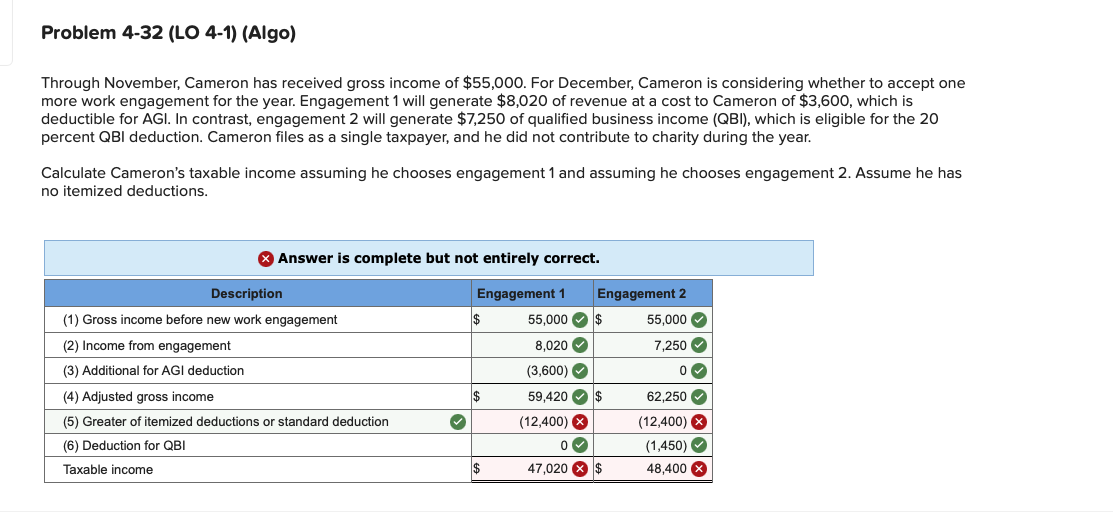

Through November, Cameron has received gross income of $55,000. For December, Cameron is considering whether to accept one more work engagement for the year. Engagement 1 will generate $8,020 of revenue at a cost to Cameron of $3,600, which is deductible for AGI. In contrast, engagement 2 will generate $7,250 of qualified business income (QBI), which is eligible for the 20 percent QBI deduction. Cameron files as a single taxpayer, and he did not contribute to charity during the year. Calculate Cameron's taxable income assuming he chooses engagement 1 and assuming he chooses engagement 2. Assume he has no itemized deductions. X Answer is complete but not entirely correct. Description Engagement 1 Engagement 2 (1) Gross income before new work engagement $ (2) Income from engagement (3) Additional for AGI deduction (4) Adjusted gross income $ (5) Greater of itemized deductions or standard deduction (6) Deduction for QBI Taxable income ✔ $ 55,000 $ 8,020 (3,600) ✔ 59,420✔ $ (12,400) X 0✔ 47,020 $ 55,000✔ 7,250✔ 0✓ 62,250✔ (12,400) X (1,450) 48,400

Through November, Cameron has received gross income of $55,000. For December, Cameron is considering whether to accept one more work engagement for the year. Engagement 1 will generate $8,020 of revenue at a cost to Cameron of $3,600, which is deductible for AGI. In contrast, engagement 2 will generate $7,250 of qualified business income (QBI), which is eligible for the 20 percent QBI deduction. Cameron files as a single taxpayer, and he did not contribute to charity during the year. Calculate Cameron's taxable income assuming he chooses engagement 1 and assuming he chooses engagement 2. Assume he has no itemized deductions. X Answer is complete but not entirely correct. Description Engagement 1 Engagement 2 (1) Gross income before new work engagement $ (2) Income from engagement (3) Additional for AGI deduction (4) Adjusted gross income $ (5) Greater of itemized deductions or standard deduction (6) Deduction for QBI Taxable income ✔ $ 55,000 $ 8,020 (3,600) ✔ 59,420✔ $ (12,400) X 0✔ 47,020 $ 55,000✔ 7,250✔ 0✓ 62,250✔ (12,400) X (1,450) 48,400

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter5: Sales And Receivables

Section: Chapter Questions

Problem 79APSA

Related questions

Question

Transcribed Image Text:Problem 4-32 (LO 4-1) (Algo)

Through November, Cameron has received gross income of $55,000. For December, Cameron is considering whether to accept one

more work engagement for the year. Engagement 1 will generate $8,020 of revenue at a cost to Cameron of $3,600, which is

deductible for AGI. In contrast, engagement 2 will generate $7,250 of qualified business income (QBI), which is eligible for the 20

percent QBI deduction. Cameron files as a single taxpayer, and he did not contribute to charity during the year.

Calculate Cameron's taxable income assuming he chooses engagement 1 and assuming he chooses engagement 2. Assume he has

no itemized deductions.

Answer is complete but not entirely correct.

Description

Engagement 1

Engagement 2

(1) Gross income before new work engagement

$

55,000

$

(2) Income from engagement

8,020

(3) Additional for AGI deduction

(3,600)

(4) Adjusted gross income

$

59,420 $

(5) Greater of itemized deductions or standard deduction

(6) Deduction for QBI

Taxable income

✓

(12,400)

47,020

*******

0✓

55,000✔

7,250

0✓

62,250✔

(12,400) X

(1,450) ✔

48,400 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning