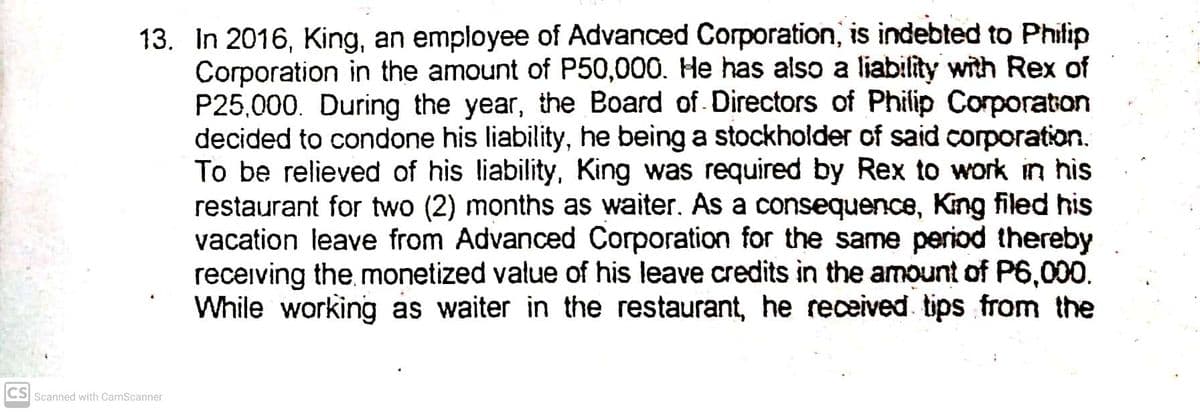

13. In 2016, King, an employee of Advanced Corporation, is indebted to Philip Corporation in the amount of P50,000. He has also a liability with Rex of P25,000. During the year, the Board of Directors of Philip Corporaton decided to condone his liability, he being a stockholder of said corporation. To be relieved of his liability, King was required by Rex to work in his restaurant for two (2) months as waiter. As a consequence, King filed his vacation leave from Advanced Corporation for the same period thereby receiving the monetized value of his leave credits in the amount of P6,000. While working as waiter in the restaurant, he received tips from the

13. In 2016, King, an employee of Advanced Corporation, is indebted to Philip Corporation in the amount of P50,000. He has also a liability with Rex of P25,000. During the year, the Board of Directors of Philip Corporaton decided to condone his liability, he being a stockholder of said corporation. To be relieved of his liability, King was required by Rex to work in his restaurant for two (2) months as waiter. As a consequence, King filed his vacation leave from Advanced Corporation for the same period thereby receiving the monetized value of his leave credits in the amount of P6,000. While working as waiter in the restaurant, he received tips from the

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter15: S Corporations

Section: Chapter Questions

Problem 2CE

Related questions

Question

Transcribed Image Text:13. In 2016, King, an employee of Advanced Corporation, is indebted to Philip

Corporation in the amount of P50,000. He has also a liability with Rex of

P25,000. During the year, the Board of. Directors of Philip Corporaton

decided to condone his liability, he being a stockholder of said corporation.

To be relieved of his liability, King was required by Rex to work in his

restaurant for two (2) months as waiter. As a consequence, King filed his

vacation leave from Advanced Corporation for the same period thereby

receiving the monetized value of his leave credits in the amount of P6,000.

While working as waiter in the restaurant, he received tips from the

CS Scanned with CamScanner

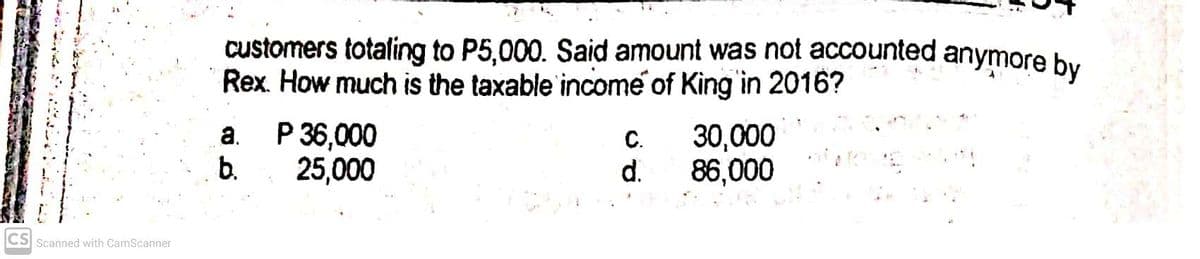

Transcribed Image Text:customers totaling to P5,000. Said amount was not accounted anymore by

Rex. How much is the taxable income of King in 2016?

a.

P 36,000

C.

30,000

b.

25,000

d.

86,000

CS Scanned with CamScanner

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT