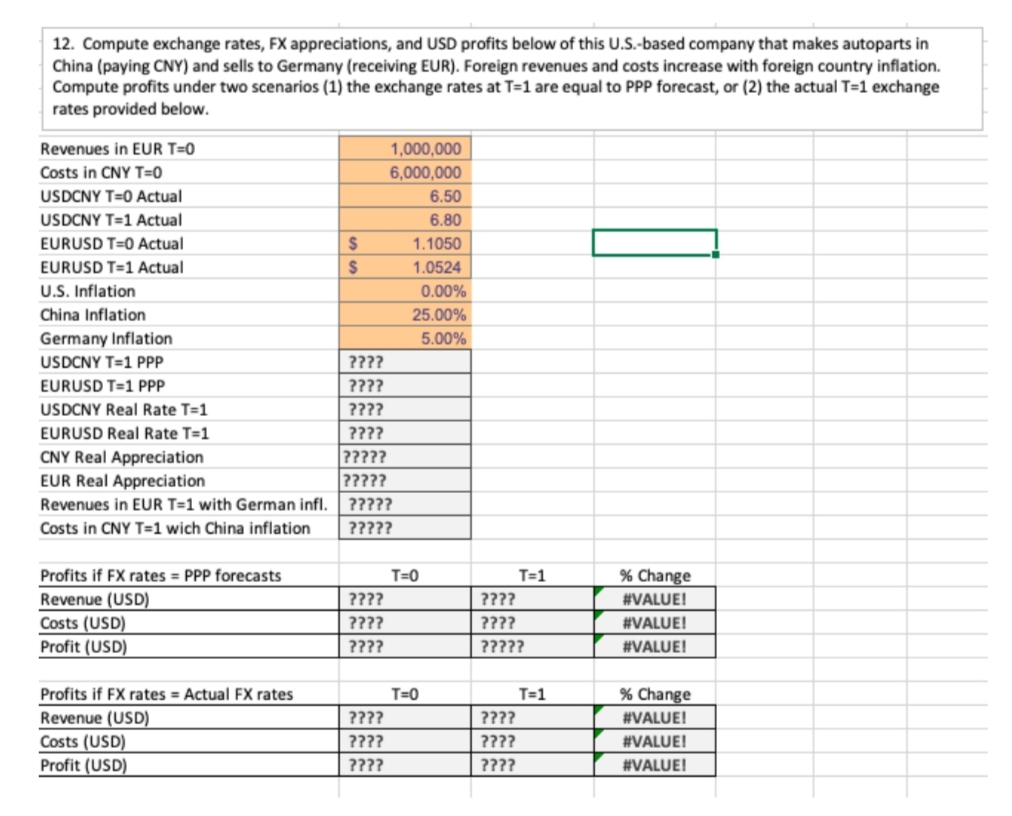

12. Compute exchange rates, FX appreciations, and USD profits below of this U.S.-based company that makes autoparts in China (paying CNY) and sells to Germany (receiving EUR). Foreign revenues and costs increase with foreign country inflation. Compute profits under two scenarios (1) the exchange rates at T-1 are equal to PPP forecast, or (2) the actual T=1 exchange rates provided below. Revenues in EUR T=0 Costs in CNY T=0 USDCNY T=0 Actual USDCNY T=1 Actual EURUSD T=0 Actual EURUSD T=1 Actual U.S. Inflation China Inflation Germany Inflation USDCNY T=1 PPP EURUSD T=1 PPP USDCNY Real Rate T=1 EURUSD Real Rate T=1 CNY Real Appreciation EUR Real Appreciation Revenues in EUR T=1 with German infl. Costs in CNY T=1 wich China inflation Profits if FX rates = PPP forecasts Revenue (USD) Costs (USD) Profit (USD) Profits if FX rates = Actual FX rates Revenue (USD) Costs (USD) Profit (USD) S S ???? ???? ???? ???? ????? ????? 1,000,000 6,000,000 ????? ????? ???? ???? ???? ???? ???? ???? 1.1050 1.0524 6.50 6.80 0.00% 25.00% 5.00% T=0 T=0 T=1 ???? ???? ????? ???? ???? ???? T=1 % Change #VALUE! #VALUE! #VALUE! % Change #VALUE! #VALUE! #VALUE!

12. Compute exchange rates, FX appreciations, and USD profits below of this U.S.-based company that makes autoparts in China (paying CNY) and sells to Germany (receiving EUR). Foreign revenues and costs increase with foreign country inflation. Compute profits under two scenarios (1) the exchange rates at T-1 are equal to PPP forecast, or (2) the actual T=1 exchange rates provided below. Revenues in EUR T=0 Costs in CNY T=0 USDCNY T=0 Actual USDCNY T=1 Actual EURUSD T=0 Actual EURUSD T=1 Actual U.S. Inflation China Inflation Germany Inflation USDCNY T=1 PPP EURUSD T=1 PPP USDCNY Real Rate T=1 EURUSD Real Rate T=1 CNY Real Appreciation EUR Real Appreciation Revenues in EUR T=1 with German infl. Costs in CNY T=1 wich China inflation Profits if FX rates = PPP forecasts Revenue (USD) Costs (USD) Profit (USD) Profits if FX rates = Actual FX rates Revenue (USD) Costs (USD) Profit (USD) S S ???? ???? ???? ???? ????? ????? 1,000,000 6,000,000 ????? ????? ???? ???? ???? ???? ???? ???? 1.1050 1.0524 6.50 6.80 0.00% 25.00% 5.00% T=0 T=0 T=1 ???? ???? ????? ???? ???? ???? T=1 % Change #VALUE! #VALUE! #VALUE! % Change #VALUE! #VALUE! #VALUE!

Chapter4: Exchange Rate Determination

Section: Chapter Questions

Problem 25QA

Related questions

Question

1

Transcribed Image Text:12. Compute exchange rates, FX appreciations, and USD profits below of this U.S.-based company that makes autoparts in

China (paying CNY) and sells to Germany (receiving EUR). Foreign revenues and costs increase with foreign country inflation.

Compute profits under two scenarios (1) the exchange rates at T=1 are equal to PPP forecast, or (2) the actual T=1 exchange

rates provided below.

Revenues in EUR T=0

Costs in CNY T=0

USDCNY T=0 Actual

USDCNY T=1 Actual

EURUSD T=0 Actual

EURUSD T=1 Actual

U.S. Inflation

China Inflation

Germany Inflation

USDCNY T=1 PPP

EURUSD T=1 PPP

USDCNY Real Rate T=1

EURUSD Real Rate T-1

CNY Real Appreciation

EUR Real Appreciation

Revenues in EUR T=1 with German infl.

Costs in CNY T=1 wich China inflation

Profits if FX rates = PPP forecasts

Revenue (USD)

Costs (USD)

Profit (USD)

Profits if FX rates = Actual FX rates

Revenue (USD)

Costs (USD)

Profit (USD)

$

S

????

????

????

????

?????

?????

?????

?????

????

????

????

1,000,000

6,000,000

????

????

????

6.50

6.80

1.1050

1.0524

0.00%

25.00%

5.00%

T=0

T=0

T=1

????

????

?????

????

????

????

T=1

% Change

#VALUE!

#VALUE!

#VALUE!

% Change

#VALUE!

#VALUE!

#VALUE!

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning