He Brat fetime pilt on 4 May 2015 was to a trust and this resulted in a gross changeable transfer of £300,000. This is after deducting all available exemptions. On 6 March 2017, Diego made a gift to his grandson of 5,000 out of the 14,000 £1 ordinary shares he owned in Pedazo Ltd, an unquoted investment company. This

He Brat fetime pilt on 4 May 2015 was to a trust and this resulted in a gross changeable transfer of £300,000. This is after deducting all available exemptions. On 6 March 2017, Diego made a gift to his grandson of 5,000 out of the 14,000 £1 ordinary shares he owned in Pedazo Ltd, an unquoted investment company. This

Chapter8: Trusts

Section: Chapter Questions

Problem 2CTD

Related questions

Question

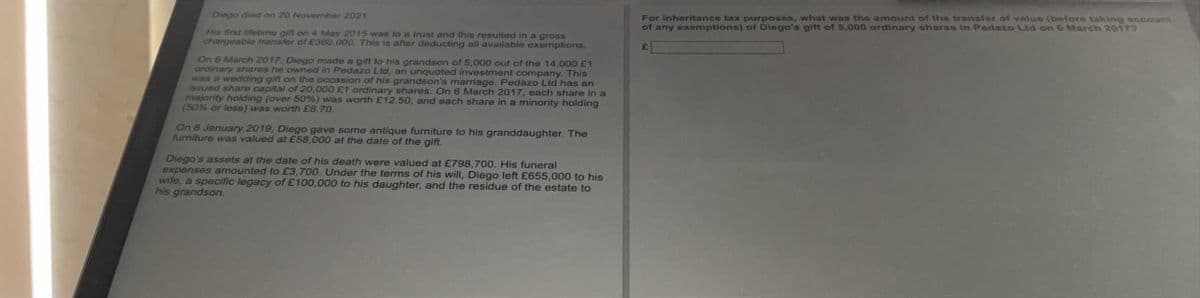

Transcribed Image Text:Diego died on 20 November 2021.

His first lifetime gift on 4 May 2015 was to a trust and this resulted in a gross

chargeable transfer of £360,000. This is after deducting all available exemptions.

On 6 March 2017, Diego made a gift to his grandson of 5,000 out of the 14,000 £1

ordinary shares he owned in Pedazo Ltd, an unquoted investment company. This

was a wedding gift on the occasion of his grandson's marriage. Pedazo Ltd has an

issued share capital of 20,000 £1 ordinary shares. On 6 March 2017, each share in a

majority holding (over 50%) was worth £12.50, and each share in a minority holding

(50% or less) was worth £8.70.

On 8 January 2019, Diego gave some antique furniture to his granddaughter. The

furniture was valued at £58,000 at the date of the gift.

Diego's assets at the date of his death were valued at £798,700. His funeral

expenses amounted to £3,700. Under the terms of his will, Diego left £655,000 to his

wife, a specific legacy of £100,000 to his daughter, and the residue of the estate to

his grandson.

For Inheritance tax purposes, what was the amount of the transfer of value (before taking account

of any exemptions) of Diego's gift of 5,000 ordinary shares in Pedazo Ltd on 6 March 20177

£

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning