rate is the credit card company charging?Your company bought equipment for $25,000 by paying 10% down and the rest on credit. The credit arrangement is for 5 years at 7% interest. After making 20 payments, you want to pay off the loan. How much do you owe?