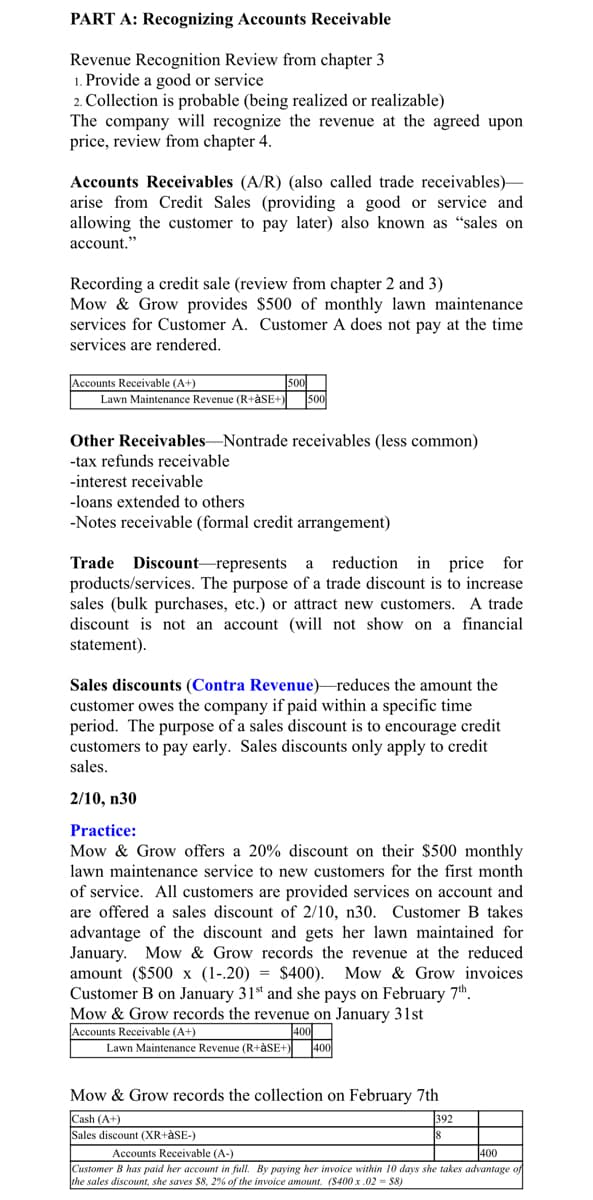

PART A: Recognizing Accounts Receivable Revenue Recognition Review from chapter 3 1. Provide a good or service 2. Collection is probable (being realized or realizable) The company will recognize the revenue at the agreed upon price, review from chapter 4. Accounts Receivables (A/R) (also called trade receivables)- arise from Credit Sales (providing a good or service and allowing the customer to pay later) also known as "sales on account." Recording a credit sale (review from chapter 2 and 3) Mow & Grow provides $500 of monthly lawn maintenance services for Customer A. Customer A does not pay at the time services are rendered. Accounts Receivable (A+) |500 Lawn Maintenance Revenue (R+àSE+) so0 Other Receivables-Nontrade receivables (less common) -tax refunds receivable -interest receivable -loans extended to others -Notes receivable (formal credit arrangement) Trade Discount-represents a reduction in price for products/services. The purpose of a trade discount is to increase sales (bulk purchases, etc.) or attract new customers. A trade discount is not an account (will not show on a financial statement). Sales discounts (Contra Revenue)–reduces the amount the customer owes the company if paid within a specific time period. The purpose of a sales discount is to encourage credit customers to pay early. Sales discounts only apply to credit sales. 2/10, n30 Practice:

PART A: Recognizing Accounts Receivable Revenue Recognition Review from chapter 3 1. Provide a good or service 2. Collection is probable (being realized or realizable) The company will recognize the revenue at the agreed upon price, review from chapter 4. Accounts Receivables (A/R) (also called trade receivables)- arise from Credit Sales (providing a good or service and allowing the customer to pay later) also known as "sales on account." Recording a credit sale (review from chapter 2 and 3) Mow & Grow provides $500 of monthly lawn maintenance services for Customer A. Customer A does not pay at the time services are rendered. Accounts Receivable (A+) |500 Lawn Maintenance Revenue (R+àSE+) so0 Other Receivables-Nontrade receivables (less common) -tax refunds receivable -interest receivable -loans extended to others -Notes receivable (formal credit arrangement) Trade Discount-represents a reduction in price for products/services. The purpose of a trade discount is to increase sales (bulk purchases, etc.) or attract new customers. A trade discount is not an account (will not show on a financial statement). Sales discounts (Contra Revenue)–reduces the amount the customer owes the company if paid within a specific time period. The purpose of a sales discount is to encourage credit customers to pay early. Sales discounts only apply to credit sales. 2/10, n30 Practice:

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter2: Analyzing Transactions Into Debit And Credit Parts

Section2.1: Using T Accounts

Problem 1OYO

Related questions

Question

From pages 5-1 and 5-2 of the VLN, which of the following is FALSE as it relates to a sales discount?

Group of answer choices

A. It is an incentive to credit customers (customers who purchased on account) to encourage them to pay their invoice early.

B. It is always recorded at the time of the sale.

C. It is a contra revenue.

D. It only applies to credit customers (customers who purchased on account).

Transcribed Image Text:PART A: Recognizing Accounts Receivable

Revenue Recognition Review from chapter 3

1. Provide a good or service

2. Collection is probable (being realized or realizable)

The company will recognize the revenue at the agreed upon

price, review from chapter 4.

Accounts Receivables (A/R) (also called trade receivables)-

arise from Credit Sales (providing a good or service and

allowing the customer to pay later) also known as "sales on

account."

Recording a credit sale (review from chapter 2 and 3)

Mow & Grow provides $500 of monthly lawn maintenance

services for Customer A. Customer A does not pay at the time

services are rendered.

Accounts Receivable (A+)

Lawn Maintenance Revenue (R+àSE+)

500

500

Other Receivables-Nontrade receivables (less common)

-tax refunds receivable

-interest receivable

-loans extended to others

-Notes receivable (formal credit arrangement)

Trade Discount–represents

reduction in price for

a

products/services. The purpose of a trade discount is to increase

sales (bulk purchases, etc.) or attract new customers. A trade

discount is not an account (will not show on a financial

statement).

Sales discounts (Contra Revenue)-reduces the amount the

customer owes the company if paid within a specific time

period. The purpose of a sales discount is to encourage credit

customers to pay early. Sales discounts only apply to credit

sales.

2/10, n30

Practice:

Mow & Grow offers a 20% discount on their $500 monthly

lawn maintenance service to new customers for the first month

of service. All customers are provided services on account and

are offered a sales discount of 2/10, n30. Customer B takes

advantage of the discount and gets her lawn maintained for

January. Mow & Grow records the revenue at the reduced

amount ($500 x (1-.20) = $400). Mow & Grow invoices

Customer B on January 31st and she pays on February 7h.

Mow & Grow records the revenue on January 31st

Accounts Receivable (A+)

Lawn Maintenance Revenue (R+àSE+)

T400

Mow & Grow records the collection on February 7th

Cash (A+)

Sales discount (XR+àSE-)

392

Accounts Receivable (A-)

400

Customer B has paid her account in full. By paying her invoice within 10 days she takes advantage of

the sales discount, she saves $8, 2% of the invoice amount. (S400 x .02 = $8)

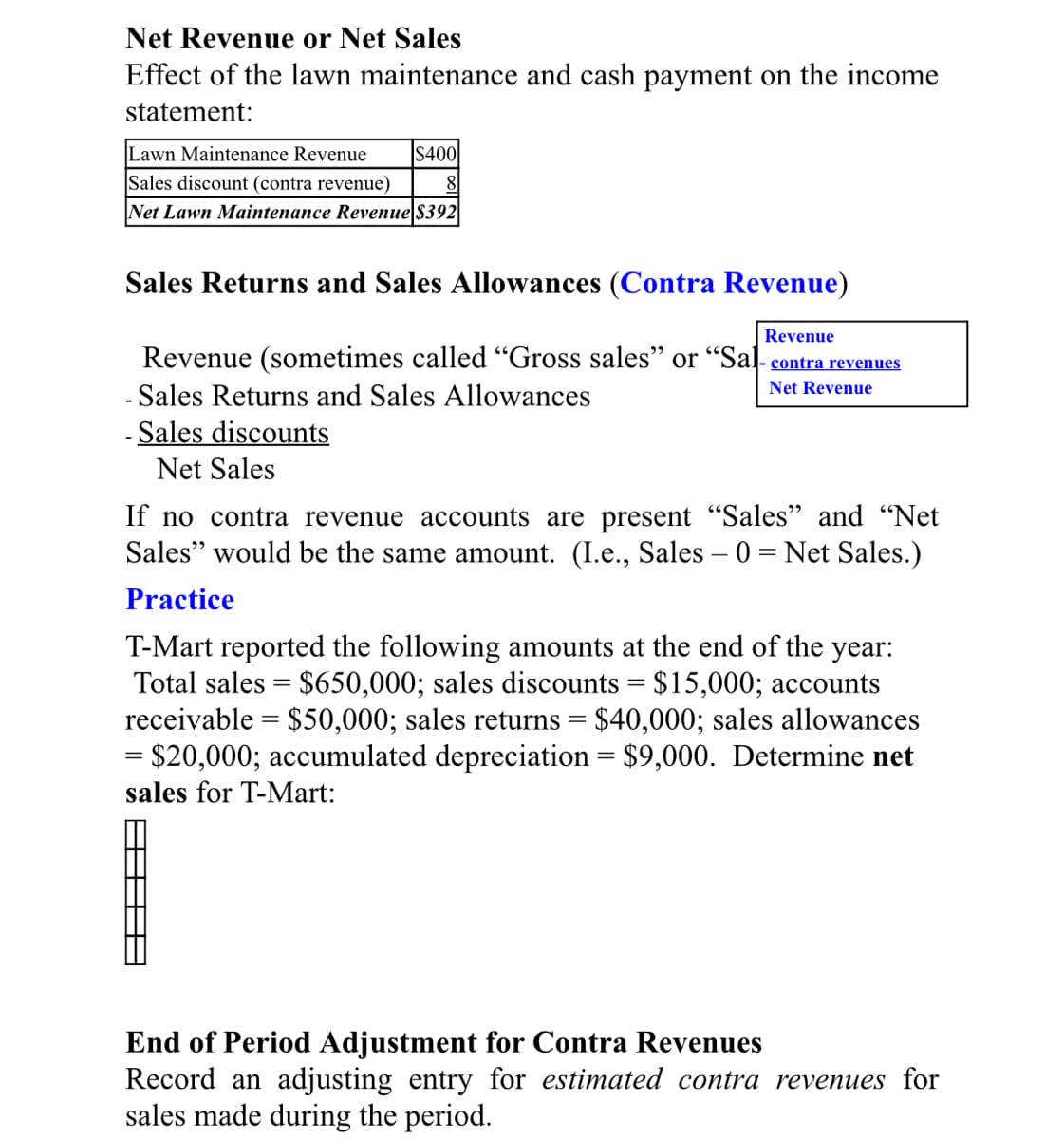

Transcribed Image Text:Net Revenue or Net Sales

Effect of the lawn maintenance and cash payment on the income

statement:

Lawn Maintenance Revenue

Sales discount (contra revenue)

Net Lawn Maintenance Revenue $392

$400

8|

Sales Returns and Sales Allowances (Contra Revenue)

Revenue

Revenue (sometimes called "Gross sales" or “Sal- contra revenues

Net Revenue

Sales Returns and Sales Allowances

- Sales discounts

Net Sales

If no contra revenue accounts are present "Sales" and "Net

Sales" would be the same amount. (I.e., Sales – 0 = Net Sales.)

Practice

T-Mart reported the following amounts at the end of the year:

Total sales = $650,000; sales discounts = $15,000; accounts

receivable = $50,000; sales returns = $40,000; sales allowances

= $20,000; accumulated depreciation = $9,000. Determine net

sales for T-Mart:

End of Period Adjustment for Contra Revenues

Record an adjusting entry for estimated contra revenues for

sales made during the period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning