tequired: n the table below, calculate Net Profit Margin, Asset Turnover, Financial Leverage, and Return quity (ROE) ratios for the two businesses. Peanut Queen Lord of Ice Net Profit Margin Asset Turnover Financial Leverage ROE

tequired: n the table below, calculate Net Profit Margin, Asset Turnover, Financial Leverage, and Return quity (ROE) ratios for the two businesses. Peanut Queen Lord of Ice Net Profit Margin Asset Turnover Financial Leverage ROE

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter6: Inventories

Section: Chapter Questions

Problem 4MAD: Monster Beverage Corporation (MNST) develops, markets, and sells energy and other alternative...

Related questions

Question

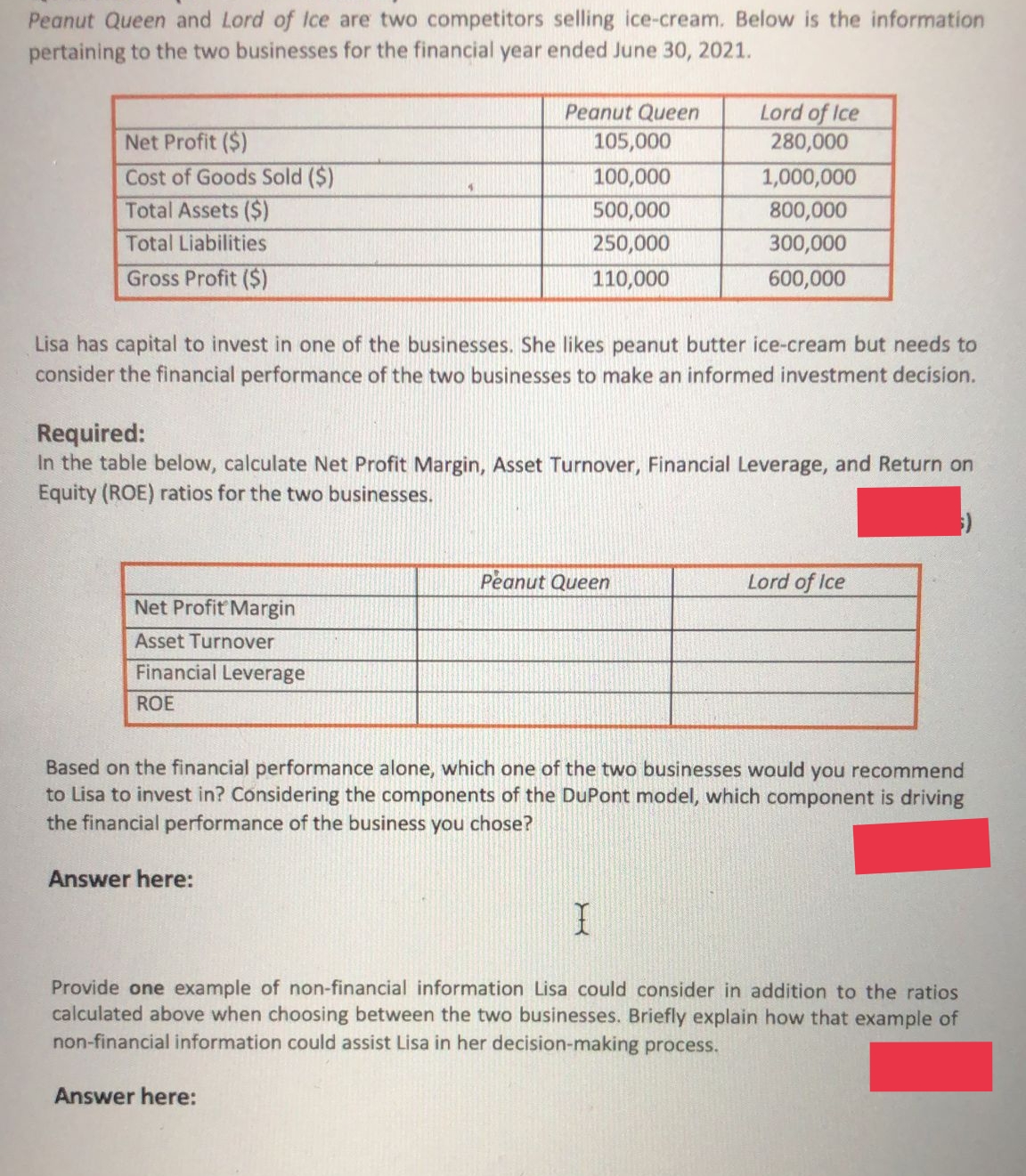

Transcribed Image Text:Peanut Queen and Lord of ice are two competitors selling ice-cream. Below is the information

pertaining to the two businesses for the financial year ended June 30, 2021.

Peanut Queen

Lord of Ice

Net Profit ($)

105,000

280,000

Cost of Goods Sold ($)

Total Assets ($)

100,000

1,000,000

500,000

800,000

Total Liabilities

250,000

300,000

Gross Profit ($)

110,000

600,000

Lisa has capital to invest in one of the businesses. She likes peanut butter ice-cream but needs to

consider the financial performance of the two businesses to make an informed investment decision.

Required:

In the table below, calculate Net Profit Margin, Asset Turnover, Financial Leverage, and Return on

Equity (ROE) ratios for the two businesses.

Peanut Queen

Lord of Ice

Net Profit Margin

Asset Turnover

Financial Leverage

ROE

Based on the financial performance alone, which one of the two businesses would you recommend

to Lisa to invest in? Considering the components of the DuPont model, which component is driving

the financial performance of the business you chose?

Answer here:

Provide one example of non-financial information Lisa could consider in addition to the ratios

calculated above when choosing between the two businesses. Briefly explain how that example of

non-financial information could assist Lisa in her decision-making process.

Answer here:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning