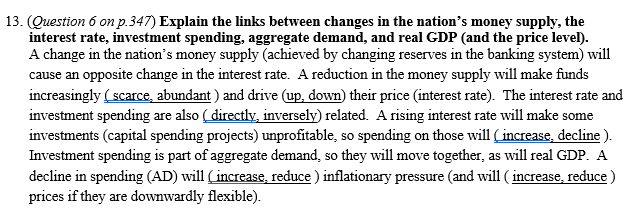

13. (Question 6 on p.347) Explain the links between changes in the nation's money supply, the interest rate, investment spending, aggregate demand, and real GDP (and the price level). A change in the nation's money supply (achieved by changing reserves in the banking system) will cause an opposite change in the interest rate. A reduction in the money supply will make funds increasingly (scarce, abundant ) and drive (up, down) their price (interest rate). The interest rate and investment spending are also (directly, inversely) related. A rising interest rate will make some investments (capital spending projects) unprofitable, so spending on those will (increase, decline ). Investment spending is part of aggregate demand, so they will move together, as will real GDP. A decline in spending (AD) will (increase, reduce ) inflationary pressure (and will ( increase, reduce) prices if they are downwardly flexible).

13. (Question 6 on p.347) Explain the links between changes in the nation's money supply, the interest rate, investment spending, aggregate demand, and real GDP (and the price level). A change in the nation's money supply (achieved by changing reserves in the banking system) will cause an opposite change in the interest rate. A reduction in the money supply will make funds increasingly (scarce, abundant ) and drive (up, down) their price (interest rate). The interest rate and investment spending are also (directly, inversely) related. A rising interest rate will make some investments (capital spending projects) unprofitable, so spending on those will (increase, decline ). Investment spending is part of aggregate demand, so they will move together, as will real GDP. A decline in spending (AD) will (increase, reduce ) inflationary pressure (and will ( increase, reduce) prices if they are downwardly flexible).

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter11: The Monetary System

Section: Chapter Questions

Problem 2PA

Related questions

Question

Transcribed Image Text:13. (Question 6 on p.347) Explain the links between changes in the nation's money supply, the

interest rate, investment spending, aggregate demand, and real GDP (and the price level).

A change in the nation's money supply (achieved by changing reserves in the banking system) will

cause an opposite change in the interest rate. A reduction in the money supply will make funds

increasingly ( scarce, abundant ) and drive (up, down) their price (interest rate). The interest rate and

investment spending are also ( directly, inversely) related. A rising interest rate will make some

investments (capital spending projects) unprofitable, so spending on those will (increase, decline ).

Investment spending is part of aggregate demand, so they will move together, as will real GDP. A

decline in spending (AD) will (increase, reduce ) inflationary pressure (and will ( increase, reduce )

prices if they are downwardly flexible).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax