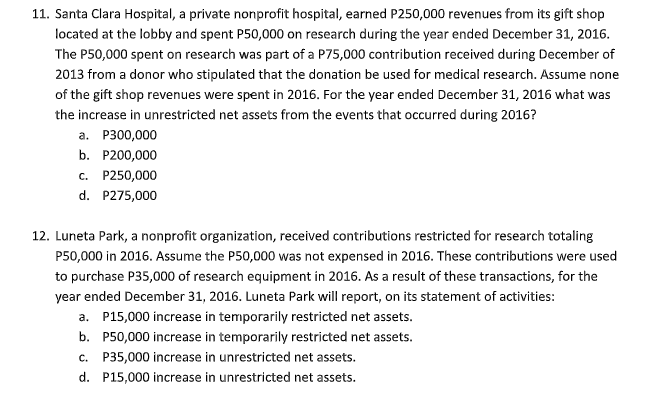

11. Santa Clara Hospital, a private nonprofit hospital, earned P250,000 revenues from its gift shop located at the lobby and spent P50,000 on research during the year ended December 31, 2016. The P50,000 spent on research was part of a P75,000 contribution received during December of 2013 from a donor who stipulated that the donation be used for medical research. Assume none of the gift shop revenues were spent in 2016. For the year ended December 31, 2016 what was the increase in unrestricted net assets from the events that occurred during 2016? a. P300,000 b. P200,000 c. P250,000 d. P275,000

11. Santa Clara Hospital, a private nonprofit hospital, earned P250,000 revenues from its gift shop located at the lobby and spent P50,000 on research during the year ended December 31, 2016. The P50,000 spent on research was part of a P75,000 contribution received during December of 2013 from a donor who stipulated that the donation be used for medical research. Assume none of the gift shop revenues were spent in 2016. For the year ended December 31, 2016 what was the increase in unrestricted net assets from the events that occurred during 2016? a. P300,000 b. P200,000 c. P250,000 d. P275,000

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 66IIP

Related questions

Question

Transcribed Image Text:11. Santa Clara Hospital, a private nonprofit hospital, earned P250,000 revenues from its gift shop

located at the lobby and spent P50,000 on research during the year ended December 31, 2016.

The P50,000 spent on research was part of a P75,000 contribution received during December of

2013 from a donor who stipulated that the donation be used for medical research. Assume none

of the gift shop revenues were spent in 2016. For the year ended December 31, 2016 what was

the increase in unrestricted net assets from the events that occurred during 2016?

a. P300,000

b. P200,000

c. P250,000

d. P275,000

12. Luneta Park, a nonprofit organization, received contributions restricted for research totaling

P50,000 in 2016. Assume the P50,000 was not expensed in 2016. These contributions were used

to purchase P35,000 of research equipment in 2016. As a result of these transactions, for the

year ended December 31, 2016. Luneta Park will report, on its statement of activities:

a. P15,000 increase in temporarily restricted net assets.

b. P50,000 increase in temporarily restricted net assets.

c. P35,000 increase in unrestricted net assets.

d. P15,000 increase in unrestricted net assets.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you