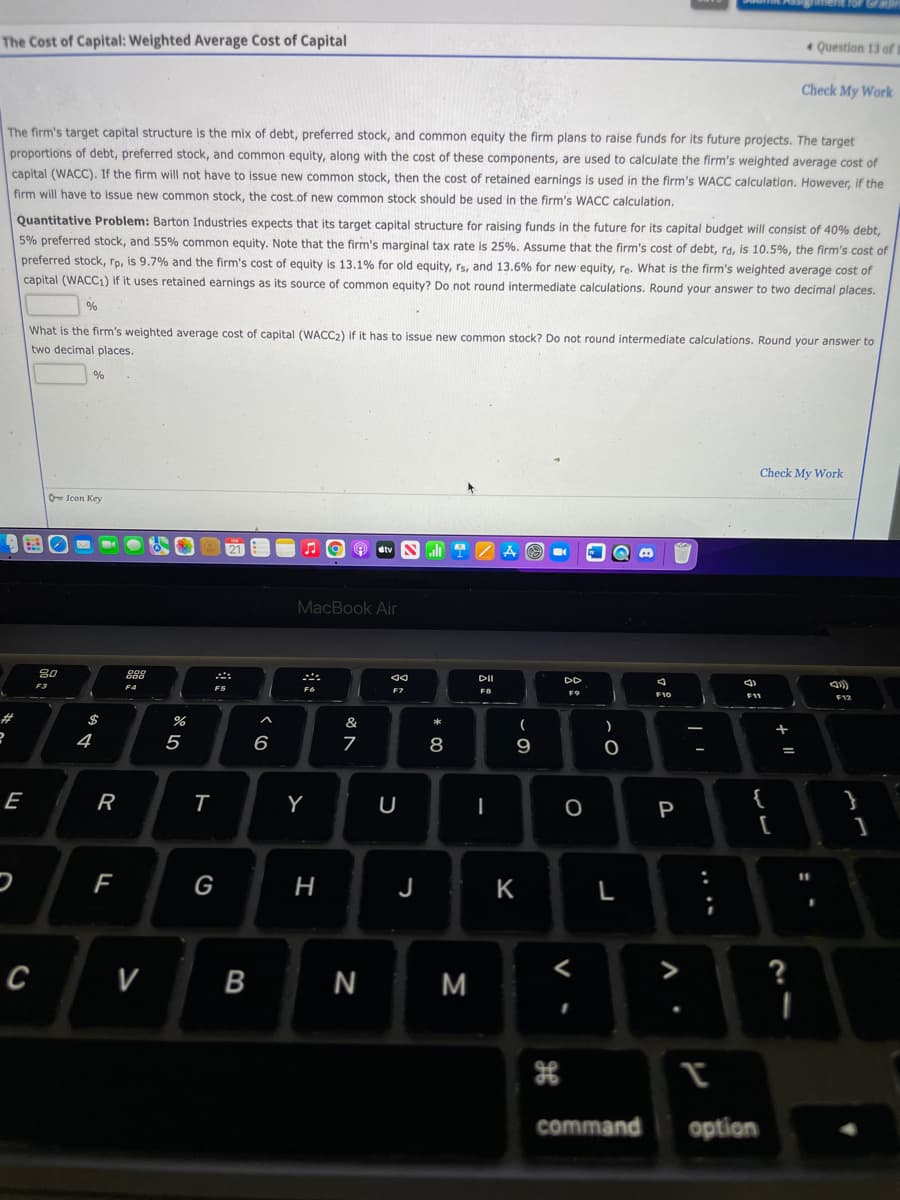

The Cost of Capital: Weighted Average Cost of Capital Question 13 of1 Check My Work The firm's target capital structure is the mix of debt, preferred stock, and common equity the firm plans to raise funds for its future projects. The target proportions of debt, preferred stock, and common equity, along with the cost of these components, are used to calculate the firm's weighted average cost of capital (WACC). If the firm will not have to issue new common stock, then the cost of retained earnings is used in the firm's WACC calculation. However, if the firm will have to issue new common stock, the cost.of new common stock should be used in the firm's WACC calculation. Quantitative Problem: Barton Industries expects that its target capital structure for raising funds in the future for its capital budget will consist of 40% debt, 5% preferred stock, and 55% common equity. Note that the firm's marginal tax rate is 25%. Assume that the firm's cost of debt, rd, is 10.5%, the firm's cost of preferred stock, rp, is 9.7% and the firm's cost of equity is 13.1% for old equity, rs, and 13.6% for new equity, re. What is the firm's weighted average cost of capital (WACC1) if it uses retained earnings as its source of common equity? Do not round intermediate calculations. Round your answer to two decimal places. % What is the firm's weighted average cost of capital (WACC2) if it has to issue new common stock? Do not round intermediate calculations. Round your answer to two decimal places. % Check My Work O- Icon Key 21 dtv

The Cost of Capital: Weighted Average Cost of Capital Question 13 of1 Check My Work The firm's target capital structure is the mix of debt, preferred stock, and common equity the firm plans to raise funds for its future projects. The target proportions of debt, preferred stock, and common equity, along with the cost of these components, are used to calculate the firm's weighted average cost of capital (WACC). If the firm will not have to issue new common stock, then the cost of retained earnings is used in the firm's WACC calculation. However, if the firm will have to issue new common stock, the cost.of new common stock should be used in the firm's WACC calculation. Quantitative Problem: Barton Industries expects that its target capital structure for raising funds in the future for its capital budget will consist of 40% debt, 5% preferred stock, and 55% common equity. Note that the firm's marginal tax rate is 25%. Assume that the firm's cost of debt, rd, is 10.5%, the firm's cost of preferred stock, rp, is 9.7% and the firm's cost of equity is 13.1% for old equity, rs, and 13.6% for new equity, re. What is the firm's weighted average cost of capital (WACC1) if it uses retained earnings as its source of common equity? Do not round intermediate calculations. Round your answer to two decimal places. % What is the firm's weighted average cost of capital (WACC2) if it has to issue new common stock? Do not round intermediate calculations. Round your answer to two decimal places. % Check My Work O- Icon Key 21 dtv

Fundamentals of Financial Management (MindTap Course List)

14th Edition

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter10: The Cost Of Capital

Section: Chapter Questions

Problem 1TCL: CALCULATING 3Ms COST OF CAPITAL In this chapter, we described how to estimate a companys WACC, which...

Related questions

Question

Transcribed Image Text:The Cost of Capital: Weighted Average Cost of Capital

* Question 13 of t

Check My Work

The firm's target capital structure is the mix of debt, preferred stock, and common equity the firm plans to raise funds for its future projects. The target

proportions of debt, preferred stock, and common equity, along with the cost of these components, are used to calculate the firm's weighted average cost of

capital (WACC). If the firm will not have to issue new common stock, then the cost of retained earnings is used in the firm's WACC calculation. However, if the

firm will have to issue new common stock, the cost of new common stock should be used in the firm's WACC calculation,

Quantitative Problem: Barton Industries expects that its target capital structure for raising funds in the future for its capital budget will consist of 40% debt,

5% preferred stock, and 55% common equity. Note that the firm's marginal tax rate is 25%. Assume that the firm's cost of debt, ra. is 10.5%, the firm's cost of

preferred stock, ro, is 9.7% and the firm's cost of equity is 13.1% for old equity, rs, and 13.6% for new equity, re. What is the firm's weighted average cost of

capital (WACC1) if it uses retained earnings as its source of common equity? Do not round intermediate calculations. Round your answer to two decimal places.

%

What is the firm's weighted average cost of capital (WACC2) if it has to issue new common stock? Do not round intermediate calculations. Round your answer to

two decimal places.

%

Check My Work

O- Icon Key

O etv Nli

MacBook Air

80

DI

DD

F3

F4

F5

F7

F10

23

$

&

*

4

5

6

9

E

R

Y

{

}

P

G

K

с

V

B

M

?

command

option

プー

....

-

I

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning