11, Dudley Bank has the following balance sheet and income statement. For Dudley Bank, calculate: Return on equity Return on assets Asset utilization

11, Dudley Bank has the following balance sheet and income statement. For Dudley Bank, calculate: Return on equity Return on assets Asset utilization

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter12: The Statement Of Cash Flows

Section: Chapter Questions

Problem 12.24MCE

Related questions

Question

100%

Practice Pack

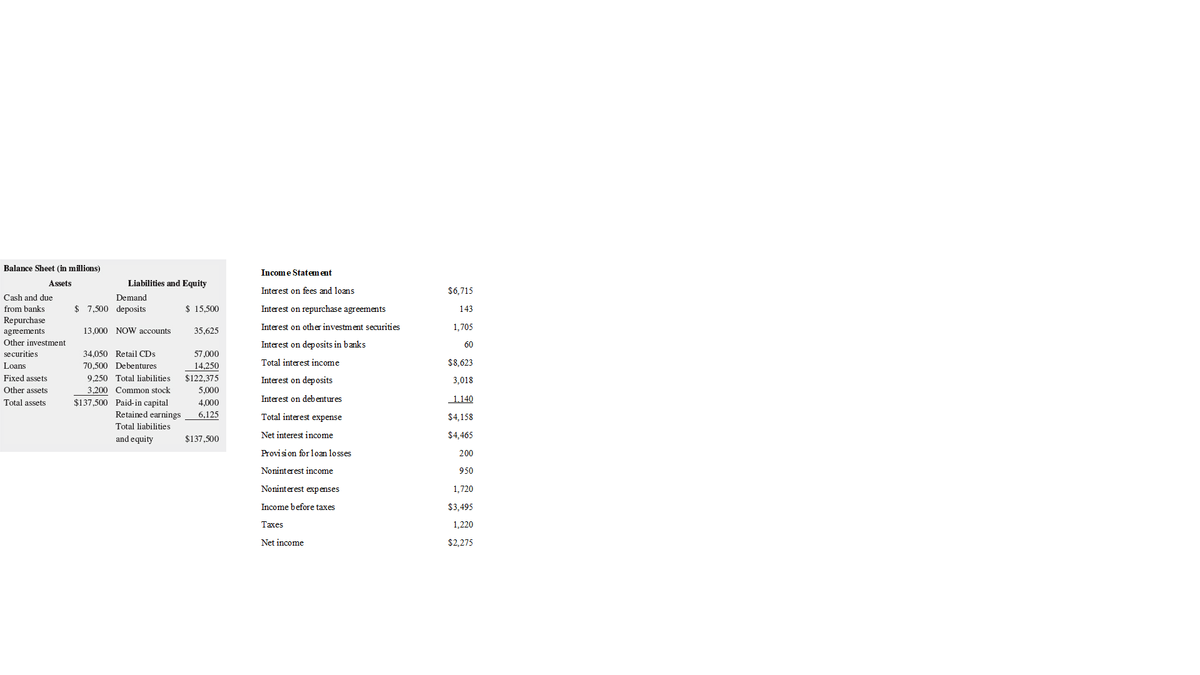

- 11, Dudley Bank has the following balance sheet and income statement.

For Dudley Bank, calculate:

- Return on equity

- Return on assets

- Asset utilization

- Equity multiplier

- Profit margin

- Interest expense ratio

- Provision for loan loss ratio

- Noninterest expense ratio

- Tax ratio

Overhead efficiency

Transcribed Image Text:Balance Sheet (in millions)

Income Statement

Assets

Liabilities and Equity

Interest on fees and loans

$6,715

Cash and due

Demand

$ 7,500 deposits

$ 15,500

Interest on repurchase agreements

from banks

143

Repurchase

agreements

13,000 NOW accounts

35,625

Interest on other investment securities

1,705

Other investment

Interest on deposits in banks

60

securities

34,050 Retail CDs

57,000

Total interest income

$8,623

Loans

70,500 Debentures

14,250

Fixed assets

9.250 Total liabilities

$122,375

Interest on deposits

3,018

Other assets

3,200 Common stock

5,000

Interest on debentures

1.140

$137,500 Paid-in capital

Retained earnings

Total assets

4,000

6,125

Total interest expense

$4,158

Total liabilities

Net interest income

$4,465

and equity

$137,500

Provision for loan losses

200

Noninterest income

950

Noninterest expenses

1,720

Income before taxes

$3,495

Taxes

1,220

Net income

$2,275

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub