Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 16P

Related questions

Question

100%

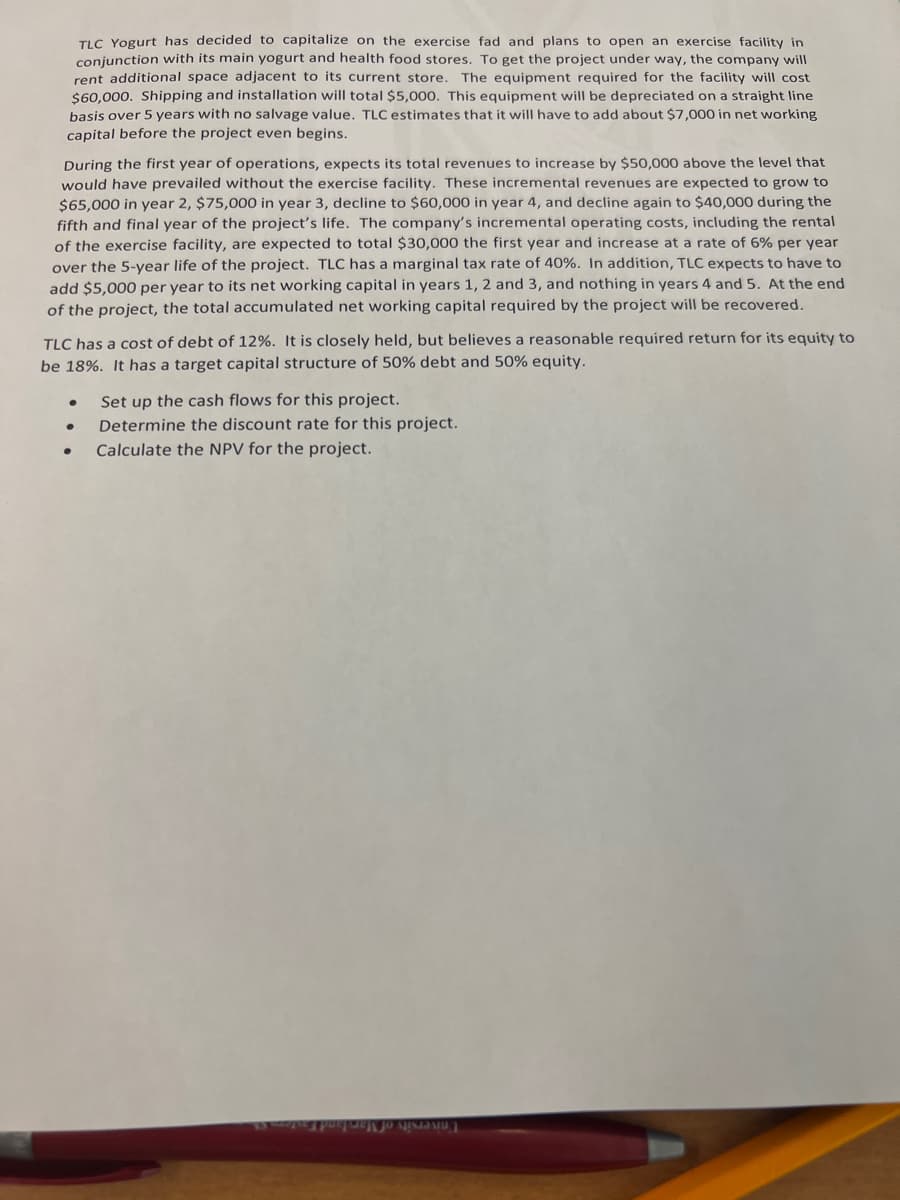

Transcribed Image Text:TLC Yogurt has decided to capitalize on the exercise fad and plans to open an exercise facility in

conjunction with its main yogurt and health food stores. To get the project under way, the company will

rent additional space adjacent to its current store.

$60,000. Shipping and installation will total $5,000. This equipment will be depreciated on a straight line

basis over 5 years with no salvage value. TLC estimates that it will have to add about $7,000 in net working

The equipment required for the facility will cost

capital before the project even begins.

During the first year of operations, expects its total revenues to increase by $50,000 above the level that

would have prevailed without the exercise facility. These incremental revenues are expected to grow to

$65,000 in year 2, $75,000 in year 3, decline to $60,000 in year 4, and decline again to $40,000 during the

fifth and final year of the project's life. The company's incremental operating costs, including the rental

of the exercise facility, are expected to total $30,000 the first year and increase at a rate of 6% per year

over the 5-year life of the project. TLC has a marginal tax rate of 40%. In addition, TLC expects to have to

add $5,000 per year to its net working capital in years 1, 2 and 3, and nothing in years 4 and 5. At the end

of the project, the total accumulated net working capital required by the project will be recovered.

TLC has a cost of debt of 12%. It is closely held, but believes a reasonable required return for its equity to

be 18%. It has a target capital structure of 50% debt and 50% equity.

Set up the cash flows for this project.

Determine the discount rate for this project.

Calculate the NPV for the project.

I'niversity of Mar!

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning