11.The CAN (Collective Negotiation Agreement) is considered as a benefit for public employees computed in one year. Given the formula below: CAN + 13th Month Pay + other benefits > Php 30,000 are taxable. Suppose a certain government employee earns a CAN = Php 12,764.12, 13th Month Pay = Php 24,291.78, and he has no other benefits. How much of his additional earnings will be taxed? 12. In connection with the previous problem, suppose a certain government employee earns a CAN = Php 2,214.12/month, 13th Month Pay = Php 12, 119.72, and he has other benefits amounting to Php 4,000.00. How much of the additional earnings will be taxed? 13. Suppose in the previous problem, the other benefits include clothing allowance. Will there be a change in the amount taxable? If yes, how much? If no, why? 14.If an employee X has CAN = Php 18,291.09, 13th Month Pay = Php 27,891.00, other benefits Php 10,000 and Php 3,000 of the other benefits is the clothing allowance. How much of his benefits is taxable? How much is nontaxable?

11.The CAN (Collective Negotiation Agreement) is considered as a benefit for public employees computed in one year. Given the formula below: CAN + 13th Month Pay + other benefits > Php 30,000 are taxable. Suppose a certain government employee earns a CAN = Php 12,764.12, 13th Month Pay = Php 24,291.78, and he has no other benefits. How much of his additional earnings will be taxed? 12. In connection with the previous problem, suppose a certain government employee earns a CAN = Php 2,214.12/month, 13th Month Pay = Php 12, 119.72, and he has other benefits amounting to Php 4,000.00. How much of the additional earnings will be taxed? 13. Suppose in the previous problem, the other benefits include clothing allowance. Will there be a change in the amount taxable? If yes, how much? If no, why? 14.If an employee X has CAN = Php 18,291.09, 13th Month Pay = Php 27,891.00, other benefits Php 10,000 and Php 3,000 of the other benefits is the clothing allowance. How much of his benefits is taxable? How much is nontaxable?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter17: Business Tax Credits And The Alternative Minimum Tax

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

100%

Please answer the following with explanation.

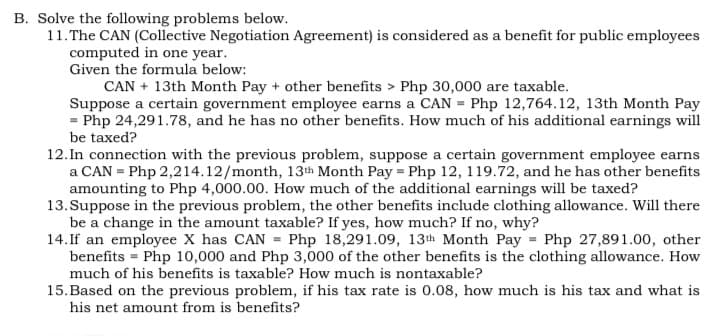

Transcribed Image Text:B. Solve the following problems below.

11.The CAN (Collective Negotiation Agreement) is considered as a benefit for public employees

computed in one year.

Given the formula below:

CAN + 13th Month Pay + other benefits > Php 30,000 are taxable.

Suppose a certain government employee earns a CAN = Php 12,764.12, 13th Month Pay

= Php 24,291.78, and he has no other benefits. How much of his additional earnings will

be taxed?

12. In connection with the previous problem, suppose a certain government employee earns

a CAN = Php 2,214.12/month, 13th Month Pay = Php 12, 119.72, and he has other benefits

amounting to Php 4,000.00. How much of the additional earnings will be taxed?

13. Suppose in the previous problem, the other benefits include clothing allowance. Will there

be a change in the amount taxable? If yes, how much? If no, why?

14. If an employee X has CAN = Php 18,291.09, 13th Month Pay = Php 27,891.00, other

benefits = Php 10,000 and Php 3,000 of the other benefits is the clothing allowance. How

much of his benefits is taxable? How much is nontaxable?

15.Based on the previous problem, if his tax rate is 0.08, how much is his tax and what is

his net amount from is benefits?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Taxation Formula

VIEW11) Computation of additional earnings that will be taxed

VIEW12) Computation of additional earnings that will be taxed to Government employee

VIEW13) Computation of taxable additional earnings if other benefits include clothing allowance

VIEW14) Computation of additional earnings that will be taxed

VIEWTrending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT