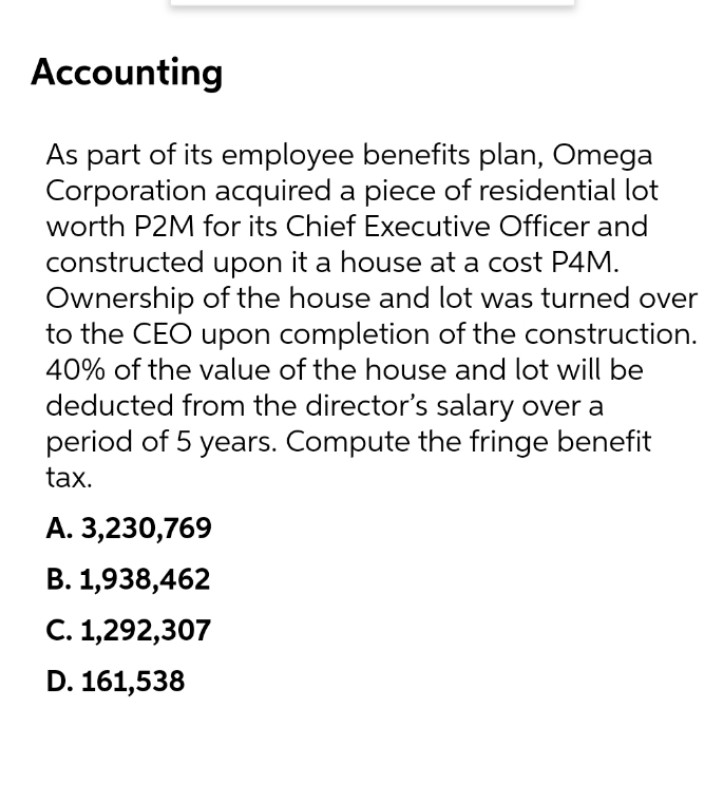

Accounting As part of its employee benefits plan, Omega Corporation acquired a piece of residential lot worth P2M for its Chief Executive Officer and constructed upon it a house at a cost P4M. Ownership of the house and lot was turned over to the CEO upon completion of the construction. 40% of the value of the house and lot will be deducted from the director's salary over a period of 5 years. Compute the fringe benefit tax. А. 3,230,769 B. 1,938,462 С. 1,292,307 D. 161,538

Accounting As part of its employee benefits plan, Omega Corporation acquired a piece of residential lot worth P2M for its Chief Executive Officer and constructed upon it a house at a cost P4M. Ownership of the house and lot was turned over to the CEO upon completion of the construction. 40% of the value of the house and lot will be deducted from the director's salary over a period of 5 years. Compute the fringe benefit tax. А. 3,230,769 B. 1,938,462 С. 1,292,307 D. 161,538

Chapter2: Income Tax Concepts

Section: Chapter Questions

Problem 45P

Related questions

Question

Transcribed Image Text:Accounting

As part of its employee benefits plan, Omega

Corporation acquired a piece of residential lot

worth P2M for its Chief Executive Officer and

constructed upon it a house at a cost P4M.

Ownership of the house and lot was turned over

to the CEO upon completion of the construction.

40% of the value of the house and lot will be

deducted from the director's salary over a

period of 5 years. Compute the fringe benefit

tax.

А. 3,230,769

B. 1,938,462

С. 1,292,307

D. 161,538

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning