Suppose the market risk premium is 6% and the risk-free interest rate is 6%. Using the data in the table, calculate the expected return of investing in a. Starbucks' stock. b. Hershey's stock. c. Autodesk's stock. Why don't all investors hold Autodesk's stock rather than Hershey's stock

Suppose the market risk premium is 6% and the risk-free interest rate is 6%. Using the data in the table, calculate the expected return of investing in a. Starbucks' stock. b. Hershey's stock. c. Autodesk's stock. Why don't all investors hold Autodesk's stock rather than Hershey's stock

Chapter7: Payroll

Section: Chapter Questions

Problem 1.13C

Related questions

Question

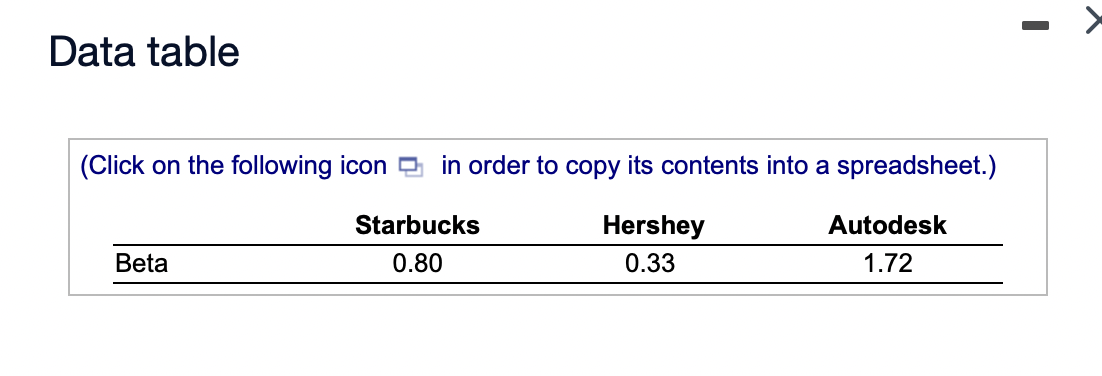

Suppose the market risk premium is 6% and the risk-free interest rate is 6%. Using the data in the table, calculate the expected return of investing in

a. Starbucks' stock.

b. Hershey's stock.

c. Autodesk's stock.

Why don't all investors hold Autodesk's stock rather than Hershey's stock

Transcribed Image Text:Data table

(Click on the following icon g in order to copy its contents into a spreadsheet.)

Starbucks

Hershey

Autodesk

Beta

0.80

0.33

1.72

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,