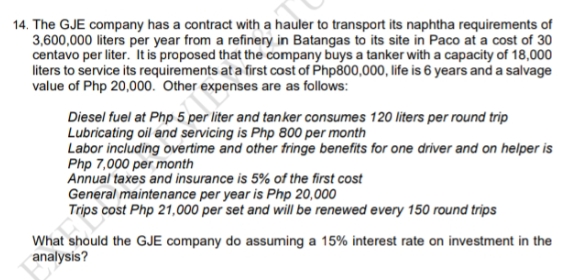

14. The GJE company has a contract with a hauler to transport its naphtha requirements of 3,600,000 liters per year from a refinery in Batangas to its site in Paco at a cost of 30 centavo per liter. It is proposed that the company buys a tanker with a capacity of 18,000 liters to service its requirements at a first cost of Php800,000, life is 6 years and a salvage value of Php 20,000. Other expenses are as follows: Diesel fuel at Php 5 per liter and tanker consumes 120 liters per round trip Lubricating oil and servicing is Php 800 per month Labor including overtime and other fringe benefits for one driver and on helper is Php 7,000 per month Annual taxes and insurance is 5% of the first cost General maintenance per year is Php 20,000 Trips cost Php 21,000 per set and will be renewed every 150 round trips What should the GJE company do assuming a 15% interest rate on investment in the analysis?

14. The GJE company has a contract with a hauler to transport its naphtha requirements of 3,600,000 liters per year from a refinery in Batangas to its site in Paco at a cost of 30 centavo per liter. It is proposed that the company buys a tanker with a capacity of 18,000 liters to service its requirements at a first cost of Php800,000, life is 6 years and a salvage value of Php 20,000. Other expenses are as follows: Diesel fuel at Php 5 per liter and tanker consumes 120 liters per round trip Lubricating oil and servicing is Php 800 per month Labor including overtime and other fringe benefits for one driver and on helper is Php 7,000 per month Annual taxes and insurance is 5% of the first cost General maintenance per year is Php 20,000 Trips cost Php 21,000 per set and will be renewed every 150 round trips What should the GJE company do assuming a 15% interest rate on investment in the analysis?

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 14P

Related questions

Question

Transcribed Image Text:14. The GJE company has a contract with a hauler to transport its naphtha requirements of

3,600,000 liters per year from a refinery in Batangas to its site in Paco at a cost of 30

centavo per liter. It is proposed that the company buys a tanker with a capacity of 18,000

liters to service its requirements at a first cost of Php800,000, life is 6 years and a salvage

value of Php 20,000. Other expenses are as follows:

Diesel fuel at Php 5 per liter and tanker consumes 120 liters per round trip

Lubricating oil and servicing is Php 800 per month

Labor including overtime and other fringe benefits for one driver and on helper is

Php 7,000 per month

Annual taxes and insurance is 5% of the first cost

General maintenance per year is Php 20,000

Trips cost Php 21,000 per set and will be renewed every 150 round trips

What should the GJE company do assuming a 15% interest rate on investment in the

analysis?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT