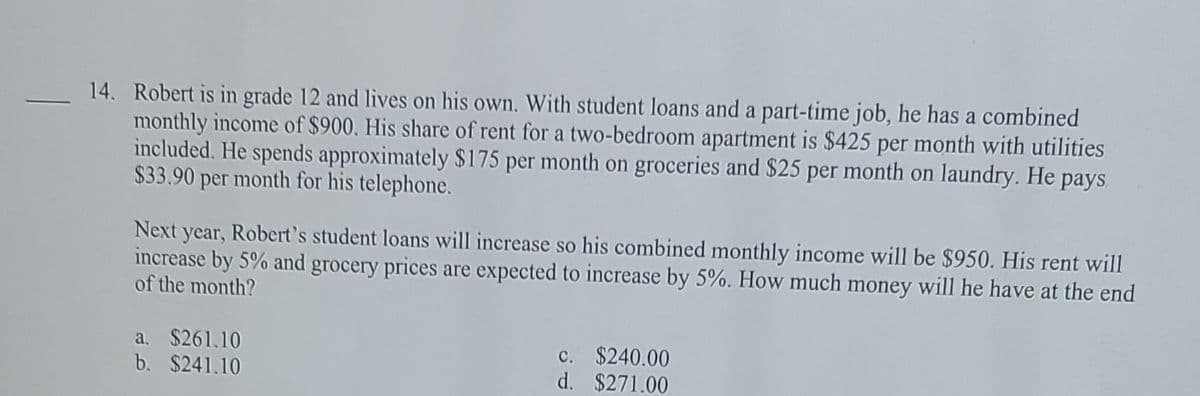

14. Robert is in grade 12 and lives on his own. With student loans and a part-time job, he has a combined monthly income of $900. His share of rent for a two-bedroom apartment is $425 per month with utilities included. He spends approximately $175 per month on groceries and $25 per month on laundry. He pays $33.90 per month for his telephone. Next year, Robert's student loans will increase so his combined monthly income will be $950. His rent will increase by 5% and grocery prices are expected to increase by 5%. How much money will he have at the end of the month? a. $261.10 b. $241.10 c. $240.00 d. $271.00

14. Robert is in grade 12 and lives on his own. With student loans and a part-time job, he has a combined monthly income of $900. His share of rent for a two-bedroom apartment is $425 per month with utilities included. He spends approximately $175 per month on groceries and $25 per month on laundry. He pays $33.90 per month for his telephone. Next year, Robert's student loans will increase so his combined monthly income will be $950. His rent will increase by 5% and grocery prices are expected to increase by 5%. How much money will he have at the end of the month? a. $261.10 b. $241.10 c. $240.00 d. $271.00

Chapter6: Business Expenses

Section: Chapter Questions

Problem 69P

Related questions

Question

Transcribed Image Text:14. Robert is in grade 12 and lives on his own. With student loans and a part-time job, he has a combined

monthly income of $900. His share of rent for a two-bedroom apartment is $425 per month with utilities

included. He spends approximately $175 per month on groceries and $25 per month on laundry. He pays

$33.90 per month for his telephone.

Next year, Robert's student loans will increase so his combined monthly income will be $950. His rent will

increase by 5% and grocery prices are expected to increase by 5%. How much money will he have at the end

of the month?

a. $261.10

b. $241.10

c. $240.00

d. $271.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning