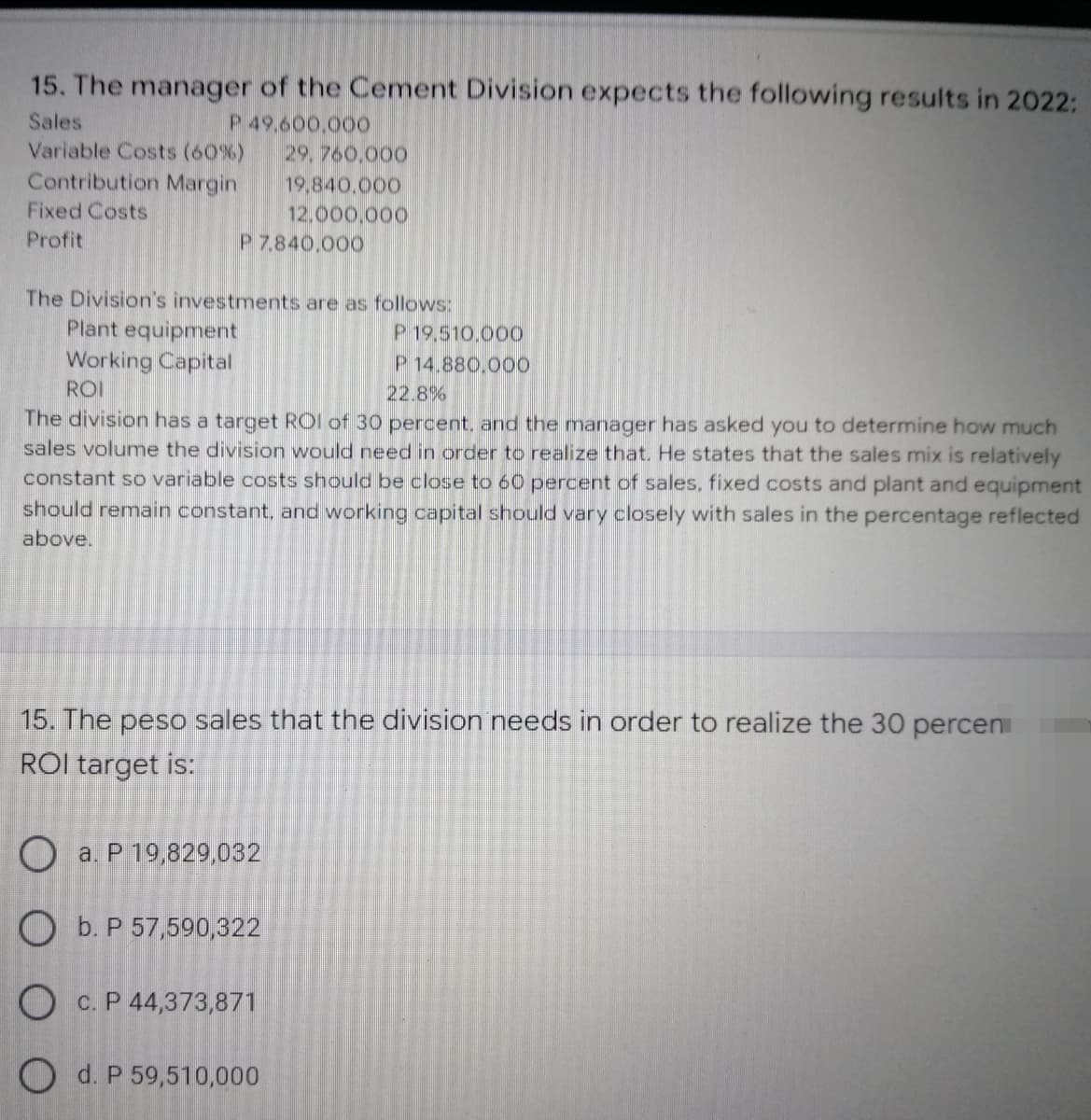

15. The manager of the Cement Division expects the following results in 2022: Sales Variable Costs (60%) P 49.600,00O 29, 760,000 19,840.000 12.000,000 P 7.840,000 Contribution Margin Fixed Costs Profit The Division's investments are as follows: Plant equipment Working Capital ROI P 19,510.000 P 14.880.00O 22.8% The division has a target ROI of 30 percent, and the manager has asked you to determine how much sales volume the division would need in order to realize that. He states that the sales mix is relatively constant so variable costs should be close to 60 percent of sales, fixed costs and plant and equipment should remain constant, and working capital should vary closely with sales in the percentage reflected above. 15. The peso sales that the division needs in order to realize the 30 perceni ROI target is: O a. P 19,829,032 O b. P 57,590,322 O c. P 44,373,871 O d. P 59,510,000

15. The manager of the Cement Division expects the following results in 2022: Sales Variable Costs (60%) P 49.600,00O 29, 760,000 19,840.000 12.000,000 P 7.840,000 Contribution Margin Fixed Costs Profit The Division's investments are as follows: Plant equipment Working Capital ROI P 19,510.000 P 14.880.00O 22.8% The division has a target ROI of 30 percent, and the manager has asked you to determine how much sales volume the division would need in order to realize that. He states that the sales mix is relatively constant so variable costs should be close to 60 percent of sales, fixed costs and plant and equipment should remain constant, and working capital should vary closely with sales in the percentage reflected above. 15. The peso sales that the division needs in order to realize the 30 perceni ROI target is: O a. P 19,829,032 O b. P 57,590,322 O c. P 44,373,871 O d. P 59,510,000

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter11: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 11.16E

Related questions

Question

Transcribed Image Text:15. The manager of the Cement Division expects the following results in 2022:

Sales

Variable Costs (60%)

Contribution Margin

P 49.600,00O

29, 760,000

19,840.000

Fixed Costs

Profit

P 7.840,000

The Division's investments are as follows:

Plant equipment

Working Capital

ROI

P 19,510.000

P 14.880.00O

22.8%

The division has a target ROI of 30 percent, and the rmanager has asked you to determine how much

sales volume the division would need in order to realize that. He states that the sales mix is relatively

constant so variable costs should be close to 60 percent of sales, fixed costs and plant and equipment

should remain constant, and working capital should vary closely with sales in the percentage reflected

above.

15. The peso sales that the division needs in order to realize the 30 percen

ROI target is:

O a. P 19,829,032

O b. P 57,590,322

O c. P 44,373,871

O d. P 59,510,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning