10.2 Net present value: Kingston, Inc. management is considering purchasing a new machine at a cost of $4,133,250. They expect this equipment to produce cash flows of $814,322, $863,275, $937,250, $1,017,112, $1,212,960, and $1,225,000 over the next six years. If the appropriate discount rate is 15 percent, what is the NPV of this investment?

10.2 Net present value: Kingston, Inc. management is considering purchasing a new machine at a cost of $4,133,250. They expect this equipment to produce cash flows of $814,322, $863,275, $937,250, $1,017,112, $1,212,960, and $1,225,000 over the next six years. If the appropriate discount rate is 15 percent, what is the NPV of this investment?

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 15E

Related questions

Question

Can I get the answers to 10.2-10.4

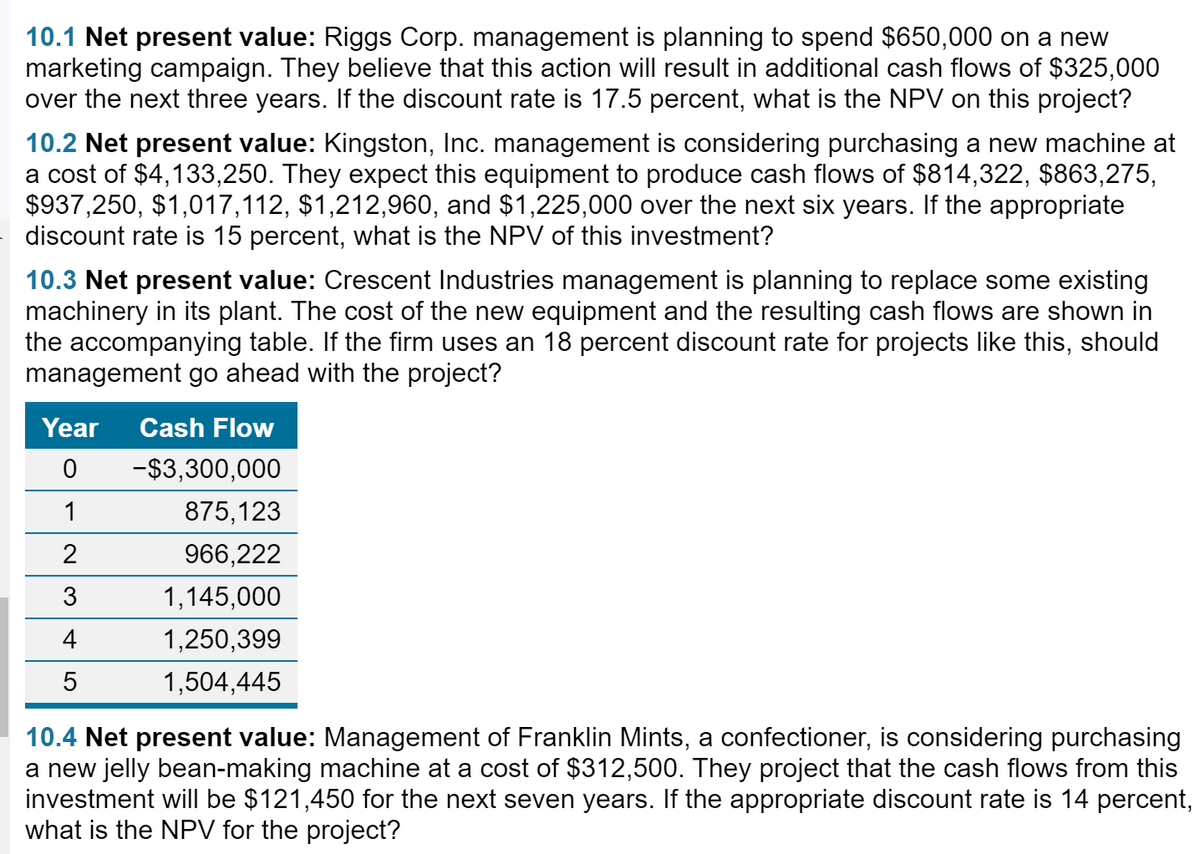

Transcribed Image Text:10.1 Net present value: Riggs Corp. management is planning to spend $650,000 on a new

marketing campaign. They believe that this action will result in additional cash flows of $325,000

over the next three years. If the discount rate is 17.5 percent, what is the NPV on this project?

10.2 Net present value: Kingston, Inc. management is considering purchasing a new machine at

a cost of $4,133,250. They expect this equipment to produce cash flows of $814,322, $863,275,

$937,250, $1,017,112, $1,212,960, and $1,225,000 over the next six years. If the appropriate

discount rate is 15 percent, what is the NPV of this investment?

10.3 Net present value: Crescent Industries management is planning to replace some existing

machinery in its plant. The cost of the new equipment and the resulting cash flows are shown in

the accompanying table. If the firm uses an 18 percent discount rate for projects like this, should

management go ahead with the project?

Year

Cash Flow

-$3,300,000

1

875,123

2

966,222

3

1,145,000

4

1,250,399

5

1,504,445

10.4 Net present value: Management of Franklin Mints, a confectioner, is considering purchasing

a new jelly bean-making machine at a cost of $312,500. They project that the cash flows from this

investment will be $121,450 for the next seven years. If the appropriate discount rate is 14 percent,

what is the NPV for the project?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning