15. In the short run the a. b. C. set by the central bank can affect investment because Nominal exchange rate; Money supply is constant Inflation rate; The real interest rate is constant Price level; Money supply is constant d. Nominal interest rate; Inflation is sticky e. Money growth rate; Prices are flexible

15. In the short run the a. b. C. set by the central bank can affect investment because Nominal exchange rate; Money supply is constant Inflation rate; The real interest rate is constant Price level; Money supply is constant d. Nominal interest rate; Inflation is sticky e. Money growth rate; Prices are flexible

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter29: Exchange Rates And International Capital Flows

Section: Chapter Questions

Problem 25CTQ: If a countrys currency is expected to appreciate in value, what would you think will be the impact...

Related questions

Question

Please help me with these questions with explanation

Transcribed Image Text:15. In the short run the

a.

b.

C.

set by the central bank can affect investment because

Nominal exchange rate; Money supply is constant

Inflation rate; The real interest rate is constant

Price level; Money supply is constant

d. Nominal interest rate; Inflation is sticky

e. Money growth rate; Prices are flexible

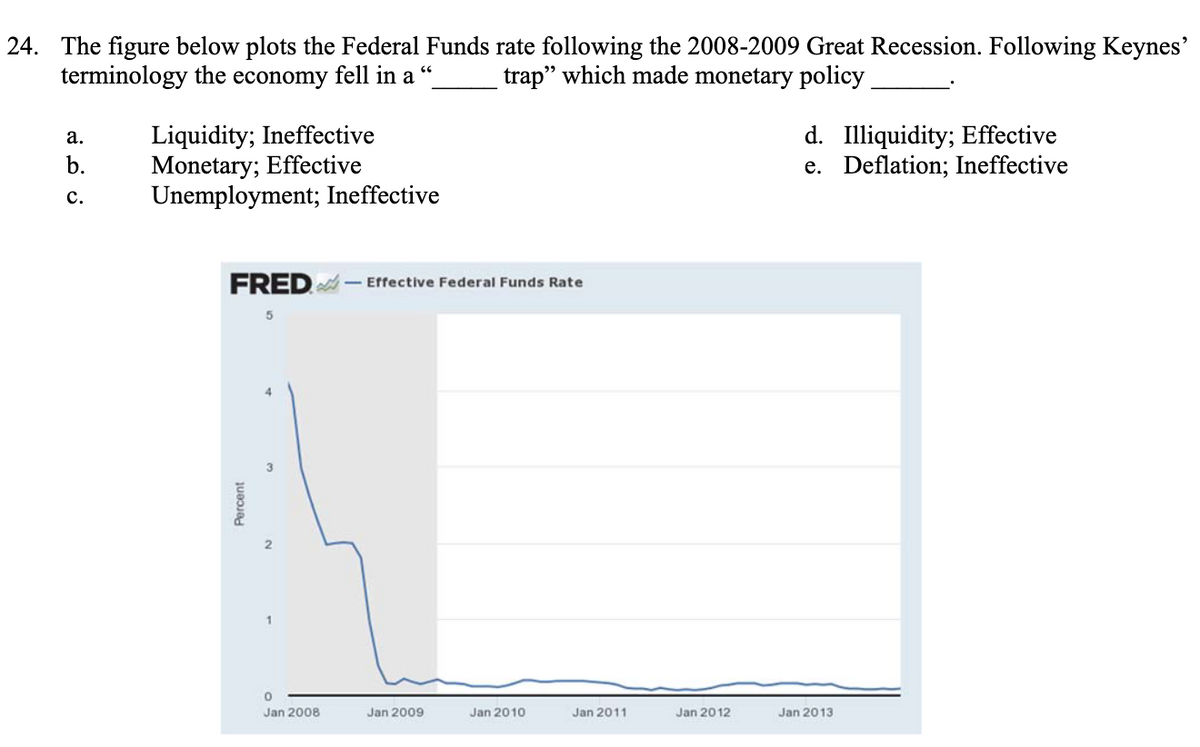

Transcribed Image Text:24. The figure below plots the Federal Funds rate following the 2008-2009 Great Recession. Following Keynes'

66

terminology the economy fell in a

trap" which made monetary policy

a.

b.

C.

Liquidity; Ineffective

Monetary; Effective

Unemployment; Ineffective

FRED - Effective Federal Funds Rate

Percent

5

N

1

0

Jan 2008

Jan 2009

Jan 2010

Jan 2011

Jan 2012

d. Illiquidity; Effective

e. Deflation; Ineffective

Jan 2013

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Macroeconomics: Principles and Policy (MindTap Co…

Economics

ISBN:

9781305280601

Author:

William J. Baumol, Alan S. Blinder

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Macroeconomics: Principles and Policy (MindTap Co…

Economics

ISBN:

9781305280601

Author:

William J. Baumol, Alan S. Blinder

Publisher:

Cengage Learning