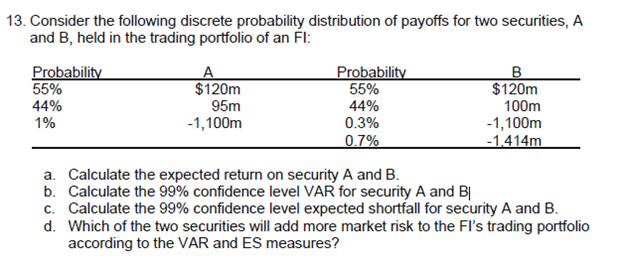

13. Consider the following discrete probability distribution of payoffs for two securities, A and B, held in the trading portfolio of an Fl: Probability 55% 44% 1% Probability 55% A $120m 95m -1,100m 44% 0.3% 0.7% $120m 100m -1,100m -1.414m a. Calculate the expected return on security A and B. b. Calculate the 99% confidence level VAR for security A and B c. Calculate the 99% confidence level expected shortfall for security A and B.

13. Consider the following discrete probability distribution of payoffs for two securities, A and B, held in the trading portfolio of an Fl: Probability 55% 44% 1% Probability 55% A $120m 95m -1,100m 44% 0.3% 0.7% $120m 100m -1,100m -1.414m a. Calculate the expected return on security A and B. b. Calculate the 99% confidence level VAR for security A and B c. Calculate the 99% confidence level expected shortfall for security A and B.

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 20P

Related questions

Question

Would like to know how to do this question about VAR and ES

Transcribed Image Text:13. Consider the following discrete probability distribution of payoffs for two securities, A

and B, held in the trading portfolio of an Fl:

Probability

55%

$120m

Probability

55%

B

$120m

100m

-1,100m

-1.414m

44%

95m

44%

0.3%

1%

-1,100m

0.7%

a. Calculate the expected return on security A and B.

b. Calculate the 99% confidence level VAR for security A and B|

c. Calculate the 99% confidence level expected shortfall for security A and B.

d. Which of the two securities will add more market risk to the FI's trading portfolio

according to the VAR and ES measures?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT