Given the following information, determine the beta coefficient for Stock L that is consistent with equilibrium: Expected return for Stock L = 10.5% Nominal Risk Free Rate (Treasury Securities) = 3.5% Expected Return on the Market Portfolio = 9.5%. %3D Beta Coefficient for L =

Given the following information, determine the beta coefficient for Stock L that is consistent with equilibrium: Expected return for Stock L = 10.5% Nominal Risk Free Rate (Treasury Securities) = 3.5% Expected Return on the Market Portfolio = 9.5%. %3D Beta Coefficient for L =

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter6: Risk And Return

Section: Chapter Questions

Problem 14P: You have observed the following returns over time:

Assume that the risk-free rate is 6% and the...

Related questions

Question

Thank you

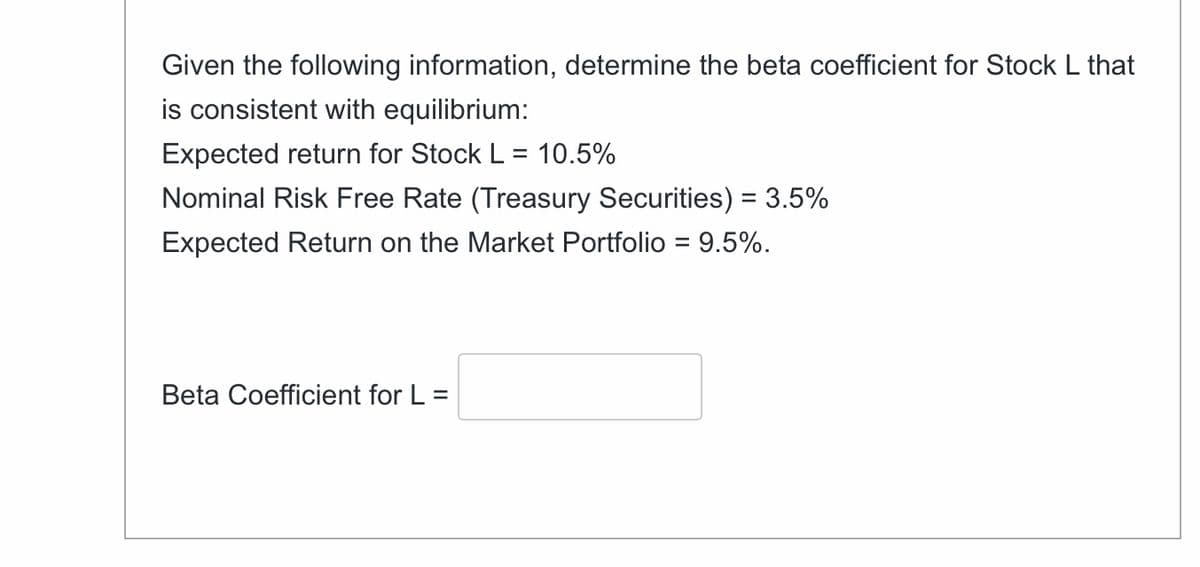

Transcribed Image Text:Given the following information, determine the beta coefficient for Stock L that

is consistent with equilibrium:

Expected return for Stock L = 10.5%

Nominal Risk Free Rate (Treasury Securities) = 3.5%

Expected Return on the Market Portfolio = 9.5%.

Beta Coefficient for L =

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning