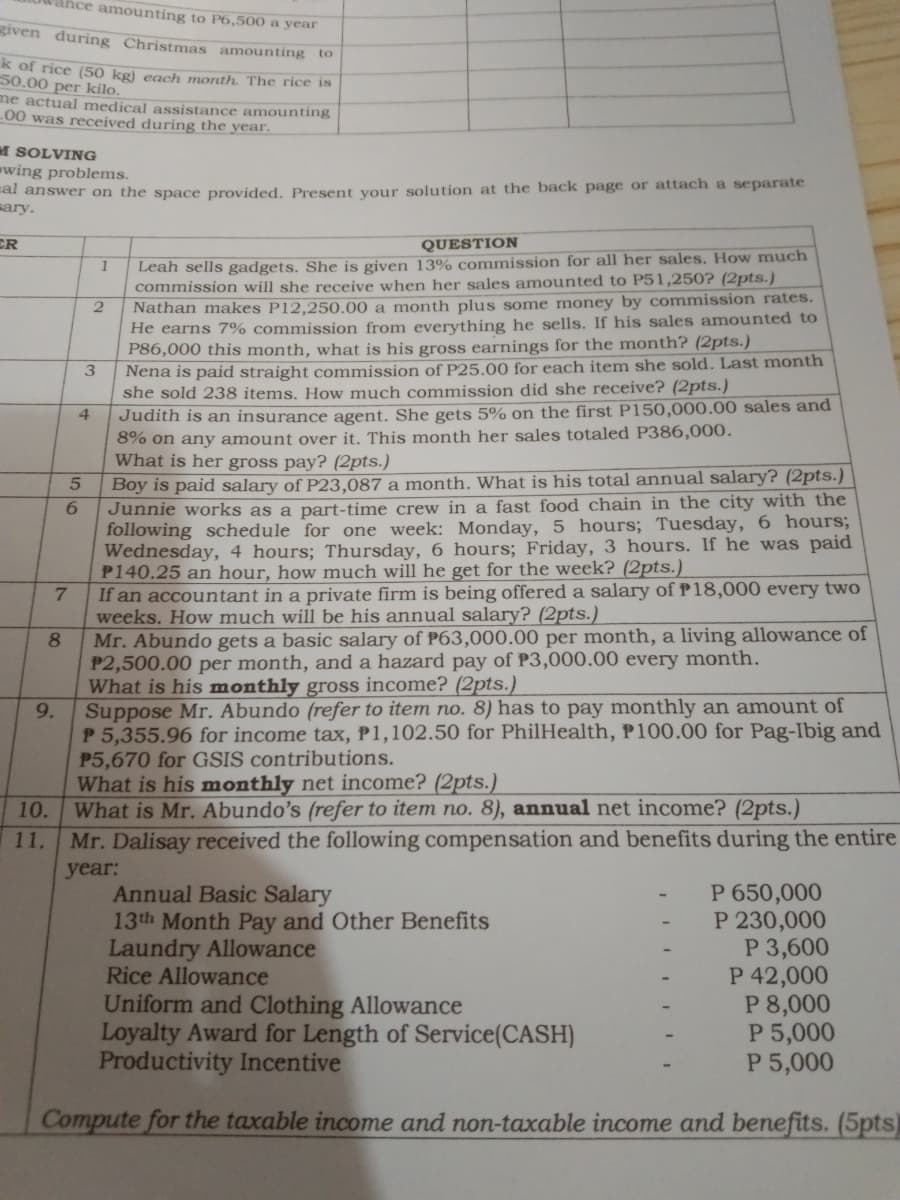

11. Mr. Dalisay received the following compensation and benefits during the entire year: Annual Basic Salary 13th Month Pay and Other Benefits Laundry Allowance Rice Allowance Uniform and Clothing Allowance Loyalty Award for Length of Service(CASH) Productivity Incentive P 650,000 P 230,000 P 3,600 P 42,000 P 8,000 P 5,000 P 5,000 Compute for the taxable income and non-taxable income and benefits. (5pts

11. Mr. Dalisay received the following compensation and benefits during the entire year: Annual Basic Salary 13th Month Pay and Other Benefits Laundry Allowance Rice Allowance Uniform and Clothing Allowance Loyalty Award for Length of Service(CASH) Productivity Incentive P 650,000 P 230,000 P 3,600 P 42,000 P 8,000 P 5,000 P 5,000 Compute for the taxable income and non-taxable income and benefits. (5pts

Chapter6: Business Expenses

Section: Chapter Questions

Problem 37P

Related questions

Question

100%

please answer number 11 only, asap. thank you

Transcribed Image Text:vance amounting to P6,500 a year

given during Christmas amounting to

k of rice (50 kg) each month. The rice is

50.00 per kilo.

me actual medical assistance amounting

00 was received during the year.

M SOLVING

wing problems.

al answer on the space provided. Present your solution at the back page or attach a separate

sary.

CR

QUESTION

Leah sells gadgets. She is given 13% commission for all her sales. How much

commission will she receive when her sales amounted to P51,250? (2pts.)

Nathan makes P12,250.00 a month plus some money by commission rates.

He earns 7% commission from everything he sells. If his sales amounted to

P86,000 this month, what is his gross earnings for the month? (2pts.)

Nena is paid straight commission of P25.00 for each item she sold. Last month

she sold 238 items. How much commission did she receive? (2pts.)

Judith is an insurance agent. She gets 5% on the first P150,000.00 sales and

8% on any amount over it. This month her sales totaled P386,000.

What is her gross pay? (2pts.)

Boy is paid salary of P23,087 a month. What is his total annual salary? (2pts.)

Junnie works as a part-time crew in a fast food chain in the city with the

following schedule for one week: Monday, 5 hours; Tuesday, 6 hours;

Wednesday, 4 hours; Thursday, 6 hours; Friday, 3 hours. If he was paid

P140.25 an hour, how much will he get for the week? (2pts.)

3

4

If an accountant in a private firm is being offered a salary ofP18,000 every two

weeks. How much will be his annual salary? (2pts.)

Mr. Abundo gets a basic salary of P63,000.00 per month, a living allowance of

P2,500.00 per month, and a hazard pay of P3,000.00 every month.

What is his monthly gross income? (2pts.)

Suppose Mr. Abundo (refer to item no. 8) has to pay monthly an amount of

P 5,355.96 for income tax, P1,102.50 for PhilHealth, P100.00 for Pag-Ibig and

P5,670 for GSIS contributions.

What is his monthly net income? (2pts.)

What is Mr. Abundo’s (refer to item no. 8), annual net income? (2pts.)

7.

8.

9.

10.

11.

Mr. Dalisay received the following compensation and benefits during the entire

year:

Annual Basic Salary

13th Month Pay and Other Benefits

Laundry Allowance

Rice Allowance

P 650,000

P 230,000

P 3,600

P 42,000

P 8,000

P 5,000

P 5,000

Uniform and Clothing Allowance

Loyalty Award for Length of Service(CASH)

Productivity Incentive

Compute for the taxable income and non-taxable income and benefits. (5pts)

56

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you