15 Maturity (ynars Price (per $100 tace value) $77 12 396 03 $91 61 S06 99 $82 17 a. Compute the yield to maturity for each bond b. Plat the zero coupen yield curve (or the first ve yean) c. is the yield cune upward sloping dowmward sloping or far?

15 Maturity (ynars Price (per $100 tace value) $77 12 396 03 $91 61 S06 99 $82 17 a. Compute the yield to maturity for each bond b. Plat the zero coupen yield curve (or the first ve yean) c. is the yield cune upward sloping dowmward sloping or far?

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter12: Investing In Stocks And Bonds

Section: Chapter Questions

Problem 8FPE: Describe and differentiate between a bonds (a) current yield and (b) yield to maturity. Why are...

Related questions

Question

6

Transcribed Image Text:c. In the yleld curve upward sloping, downward tloping, or flat? (Select from the drop-down menu)

The yield curve is

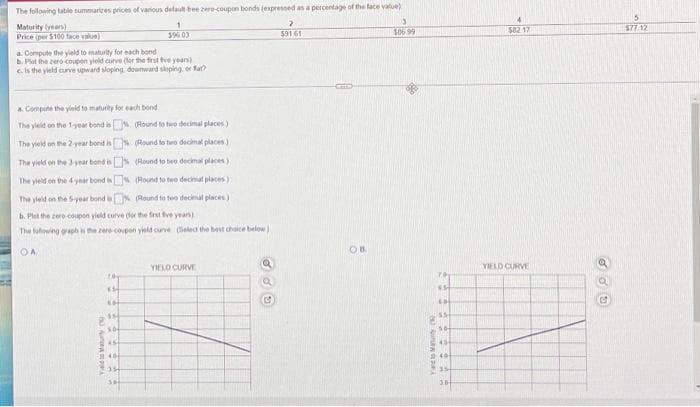

Transcribed Image Text:The following table summarires prices of various detaut bee zer coupon bonds (expressed as a percentage of the face value)

Maturity (yan)

Price per $100 tace value)

चाँघ

506 99

S82 17

$77 12

396 03

591 61

a. Compute the yield to maturity for each bond

b. Plat the zero copon yield curve (lor the first ve yean)

c. is the yield curve upward sloping dounward sloping or far

a. Compute the yield to maturity for eadh bond

The yield on the 1-year bond is (Round to two decimal places)

The yield on the 2year bond is (Round to two decimat places)

The yield on the year bond is (Round to bee decimal places)

The yleld on the 4year bond is (Round to twe decimal places)

The yleld on the Syear bond Round to teo decimal places)

b. Plet the zero coupon yield curve er the frst ve yean)

The fuowing graph the zere copon yeld cunve Seled the hest chaice below)

YIELD CURVE

VIELD CURVE

143

9:40

35-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning